House-Hacking: How to Live for Free

We sold our suburban home and moving into a duplex in a far less affluent neighborhood of Winnipeg. This bold move not only slashes our living expenses but also sets the stage for significant financial growth. Here’s how it’s all unfolding.

The custom built home we sold

The custom built home we sold

Living Frugally and Building a Nest Egg

From the beginning of my financial journey, I prioritized frugality and discipline. One of my earliest strategies was making double mortgage payments, motivated by a straightforward yet powerful financial principle: eliminate debt as quickly as possible.

The Power of Early Mortgage Payments

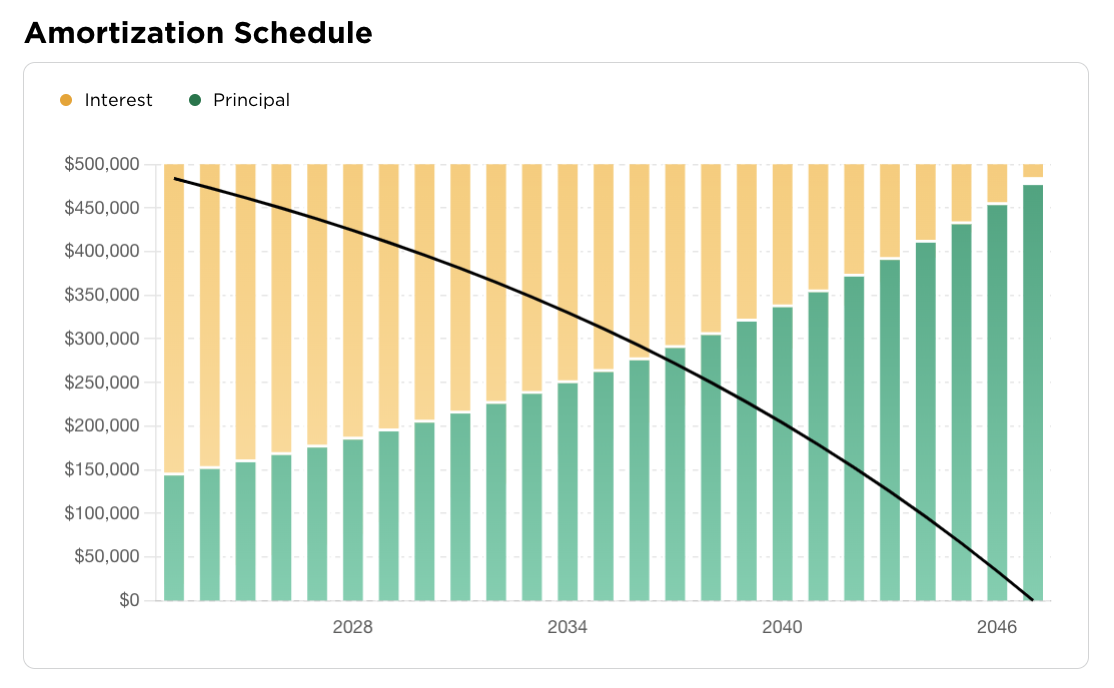

Most people don’t fully grasp how compounding interest works, especially when it works against you. Understanding the amortization schedule of a mortgage is crucial. Mortgage interest is front-loaded, meaning you pay more interest than principal in the early years. By making large principal payments early, you can save astronomical amounts in interest and shave years off your mortgage.

For example, I put 20% down on my first home with a 25-year amortization. By making double mortgage payments, I could pay off my mortgage in 8.5 years instead of 25. Many banks also allow annual lump-sum payments, usually 10–20% of the original mortgage balance. If you combine double payments with a 10% annual lump-sum payment, you could be mortgage-free in 4.5 years. That’s a dramatic reduction from the original term!

Rethinking Homeownership

Many view owning a house as an investment, but it’s crucial to understand that a primary residence is primarily a consumer good, not an asset. The total cost of homeownership often surpasses the cost of renting, especially when you account for opportunity costs like immobilized capital and reduced flexibility. Delaying a home purchase until you are financially prepared can significantly impact your long-term financial health.

Key Principles to Guide Homeownership Decisions

Avoid Stretching Beyond Your Means

Purchasing a home that exceeds your budget can hinder your financial growth, leaving little room for savings, investments, or other opportunities.

Watch Out for the Middle-Class Trap

Societal norms and pressures often push people to buy expensive homes early, under the guise of “success.” However, this approach can stunt wealth accumulation and limit career or personal growth.

Follow the 30% Rule

Most lenders require that your monthly mortgage payments (excluding property taxes, utilities, and maintenance)—remain below 30% of your net income.

I recommend going a step further: only purchase a home if you can comfortably afford to make double the mortgage payments while still staying within this threshold. If you can’t, it’s a clear sign that the house is beyond your financial means.

Purchase Something You Can Improve and Hold Long-Term

Choose a property you can add value to and plan to hold for 10+ years—longer is better. Most people underestimate the significant transaction costs associated with real estate, which quickly erode wealth.

Consider this: you buy a house for $300,000, put 5% down, and two years later, sell it to “upgrade” to a more expensive home in a “better” neighborhood. By the time you pay 3% in land transfer taxes, legal fees, closing costs, mortgage fees, and 6% realtor fees, plus moving expenses and mortgage pre-payment penalties, you’ve almost entirely lost your equity. Add in the costs of buying back into the market, and you’re left worse off. Real estate requires a long time horizon to spread out these costs.

Example before and after

Example before and after

The Springboard to Financial Independence

I recognized that my primary residence was a liability, tying up capital that could be working for me elsewhere. By embracing house hacking, I aimed to dramatically reduce my living expenses and create a financial runway to take calculated risks—like starting my own business—and work toward achieving lean FIRE (financial independence, retire early).

In addition to this first house hack, I purchased a second duplex in Winnipeg’s North End—a story for another blog post. With these two strategic moves, I traded one liability for two income-generating assets, housing three sets of tenants and giving me a free place to live. This shift transformed my housing situation and built a sustainable, scalable path to financial freedom.

What Is House Hacking?

House hacking involves purchasing a property with more than one rentable area with the goal of subsidizing your housing costs. This can include residential suites, commercial spaces, parking stalls, garage rentals, storage rentals, and more.

The Benefits of House Hacking

Low Money Down: As a primary residence, you can qualify for mortgages requiring minimal down payments (e.g., 5% down in Canada or 3.5% FHA loans in the U.S.), increasing your return on investment.

Renovate with the Bank’s Help: You can bundle purchase and improvement loans, allowing you to improve the property and create equity without using your own money.

Subsidize Your Largest Expense: Housing typically consumes over 40% of income. Reducing this to zero—or even turning it into income—accelerates your personal savings rate significantly.

Foundation for Opportunities: Lower living expenses provide a launching pad to take risks, start a business, return to school, or make a career change without the stress of high housing costs.

Consider applying the BRRRR Method—Buy, Rehab, Rent, Refinance, Repeat This strategy enables you to expand your real estate portfolio efficiently. You start by purchasing a property with a low down payment, minimizing your initial outlay. Next, you rehab the property by making targeted improvements that slightly increase its value. Once renovated, you rent it out, generating steady income and enhancing the property’s appeal to lenders. With the increased value and rental income, you’re in a strong position to refinance the property. This allows you to retrieve your initial investment, freeing up capital. You can then repeat the process annually, using the recovered funds to acquire additional properties.

It’s like finding an “infinite money glitch” in real estate investing!

Reduced Housing Costs for Life: When you move, rent out your unit to cover the housing costs of your next home. A few house hacks can eventually cover the expenses of your “forever home.”

Short-Term Rental (STR) Strategy: STRs can enhance cash flow and offer flexibility. You can block days for personal use and convert units back to long-term rentals if needed.

Multi-Unit Listings: With a multi-unit property, you can list each unit separately and also offer the entire property, appealing to a broader range of travelers.

Educational Experience: House hacking introduces you to property management, tenant relations, contracts, renovations, bookkeeping, and more.

Creative Financing: Strategies like seller financing or assumable mortgages can minimize or eliminate out-of-pocket expenses, increasing ROI and preserving funds for future investments.

Our First House Hack: A Leap of Faith

After realizing that our suburban home was a financial liability, my wife and I decided to pursue house hacking. We spent months educating ourselves on real estate leverage, property management, renovations, and creative financing. We learned everything we could about managing and sourcing tenants, bookkeeping, finding undervalued properties, working with realtors, securing insurance and mortgages for rentals, and financing improvements creatively.

Eventually, we found a duplex on the 200 block of Langside St in Winnipeg—a much rougher area compared to our previous suburban setting. If you’re familiar with Winnipeg, you know that this neighborhood is far less polished than the suburbs.

Our new house-hack!

Our new house-hack!

The Property Details

- Type: Two-and-a-half-story house built in 1907 with a stone foundation.

- Units: One-bedroom suite on the main floor and a three-bedroom suite upstairs.

- Features: Separate hot water tanks, utilities, and entrances.

- Condition: Dated with deferred maintenance but structurally sound.

We met the existing tenant in the upstairs unit—a kind, down-to-earth woman with a strong rental history. She had never missed a payment and seemed like not only a great tenant but also a wonderful neighbor.

Making It Work

To make the move appealing, especially to my wife, we planned to renovate the property extensively. This was perfect timing, as I was transitioning between careers—from sprinkler fitting to pipeline work—and had a period where I was off work, waiting for the call. This gave me the time to focus on renovations.

Financing

We purchased the duplex using a 5% down CMHC loan, minimizing our initial outlay. This allowed us to keep most of the $79,000 in equity from selling our suburban home to invest in more real estate and start my business.

Renovations

After purchasing the property—which coincidentally landed on my 24th birthday—I spent the next three weeks renovating our entire unit:

- Demolition: Ripped out all the flooring and cabinetry.

- Kitchen Upgrade: Designed and installed a new kitchen using IKEA Products and Google SketchUp.

- Cosmetic Improvements: Cleaned up the landscaping, painted walls, and added trim.

- Bathroom Overhaul: Completely renovated the bathroom.

Costs

The total renovation cost was approximately $4,100 for materials. Doing the work myself not only saved money but also provided invaluable experience in timelines, costs, and project management. Labor typically doubles the cost of materials, so by investing my time, I effectively saved another $4,100.

This low renovation cost amazed me, revealing how a modest investment could significantly increase a property’s value. The perceived value of a fully renovated house far exceeds the actual cost, especially when you do the work yourself.

Before

After

Overcoming Doubts

Transitioning from a brand-new suburban home with granite countertops and luxury vinyl plank flooring to an older property in a less affluent area wasn’t easy. We viewed the house twice, and I remember the first time we walked in—it didn’t smell great, perhaps due to some old carpet with possible pet urine. The house creaked, the floors were slightly sloped due to its age, there was no air conditioning, and no garage to park in during Winnipeg’s harsh winters.

I had to convince my wife that this move was the right decision for us. She believed in me and our shared vision, but the reality of leaving our comfortable home was daunting. The night before moving in, we decided to drive through the neighborhood to get excited and plan what we’d do with the property. As we turned onto Langside Street, we saw people loitering, pushing shopping carts full of belongings, and others yelling and arguing.

My wife looked at me and asked, “Are we really going to do this?” I reassured her, saying, “We won’t regret this.”

And in hindsight, it turned out to be one of the best financial decisions we ever made. The move became the springboard for the rest of our lives.

The Financial Breakdown

Let’s delve into the numbers to illustrate the impact:

- Purchase Price: $257,000

- Down Payment and Closing Costs: Approximately $12,850

- Renovation Costs: $4,100 (materials only; labor provided by me)

- Total Initial Investment: $16,950

Monthly Expenses and Income

On Purchase:

| Description | Amount |

|---|---|

| Upstairs Rent (Existing Tenant) | $900/month (with potential to increase to $1,400/month) |

| Mortgage Payment | $950/month |

| Property Taxes | $275/month |

| Insurance | $97/month |

| Utilities (Hydro, Internet, Gas) | ~$165/month (I paid for the one-bedroom unit’s utilities) |

| Repairs and Maintenance Budget | $90/month |

| Total Expenses (Including Mortgage) | $1,577/month |

Net Effect:

- Our Out-of-Pocket Housing Cost: $627/month

By increasing the upstairs rent to market rates ($1,400/month) through improvements and reducing expenses, our out-of-pocket monthly housing cost would drop to $177/month.

Previous Housing Cost:

- Mortgage Payment Alone: $1,300/month

- Total Monthly Housing Expenses: Approximately $2,500/month (including property taxes, insurance, and utilities)

By moving, we dramatically reduced our monthly housing expenses, freeing up cash flow to invest in our business and future properties.

Tax Benefits

Since we occupied only a portion of the property (approximately one-third), we could deduct 60% of shared expenses like property taxes, insurance, internet, landscaping, and maintenance on our income taxes as they are now classified as business expenses. This further improved our financial position by reducing our taxable income.

Scaling the Strategy

My goal was to purchase a multi-family property each year using low-down-payment mortgages, moving into each one, renovating, and then renting out our previous unit. Contrary to common belief, you can obtain multiple insured mortgages in Canada through different insurers (CMHC, Genworth, Canada Guaranty).

By the third year, we planned to refinance the first property into a traditional mortgage, freeing up the ability to secure another insured mortgage for a new property. This strategy maximizes leverage and allows for rapid portfolio growth.

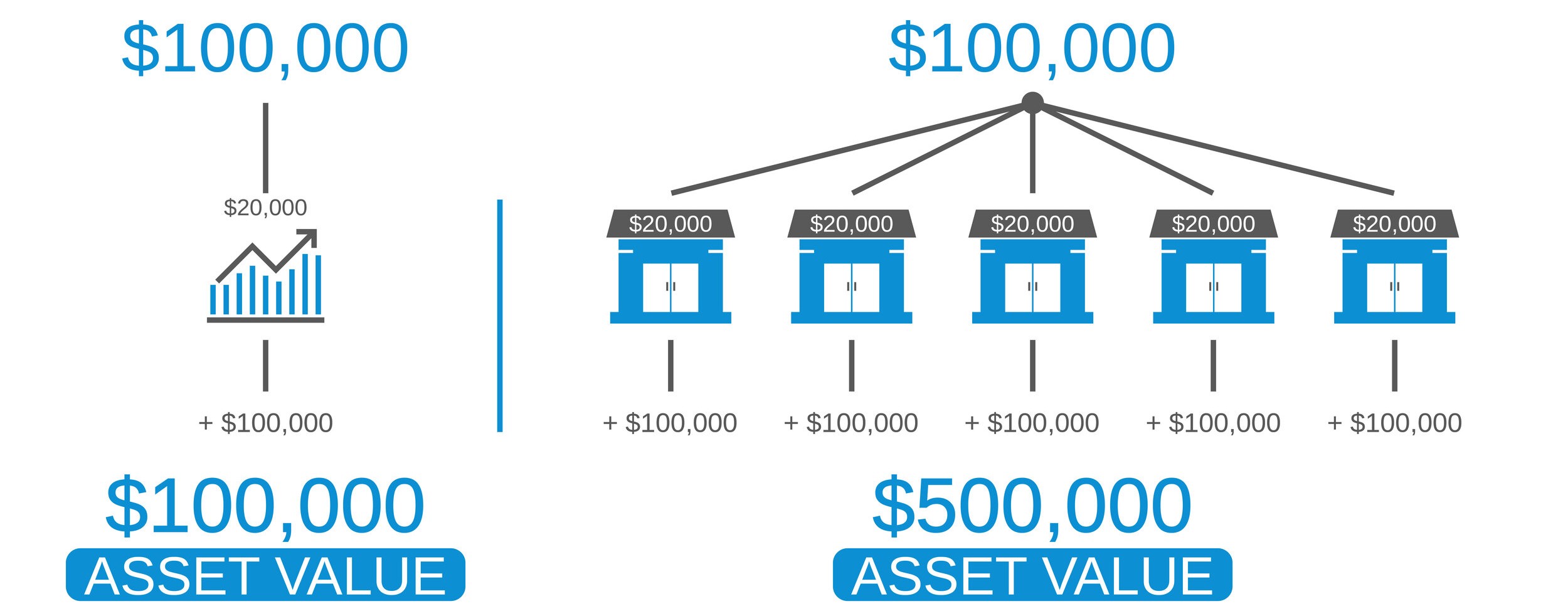

Leverage Comparison:

- Traditional Approach: $100,000 divided into four $25,000 down payments = 4 properties.

- House Hacking Approach: $100,000 with 5% down payments = 20 properties.

Would you rather control $400,000 in assets or $2 million? For me, the choice is clear.

The Long-Term Vision

Imagine purchasing five duplexes over five years:

- Total Units: 10 rental units

- Total Property Value: Approximately $1,250,000

- Annual Appreciation (3%): $37,500

- Annual Mortgage Paydown (2%): $25,000

- Annual Cash Flow (Assuming 1% of Purchase Price): $12,500

- Total Annual Wealth Accumulation: $75,000

Over time, the properties appreciate, tenants pay down the mortgages, and cash flow increases. This doesn’t account for forced appreciation through renovations or potential refinancing opportunities.

With mortgages eventually paid off, the cash flow could provide significant passive income—enough to fund retirement, further investments, or major life expenses. Having 10 units paid off, each renting for $1,200 (without adjusting for inflation), could generate $12,000 per month in rental income. Even after operating costs, we’d be netting around $7,200 per month—a comfortable passive income that surpasses many pensions which require a 25+ year commitment.

Enhancing Returns

As we move on to our next property, I plan to turn our current unit into an Airbnb. Instead of selling or moving all our furnishings—which often don’t match new spaces or styles—we will leave much of it in the unit. This decision will not only save us the hassle of selling or moving items but also allow us to generate significant income.

That little one-bedroom unit is projected to bring in over $2,500 per month through Airbnb, VRBO, and other furnished rental sites. Short-term rentals command a premium over long-term leases. Based on local competitor rates ranging from $85 to $150 per night—depending on the season—and assuming a 70% occupancy rate (most hotels aim for 80%). This income will go directly into our pockets and help fund future investments.

Conclusion: The Power of Strategic Risk-Taking

Selling our suburban home and embracing house hacking was a transformative decision. By reducing our living expenses and leveraging real estate strategically, we positioned ourselves for long-term financial success.

This journey wasn’t without challenges. Moving into a less affluent neighborhood, renovating an old property, becoming a property manager, and stepping out of our comfort zone required courage and conviction. But the benefits far outweighed the difficulties.

House hacking has given us peace of mind by reducing financial stress. No longer do we feel the constant pressure of needing to work extra hours just to keep a roof over our heads. I can think more clearly, plan effectively, and focus on my vision. Meanwhile, my girlfriend can dedicate herself to her studies at the University of Manitoba without the added burden of picking up extra shifts during exam season.

House hacking provided us with:

- Financial Flexibility: Lower expenses and increased savings.

- Investment Growth: A scalable strategy for building wealth through real estate.

- Life Opportunities: The ability to start a business, invest in ourselves, and plan for the future without the burden of excessive housing costs.

By selling the suburban home, I unlocked over $79,000 in trapped equity and eliminated $2,500 in monthly housing costs. I invested $16,950 of that equity to purchase and renovate a duplex where we now live virtually rent-free. The remaining $62,050 went towards acquiring another duplex, and I still had funds left over to start my business, further supported by my savings and stock portfolio. In the long term, this property alone will generate over $30,000 annually in cash flow—not to mention the appreciation and tax benefits.

Imagine doing this every year for five years. The position we’d be in would be life-changing.

If you’re considering ways to accelerate your financial growth, house hacking is a strategy worth exploring. It requires courage, education, and effort, but the potential rewards are tenfold. We’ll look back on our decision without regret, knowing it was one of the best financial moves we ever made.

Thank you for joining me on this journey. I hope my experiences inspire you to consider the possibilities that strategic real estate investing can offer. Here’s to taking calculated risks and reaping the rewards!