The Simple Math of Early Retirement

What if I told you that retiring early—whether at 30, 40, or just before the gray hairs fully settle in—isn’t about earning six figures or hitting the lotto? Instead, it all boils down to one elegant equation:

Time to Retirement = How Much You Save ÷ How Much You Spend.

Intrigued? Let’s dive into the surprisingly simple math that can change your life, sprinkle in some wit (because who doesn’t love a chuckle while dismantling the 9-to-5 grind?), and get you closer to the ultimate goal: freedom.

The Equation That Rules Them All

Here’s the secret sauce: figure out how much you’ll need each year in retirement, then save 25 times that amount. Once you hit that target, you can safely withdraw 4% annually, a strategy known as the Safe Withdrawal Rate (SWR). That’s right—your money works for you while you sip margaritas on a beach (or, you know, binge-watch your favorite shows guilt-free).

The Math Is Simple:

- Spend $100,000/year? You’ll need $2,500,000 saved.

- Spend $40,000/year? You’ll need $1,000,000 saved.

- Spend $20,000/year? You’re good with $500,000.

This 25x rule ensures your nest egg grows with inflation, lasts indefinitely, and doesn’t force you to dumpster dive in your golden years.

To be conservative, I’m personally aiming for a 2% SWR. You can always adjust your withdrawl rate based on your lifestyle at the time, but I would never exceed 4% SWR per year.

The Key: Save Big, Spend Smart

If your savings rate is 0%—aka living paycheck to paycheck—retirement is a mirage. You’re chained to the office forever. But crank that savings rate up, and the equation works in your favor.

Example:

- Save 50% of your income, and you’re free in 16 years.

- Save 75%, and you’re out in just 7 years. (my goal)

The magic? Every dollar you save is a double win:

- It shrinks the amount you need to cover annual expenses.

- It grows your nest egg faster.

Less spending, more saving. It’s not about sacrifice; it’s about choices. Your future self will thank you.

Frugality: The Unsung Hero

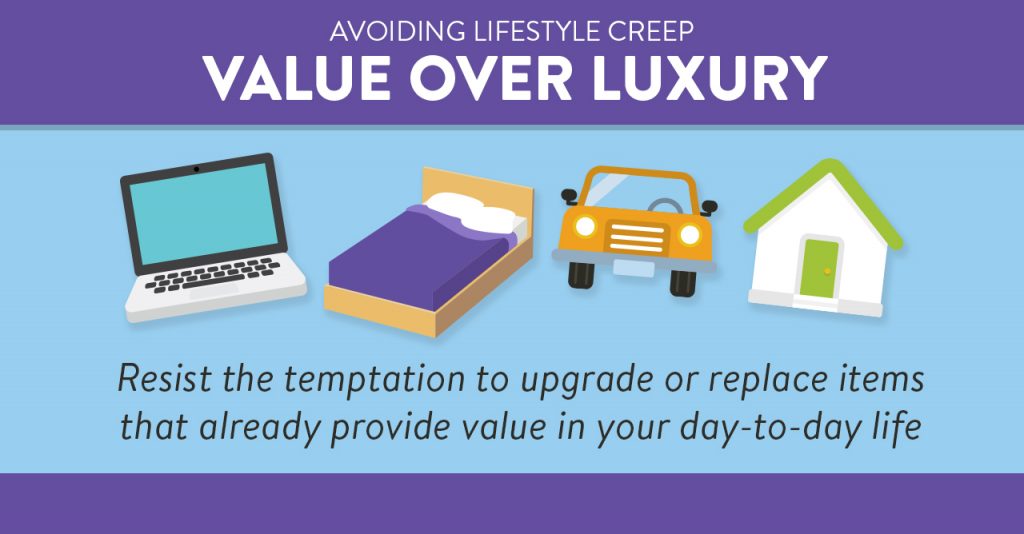

Frugality gets a bad rap. People imagine a joyless existence of clipping coupons and saying goodbye to avocado toast. But true frugality is about maximizing value—not deprivation.

Why It’s So Powerful:

- Saves Money Today. Every dollar not spent is a dollar invested.

- Shrinks Your Target. Spend less, and your retirement fund needs to be smaller.

Let’s say you trim $500/month (ditch subscriptions, cook more, drive a paid-off car). That’s $6,000/year you save—and $150,000 less needed to retire. That’s the math flex no latte can match.

The 4% Rule: Your Freedom Blueprint

The 4% withdrawal rate works because it lets your investments grow even as you spend. Whether your money is parked in stocks, real estate, or index funds, it churns out returns year after year.

Think of It Like This:

- You’re not living off your cash pile; you’re living off the energy (returns) it generates.

- Your investments become a self-sustaining money machine, covering inflation and your dreams.

Compound Growth: The Snowball Effect

Here’s where the math gets spicy. Your savings don’t just sit there—they grow exponentially thanks to compound interest.

Example:

- Invest $10,000 at a 7% return. In 10 years, you’ll have $20,000.

- Keep adding to it monthly, and the snowball gets unstoppable.

The earlier you start, the more powerful compounding becomes. Time isn’t just money—it’s freedom.

Savings Rate Cheat Sheet

Curious about how your savings rate affects your retirement timeline? Here’s a quick guide:

| Savings Rate (%) | Years to Retirement |

|---|---|

| 10% | 51 years |

| 25% | 32 years |

| 50% | 16 years |

| 75% | 7 years |

The higher the savings rate, the shorter the grind. Extreme? Maybe. But so is spending your golden years in a cubicle.

Five Steps to Early Retirement

- Track Every Dollar. Knowledge is power. Use apps or spreadsheets to know where your money goes.

- Cut Ruthlessly. Ditch expenses that don’t spark joy—or fund freedom.

- Save Aggressively. Aim for at least 50%, or 75%+ if you’re ambitious.

- Invest Wisely. Index funds, real estate, or businesses.

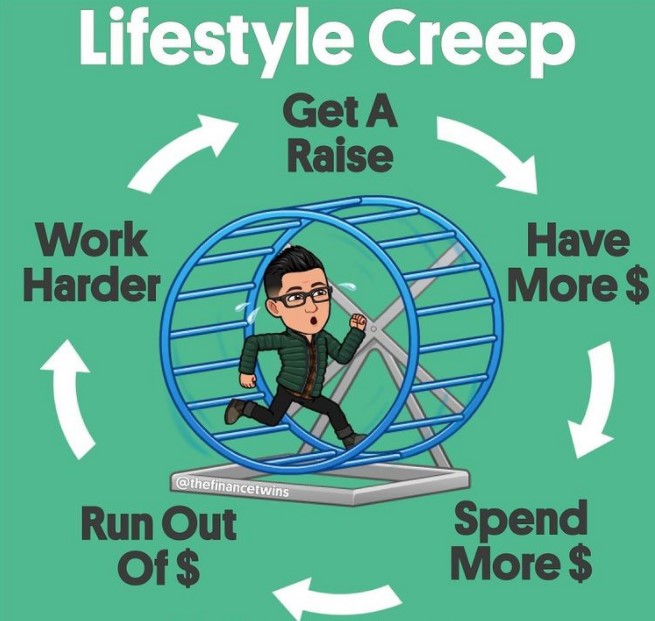

- Say No to Lifestyle Creep. Keep your spending steady, even as income rises. (hardest to overcome)

The Mental Shift Most People Miss

The math is simple, but the mindset shift is harder:

- Consumerism is a trap. Stuff doesn’t bring happiness—freedom does.

- Wealth ≠ Income. It’s not what you earn, it’s what you keep.

- Patience pays. Compound growth takes time, but its rewards are life-changing.

Most people dismiss this approach as extreme because they’ve bought into a system that equates spending with success. Breaking free means redefining what enough looks like—and realizing that freedom beats fleeting luxuries every time.

Final Thoughts: Freedom Is Worth the Effort

Early retirement isn’t about hoarding wealth; it’s about reclaiming time. Every dollar saved buys a piece of your future, whether it’s traveling the world, starting a passion project, or just sleeping in on a Monday.

The formula is deceptively simple: Save more, spend less, invest smart. Start now, and every step brings you closer to living life on your own terms. Because in the end, early retirement isn’t about math—it’s about freedom.

Are you ready to do the math that sets you free?