The Goal: Financial Independence by 30

Picture this: it’s a Tuesday morning, and instead of sitting in a fluorescent-lit cubicle, pretending to care about another email chain that spiraled out of control, I’m doing exactly what I want. Maybe I’m hiking a mountain, working on a passion project, or just sipping coffee in my pajamas. That’s the dream I’m chasing: Financial Independence by 30.

Why? Because I want the kind of freedom that most people only talk about in retirement but never actually get to experience. Freedom to wear what I want, talk to whom I want (or don’t want), live where I choose, and wake up without an alarm. But freedom comes at a price—a price I’ve decided to pay through extreme frugality and disciplined investing.

At 23 years old, I’m laying the groundwork now to retire in just seven years. I know it sounds ambitious, but let me explain why I believe it’s possible and exactly how I’m making it happen.

The “Why” Behind Financial Independence

1. Freedom from “The Man”

I realized something about myself early on: I’m not employable. Sure, I can show up, do the work, and make myself useful. But the truth is, I don’t like being told what to do or asking permission for time off. I’m not interested in office politics or arbitrary dress codes.

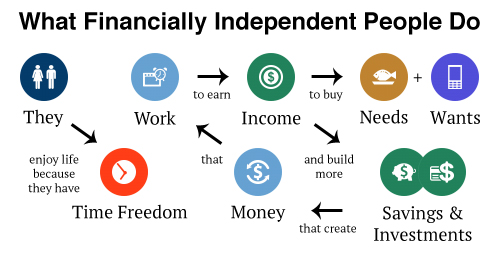

Financial Independence means I don’t have to answer to anyone. No boss, no HR meetings, no “team-building” exercises. It’s the ultimate power move: being able to say “no” to anything and anyone because I’ve built a wall of financial security between me and the demands of the world.

2. Flexibility and Autonomy

Imagine being able to decide where you live, how you spend your time, and what projects you work on—all without worrying about a paycheck. That’s the life I want. I don’t want to be tied to a single job, city, or lifestyle. I want options.

When you’re financially independent, your life becomes a blank canvas. You get to paint it however you like, without needing approval from anyone else.

3. Taking Care of My Own

This isn’t just about me. Financial Independence gives me the ability to take care of my immediate family without stress. Whether it’s helping a loved one in need or providing opportunities for those closest to me, I want to be in a position where money is never an obstacle.

4. Because It’s Possible

When I told my coworkers I plan to retire by 30, they laughed. They said it was impossible. But the truth is, they were never taught it’s even an option. Most people think you need a pension, a lottery win, or an inheritance to retire early. They don’t realize that with careful planning, anyone can create their own pension by building a base of income-generating assets.

The “How” of Financial Independence

Here’s my plan, laid out step-by-step. Spoiler alert: it’s not glamorous, but it works.

1. Extreme Frugality: Saving 75%+ of My Income

I’ve adopted a no-frills lifestyle. Every dollar I save is a soldier in my army of financial freedom. That means saying no to expensive nights out, unnecessary subscriptions, and impulse buys. My coworkers might think it’s odd that I skip drinks or pack my lunch, but every time I say “no” to spending, I’m saying “yes” to my future.

But frugality isn’t just about cutting back—it’s about downgrading every aspect of my life to its essentials while still sustaining happiness. Here’s what that looks like:

- Transportation: I’m reducing my transportation costs by downgrading my vehicle and living closer to work to cut fuel and maintenance expenses.

- Housing: I’ll downgrade my housing, choosing a smaller, more affordable space closer to work to save on rent or mortgage payments.

- Food: Eating out is off the table. All my meals will be homemade, which is healthier and significantly cheaper.

- Consumerism: I’ve stopped buying useless stuff to impress people I don’t even know. If it’s not essential, it doesn’t make the cut.

- Subscriptions and Luxuries: All unnecessary subscriptions are canceled. Streaming, memberships, or any recurring costs that don’t add value are gone.

By embracing this minimalist approach, I’m maximizing my savings without sacrificing my ability to enjoy life. I don’t need the flash; I need the freedom.

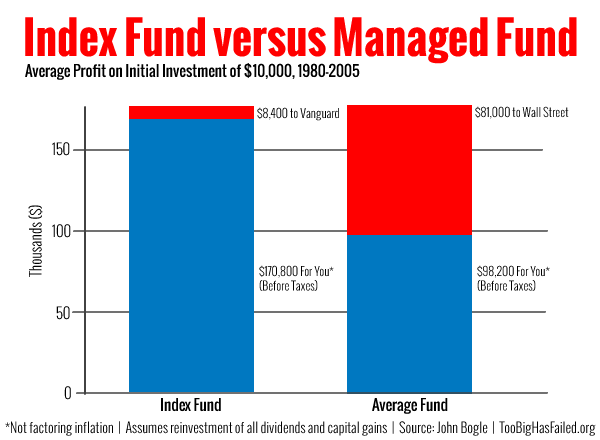

2. Investing Through Dollar-Cost Averaging

Every paycheck, I invest a big chunk of my savings into broad-based U.S. index funds. Dollar-cost averaging means I invest consistently, regardless of whether the market is up or down. Over time, these investments grow and compound, creating a steady stream of income that I can eventually live off.

3. Building an Asset Base

The key to retiring early is owning assets that generate income. Stocks, bonds, real estate, businesses—these are the things that work for you while you sleep. My goal is to accumulate enough assets that the income they produce covers my living expenses forever.

4. Leveling Up My Skills and Income

While cutting back is critical, I’m also focused on increasing my earning potential. I spend my free time studying wealth, understanding business, and learning about entrepreneurship and real estate. I’m applying for higher-paying jobs, building new skills, and exploring side hustles to grow my income.

By increasing my earnings while keeping my expenses low, I’m accelerating my path to Financial Independence.

The Benefits of Financial Independence

Achieving Financial Independence isn’t just about quitting a job or retiring early. It’s about living a life on your own terms. Here are a few of the benefits that keep me motivated:

- Peace of Mind: Knowing my financial future is secure allows me to sleep better at night.

- Time Freedom: I can spend my time doing what I love instead of what I’m obligated to do.

- Creative Pursuits: Without the constraints of a 9-to-5, I can explore entrepreneurial ideas and hobbies that truly excite me.

- Meaningful Relationships: I’ll have more time and energy to invest in the people who matter most.

Why You Should Consider This Path

Most people are stuck in a cycle of working to pay bills until they’re too old to enjoy life. But it doesn’t have to be that way. Financial Independence is achievable for anyone willing to make sacrifices and plan strategically.

It’s not easy—saving 75% of your income, investing consistently, and living below your means takes discipline. But the rewards are worth it: a life of freedom, flexibility, and purpose.

If you’re tired of living paycheck to paycheck or feeling like your life revolves around work, maybe it’s time to consider Financial Independence. Start small. Track your spending, cut unnecessary expenses, and start investing. The earlier you start, the sooner you can break free.

Final Thoughts

Retiring at 30 isn’t about avoiding work; it’s about creating a life so fulfilling that work becomes optional. At 23, I’ve made the decision to take control of my future now, so I don’t have to look back with regret later.

My path to Financial Independence might seem extreme, but to me, it’s the most logical way to achieve the freedom I crave. If this resonates with you, start your journey today. The road might be long, but the destination is worth it.

So here’s to freedom—to never asking for permission again, to living life on your terms, and to proving that yes, it’s possible to retire at 30.

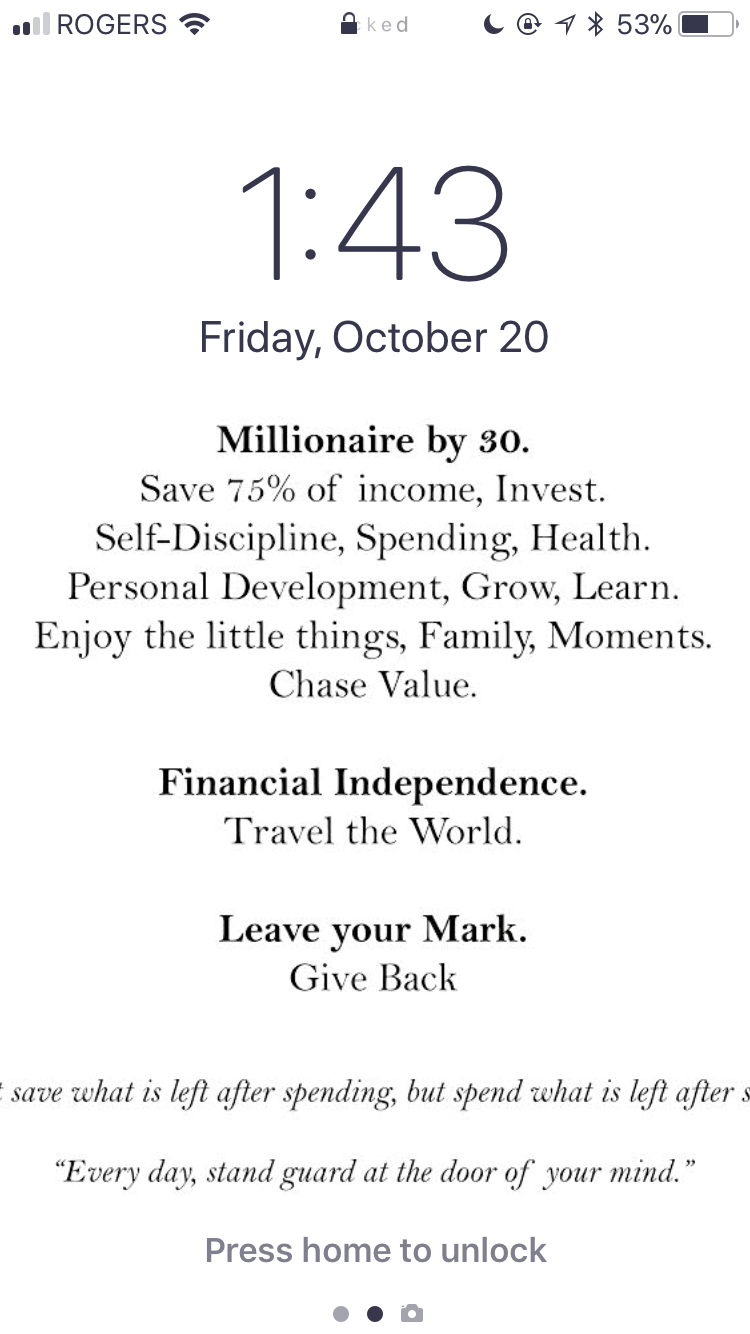

My Cell Phone Wallpaper: Best Reminder For Keeping Goals Top Of Mind. Note: This photo was added a few months after the post was published.

My Cell Phone Wallpaper: Best Reminder For Keeping Goals Top Of Mind. Note: This photo was added a few months after the post was published.