A Simple Portfolio Returned 41% In 4 Years

At 20 years old in January 2014, I faced a common dilemma for young investors: how to grow my savings wisely. Instead of chasing high-risk stocks or paying hefty fees to a financial advisor, I adopted a simple, time-tested strategy—investing in the S&P 500 Index through a Vanguard ETF. Over the next four years, I consistently invested monthly, relying on dollar-cost averaging (DCA) to build my portfolio.

This case study details my approach, results, and why I firmly believe that instead of searching for the “needle” (individual stocks), buying the “haystack” (the S&P 500) is the smartest and most reliable long-term investment strategy for young investors.

Why I Prefer Self-Directed Investing

When it comes to investing, I prefer to take a self-directed approach. It’s not something I would recommend to everyone — it requires a good amount of self-discipline, a willingness to stay informed about global events, and a real passion for personal finance. But for me, it’s the only way that feels right.

I’m not here to criticize financial advisors; they absolutely serve their purpose. But I personally don’t feel that the value they provide is worth the cost in my situation. There’s always been a friction for me when it comes to handing over control to money managers. The fundamental misalignment is hard to ignore: the way most professional money managers make money is by taking fees from my investments, regardless of whether I win or lose. They typically charge an annual management fee of 1-2% of assets under management, and this fee is paid whether the portfolio gains or loses value. In other setups, like hedge funds or private equity, they may take a performance fee on top of that — often 20% of the profits.

The point is, no matter what happens to my money, the fees keep coming out. And I just don’t like that structure. I understand that managers have costs to cover and that the market can be unpredictable. But in my view, it’s their job to anticipate and mitigate risks. Yet, the model remains lucrative for them, with almost no downside.

Most people don’t realize that the person they deal with — the client-facing advisor — isn’t usually the one managing their money. The real decisions are made by teams of financial professionals working behind the scenes, often in major financial hubs like Toronto or New York. Sometimes, it’s not even humans making the trades but algorithms with human oversight. So, the person you speak with is essentially there to maintain relationships, not to make the tough calls with your investments. To me, that feels off; there’s no real alignment between the advisor and the performance of my funds.

Now, I get why financial advisors exist. For people who are extremely busy or simply uninterested in diving into the complexities of investing, they provide a valuable service. If you’re someone who doesn’t want to think about stocks, bonds, or asset allocations, having someone handle that is worth the price. As the saying goes, “ignorance is bliss,” but in this case, it’s also costly, especially over a long investment horizon.

Finance can seem intimidating, and a lot of the jargon thrown around by professionals only makes it worse. I think some of that is intentional — it keeps people feeling dependent on experts. But the truth is, there are simple, time-tested strategies that almost anyone can follow at home. With just a bit of learning, you can manage your own investments effectively, spending maybe an hour every few months monitoring your portfolio. There’s a quote that captures my sentiment well: “Wall Street is the only place where people arrive in Rolls Royces to take advice from those who take the subway.”

For me, investing is about taking responsibility and maintaining control. The rewards of self-directed investing go beyond financial returns; it’s the confidence that comes from knowing you have a hand on the wheel.

This is also why I take issue with employer pensions. I wish there was at least an option for employees to self-direct the contributions made by their employers. That, however, is a topic I may explore in more detail in the future.

The Strategy: Dollar-Cost Averaging into the S&P 500

Investment Details

Monthly Contribution: $1,500

Annual Contribution: $18,000

Time Period: January 2014 – December 2017

Total Contributions: $72,000

Portfolio Value at End: $101,581

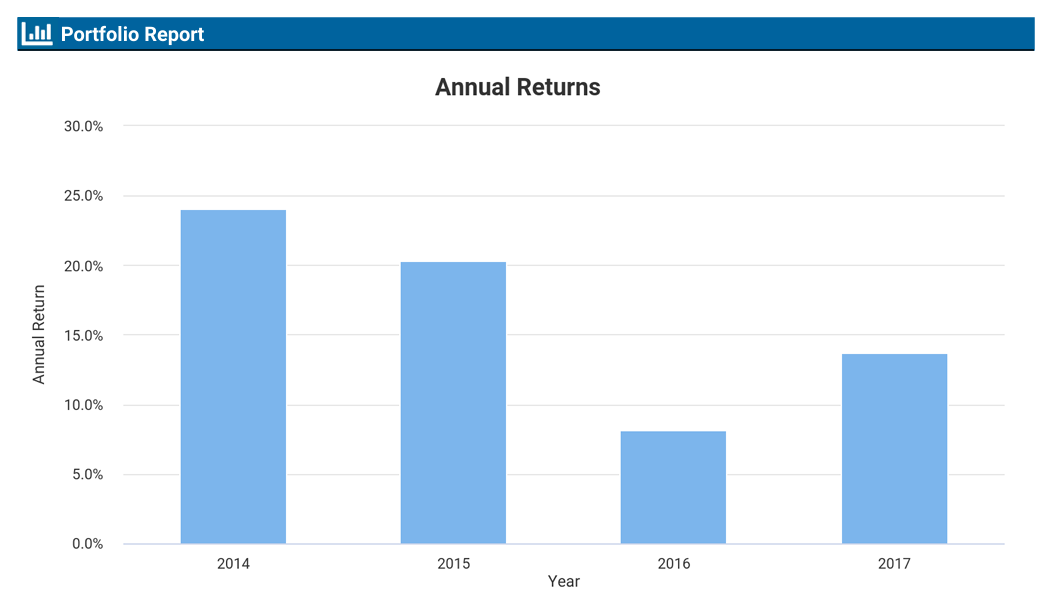

Performance Overview

Investment Gain: $29,581

Total Return: 41.08%

Money-Weighted Rate of Return (MWRR): 14.72%

Best Year: 24.05% (2014)

Worst Year: 8.18% (2016)

Download my Full Investment Summary

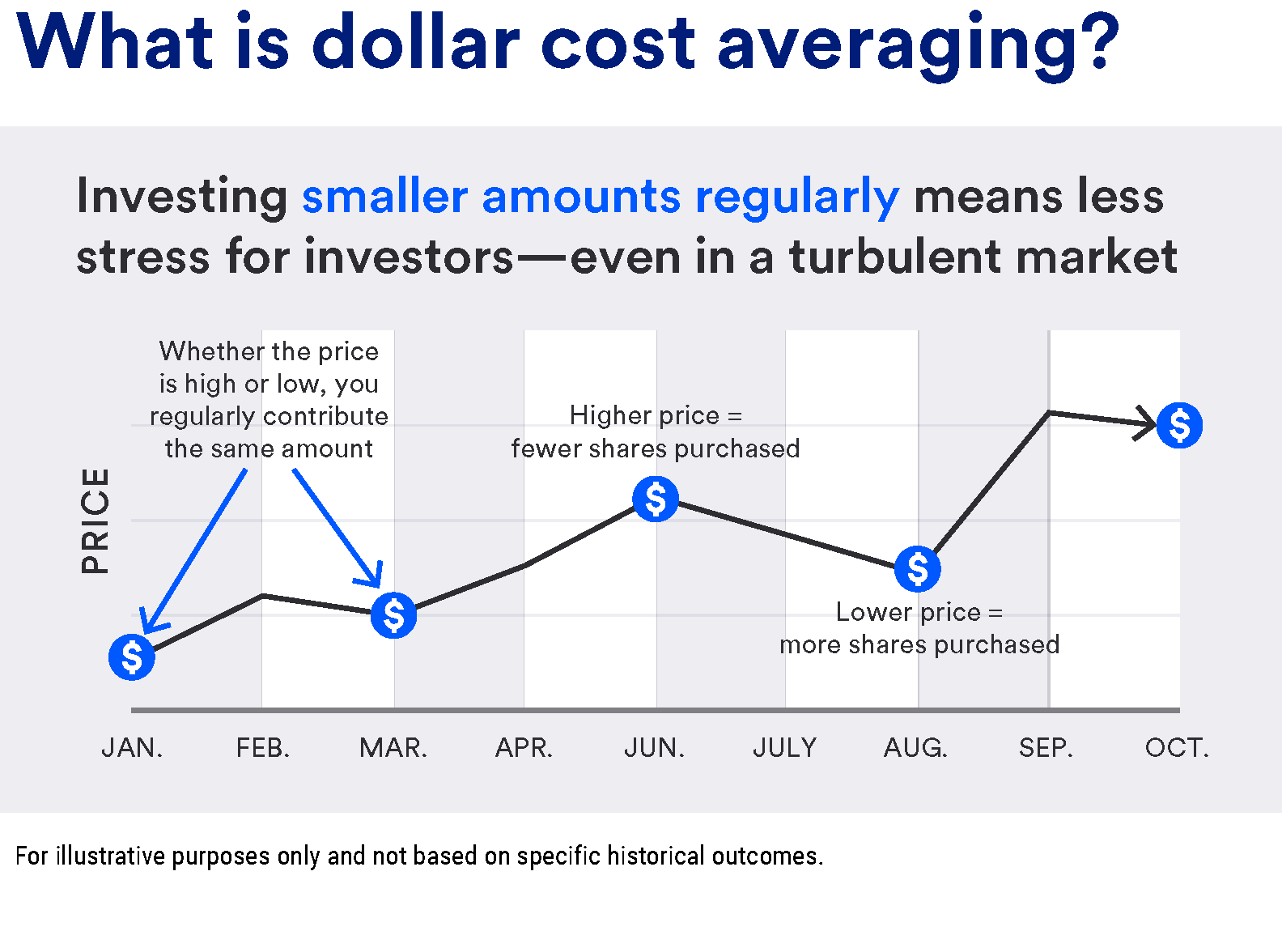

Using a disciplined DCA approach, I invested in VFV.TO, a Canadian-listed ETF tracking the S&P 500 Index . DCA allowed me to invest the same amount regularly, irrespective of market conditions. This strategy minimized the risk of poorly timed investments by buying more shares during dips and fewer shares during peaks.

Download my Full Investment Summary

Why VFV.TO Was My Investment Vehicle

The Vanguard S&P 500 Index ETF (VFV.TO) was an excellent choice for my goals as a Canadian investor:

- Currency Convenience: Traded on the Toronto Stock Exchange (TSX) in CAD, eliminating currency conversion fees.

- No Currency Hedging: The ETF’s value fluctuates with the USD/CAD exchange rate, benefiting me when the U.S. dollar strengthened.

- Low Fees: With a management expense ratio (MER) of 0.08%, VFV offered a cost-effective way to gain exposure to the U.S. market.

- Tax Efficiency: Holding VFV in a registered account (like an RRSP) avoided U.S. estate tax risks and facilitated the recovery of U.S. withholding taxes on dividends.

The Needle vs. The Haystack: Why the S&P 500 Wins

Instead of picking individual “needle” stocks, I chose to invest in the “haystack”—the S&P 500, which includes 500 of the largest U.S. companies across various sectors. Here’s why this strategy works:

- Diversification: Risk is spread across hundreds of companies.

- Consistent Returns: Historically, the S&P 500 delivers approximately 10% annual returns over the long term.

- Reduced Risk of Failure: Individual stocks may fail, but the index evolves by replacing underperformers with rising stars.

- Outperformance: Over 80% of actively managed funds underperform the S&P 500 due to high fees and inconsistent strategies.

Additionally, I recognized my limitations. I lacked the time, education, and experience to analyze stocks effectively. By simplifying my investments with the S&P 500, I avoided the pitfalls of overcomplicated strategies.

Mindset: Staying Disciplined During Volatility

Investing isn’t just about logic—it requires emotional discipline, especially during downturns. While I was fortunate to avoid severe market drops during my four years, I did face a nearly 8% drawdown in January 2016. Here’s what helped:

- Belief in the Thesis: Confidence in the U.S. market’s long-term resilience kept me from panic-selling.

- Discipline to Hold: Resisting the urge to sell during dips is crucial. Historically, markets recover over time.

Opportunistic Buying: Market downturns are “sales” for investors. I kept accessible liquidity to buy more shares during these times.

Panic selling is one of the fastest ways to erode returns. The key is to stay focused on your long-term goals, trusting that volatility is temporary.

Dollar-Cost Averaging vs. Lump-Sum Investing

While lump-sum investing can yield higher returns (if timed perfectly), most young investors don’t have large sums to invest. For me, DCA had significant advantages:

- Risk Mitigation: DCA smoothed out the impact of market volatility.

- Consistent Savings Habit: Monthly investments built discipline and ensured I regularly allocated money to my portfolio.

Why Vanguard Funds?

I chose Vanguard’s VFV for its ultra-low fees and simplicity. Here’s how it compares to actively managed funds:

- Low Expense Ratio: At 0.08%, VFV costs a fraction of the 1-2% fees typical of mutual funds.

- Long-Term Growth: Over decades, lower fees mean higher returns due to compounding.

- No Managerial Risk: Index funds track the market, eliminating risks from poor fund manager decisions.

Comparing Returns: VFV vs. Mutual Funds

To benchmark my performance, I compared VFV’s returns to the RBC Select Growth Portfolio (Series A) (RBF459), a popular mutual fund. Here’s the data from 2014–2017:

RBC Select Growth Fund Performance

• Annualized Return: 8.43%

• Cumulative Return: 27.8%

VFV Performance

• Annualized Return: 14.72%

• Cumulative Return: 41.08%

Key Differences

- Fees: The RBC fund’s MER was 2.14%, eroding returns. VFV’s MER was just 0.08%.

- Asset Allocation: The RBC fund included bonds and other low-growth assets, reducing its upside potential compared to VFV’s pure S&P 500 exposure.

Despite limited investing experience, I outperformed Canada’s flagship mutual fund with minimal effort—all thanks to lower fees and better asset allocation.

Compounding: The Key to Wealth Building

Albert Einstein famously called compound interest the “eighth wonder of the world.” Here’s why:

- Reinvested Dividends: Returns generated more returns, accelerating portfolio growth.

- Long-Term Growth: Investing $18,000 annually at a 10% return grows to:

- $1,145,000 in 20 years,

- $3,144,000 in 30 years,

- $8,054,000 in 40 years.

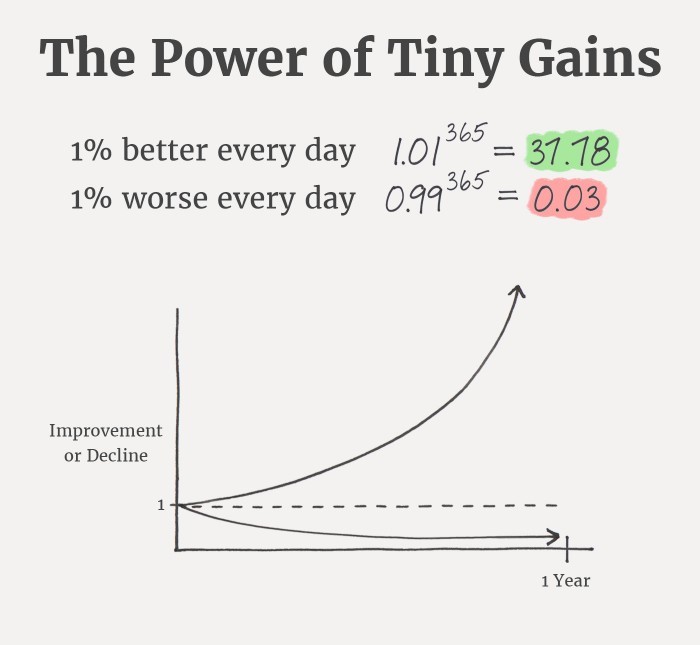

Small, consistent progress creates exponential results—both in investing and life.

Life, like money and wealth, is all about compounding. Every aspect—your relationships, skills, abilities, writing, thinking, typing, career, health, and finances—compounds over time. When you focus on improving just a little bit each day, the growth is gradual at first but becomes exponential, creating a “hockey stick” curve of progress. Small, consistent effort leads to massive returns in the long run. Keep investing in yourself, and watch the power of compounding transform your life.

Inflation: The Hidden Wealth Eroder

Inflation isn’t just about rising prices—it’s also about rising asset costs. By investing in the S&P 500, I feel I have hedged against it:

In my view, inflation comes in two distinct forms. The first is the familiar Consumer Price Inflation (CPI)—the rising cost of everyday goods and services. This includes things like dining out, buying a movie ticket, or purchasing electronics. We’re often told this inflation is growing at just a few hundred basis points (e.g., 2-3%) per year.

However, I believe there’s a second, less-discussed form of inflation: asset inflation. This affects those who are forward-thinking, planning for the future, and investing in assets like real estate, stocks, and businesses. Unlike consumers focused solely on day-to-day expenses, these individuals face a much higher rate of inflation.

Ask yourself: if inflation is really only 2-3%, why do the prices of scarce, desirable assets—such as housing, investments, and stocks—far outpace CPI? In my opinion, this disconnect is tied to the expansion of the M2 money supply. The S&P 500, for example, closely mirrors the growth of M2. As more money is printed and circulates in the economy, a significant portion finds its way into these scarce, easily investable assets, driving their prices upward.

In essence, the S&P 500 can serve as a more accurate reflection of true inflation for those looking to grow their savings and wealth. If your returns aren’t at least matching the S&P’s growth, you’re likely falling behind in real terms. For those focused on building financial freedom, this is the inflation rate that truly matters.

Warren Buffett’s Endorsement: Why the S&P 500?

Warren Buffett, the “Oracle of Omaha” and one of the most successful investors in history, has repeatedly emphasized his unwavering faith in the S&P 500. In fact, his will explicitly directs 90% of his estate to be invested in an S&P 500 index fund, bypassing his own company, Berkshire Hathaway. Buffett’s reasoning is simple and compelling:

“A low-cost index fund is the most sensible equity investment for the great majority of investors.” If the world’s most renowned investor trusts the S&P 500 for his legacy, why should we second-guess it? Here’s a closer look at Buffett’s strongest arguments for this approach:

1. Simplicity and Effectiveness

Buffett has often advised individual investors to avoid complexity. He famously said, “In my view, for most people, the best thing to do is to own the S&P 500 index fund.” This straightforward strategy eliminates the need for deep market knowledge or frequent decision-making, allowing investors to benefit from broad market growth without the stress of active management.

2. Long-Term Performance

Buffett’s confidence in the S&P 500 stems from its historical resilience and growth. “American business – and consequently a basket of stocks – is virtually certain to be worth far more in the years ahead.” This statement reflects his belief in the enduring strength of the U.S. economy, which the S&P 500 reliably represents.

3. Outperforming Active Management

Buffett made headlines when he bet $1 million that an S&P 500 index fund would outperform a group of hedge funds over a decade. The result? The S&P 500 index fund gained 125.8%, While the hedge funds lagged significantly behind. This real-world example underscores his argument that low-cost passive investments often outperform high-fee actively managed strategies.

4. Cost-Effectiveness

Buffett consistently stresses the detrimental impact of high fees on returns. “Costs matter in investments. If returns are going to be seven or eight percent and you’re paying one percent for fees, that makes an enormous difference in how much money you’re going to have in retirement.” With ultra-low expense ratios (often under 0.1%), S&P 500 index funds preserve more of the portfolio’s growth compared to actively managed funds that charge 1-2% or more annually.

5. Personal Commitment

Perhaps the most powerful endorsement of all: Buffett practices what he preaches. He’s directed that 90% of his wealth be invested in a low-cost S&P 500 index fund after his passing. This decision reflects his unshakable confidence in the strategy’s reliability and performance over time.

6. Accessibility for Every Investor

Buffett emphasizes that success in investing doesn’t require advanced expertise or a professional background. “The goal of the non-professional should not be to pick winners… but to own a cross-section of businesses that in aggregate are bound to do well. A low-cost S&P 500 index fund will achieve this goal.” This makes the S&P 500 an ideal option for everyday investors seeking long-term growth without the complexity or risk of stock-picking.

Final Thoughts: Why the S&P 500?

From 2014 to 2017, I learned that simplicity outperforms complexity. The S&P 500 offered:

- Diversification across leading companies.

- Consistent long-term returns.

- Low fees with Vanguard ETFs.

- Minimal time commitment, allowing me to focus on earning more and cutting expenses.

Investing in the S&P 500 is more than a strategy—it’s a philosophy rooted in confidence in American innovation and resilience. By dollar-cost averaging, leveraging compounding, and embracing market volatility, I laid the foundation for lasting wealth.

“To become financially independent, you must turn part of your income into capital; turn capital into enterprise; turn enterprise into profit; turn profit into investment, and turn investment into financial independence.” — Jim Rohn

The sooner you start, the bigger the payoff. Why not begin today?

Disclaimer: This is not financial advice. Everyone’s situation and risk tolerance are unique. Please consult a financial advisor before making investment decisions.