Is Canada’s Housing Market About to Crash??

Is Canada’s Real Estate Market a Bubble About to Burst? Here’s Why I Think It’s Not

Whenever real estate prices soar, the word “bubble” tends to get tossed around, accompanied by warnings of an impending crash. But in my opinion, Canada’s real estate market is not a bubble poised to burst. In fact, I believe prices will continue to rise for the foreseeable future. Let me explain why.

At the core of this issue lies one of the most fundamental principles of economics: supply and demand. When supply is limited and demand is high, prices inevitably increase. Today, I’ll unpack the reasons behind Canada’s ongoing housing shortage and explore the factors fueling heightened demand.

“The first lesson of economics is scarcity: There is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.” – Thomas Sowell

Part One: The Supply Shortage

A Persistent Housing Deficit

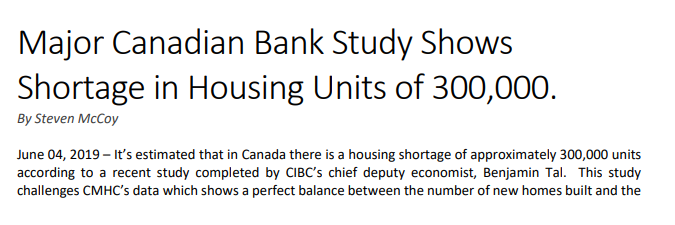

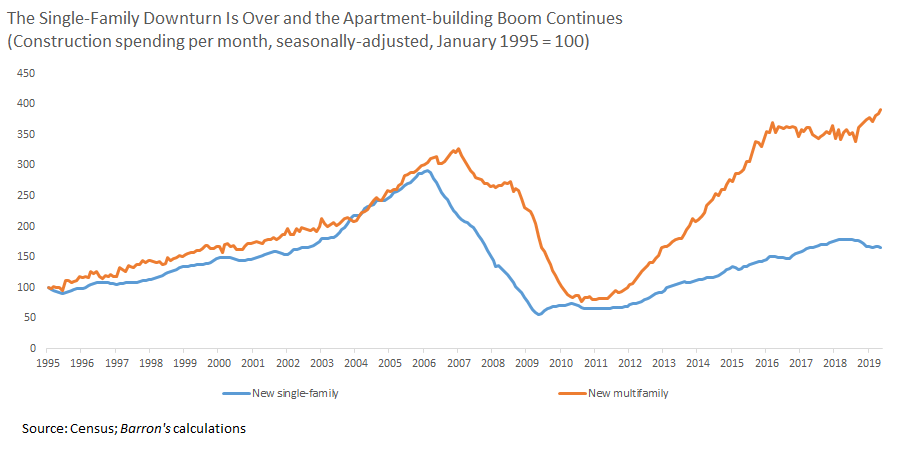

Back in 2019, economist Benjamin Tal conducted a study on Canada’s housing supply and found an annual shortfall of 300,000 homes. Due to various constraints on new housing construction, Canada is consistently failing to meet the demand for homes.

Why Can’t We Build Enough?

Land Scarcity and Regulation:

Only 11% of Canada’s land is privately owned (e.g., just 4% of BC land is private). Government restrictions on the sale of Crown land limit opportunities for large-scale development, leaving high-density projects (e.g., condos) as the only viable option. This leads to skylines full of empty, often speculative, investment condos.

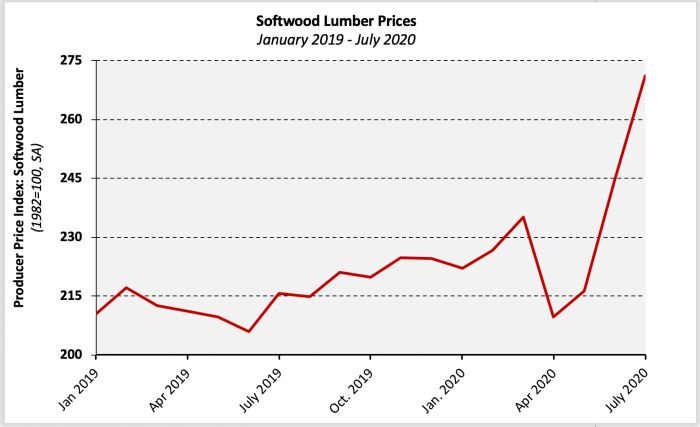

Rising Construction Costs:

Since 2019, wood prices have nearly tripled, increasing construction costs by roughly $12/sqft. For a 2,500 sq ft home, that’s an extra $30,000. Other costs—permits, labor, materials, and stricter building codes—continue to eat into builders' profit margins, further discouraging new developments.

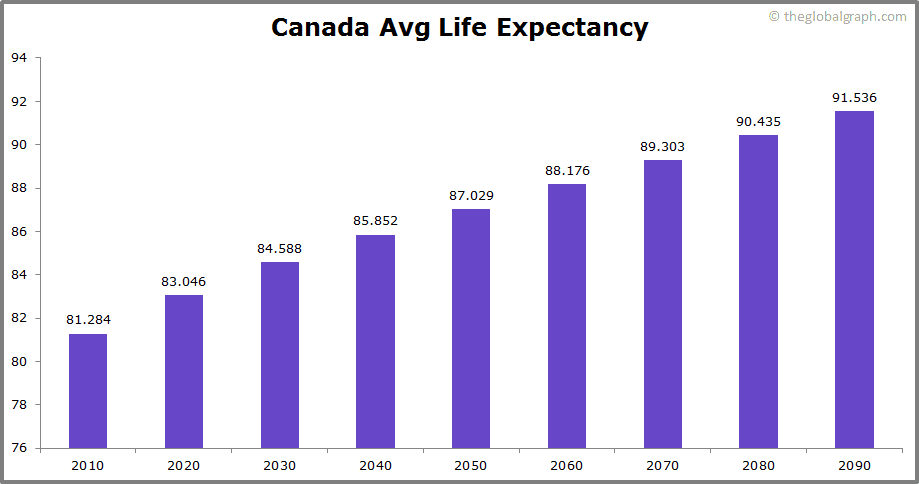

Increasing Life Expectancy:

Canadians are living longer than ever, with the average life expectancy rising from 72.35 years in 1970 to 81.95 years today. This reduces housing turnover, adding to the supply crunch.

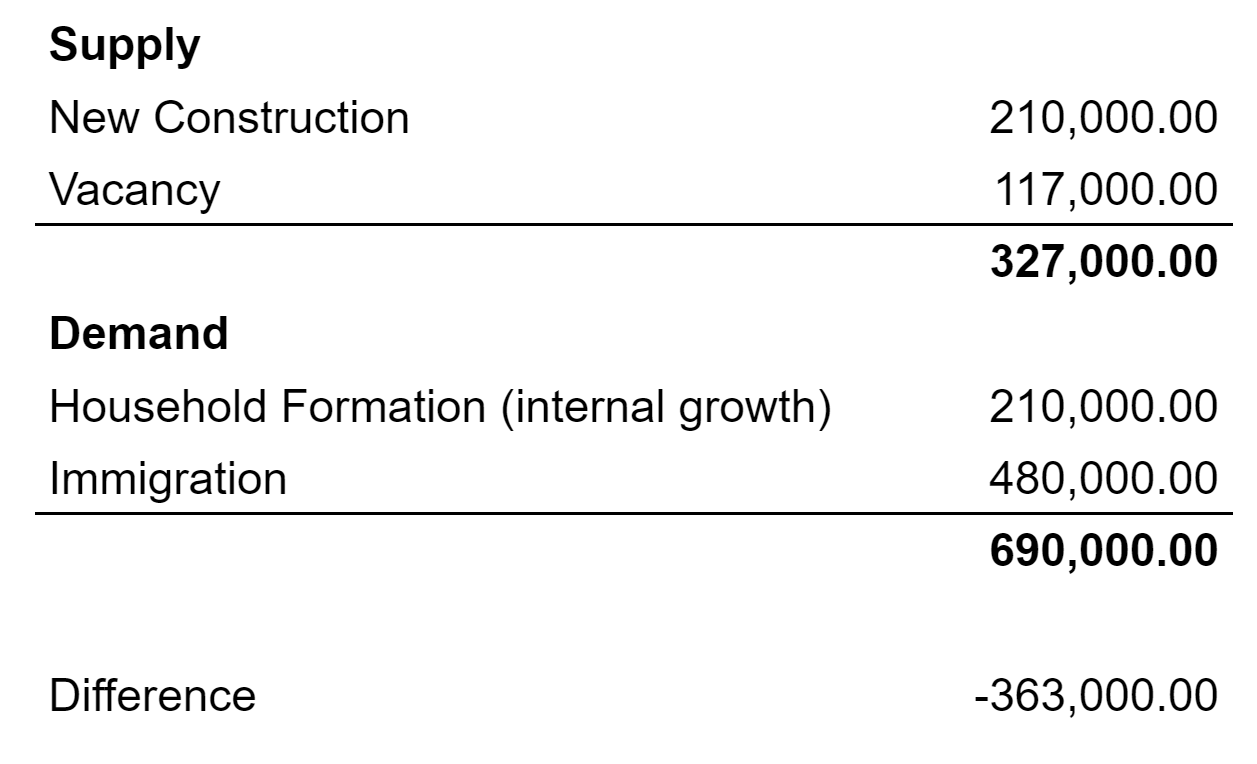

Despite all these challenges, Canada builds only 210,000 homes per year (according to CMHC). That matches the number of newly formed households annually but does little to address the backlog or incoming population growth.

Part Two: Growing Demand

Population Growth

Canada’s population grows by 1.4% annually, adding around 526,000 people per year. Household formation studies estimate 210,000 new households annually, putting immediate strain on the housing supply.

Immigration

Canada’s liberal immigration policy further intensifies demand. The government’s current plan allows for 400,000–450,000 immigrants annually, plus an additional 30,000 asylum seekers/refugees, pushing an estimated 480,000 newcomers into the housing market every year.

Limited Housing Stock

Canada has 12.4 million households. Of these:

8.5 million are homeowners 3.9 million are renters With a national vacancy rate of around 3%, only 117,000 homes are potentially available for new renters or buyers—far short of the population influx.

A Surge in Buying Power

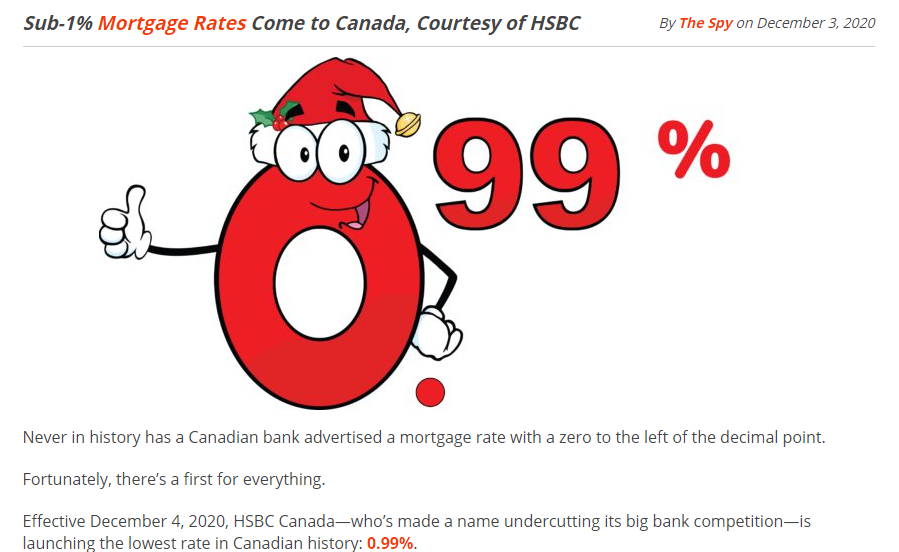

The pandemic brought historically low interest rates, paired with unprecedented levels of household savings:

$90 billion in private household savings

$80 billion in business accounts

This combination of cheap borrowing and excess cash created a perfect storm, as many Canadians jumped into the market to buy their first home, upgrade, or relocate to more desirable areas.

Is It Really a Bubble?

The word “bubble” suggests a market fueled by unsustainable speculation, ready to pop at any moment. However, Canada’s housing market doesn’t fit this description. Here’s why:

Supply and Demand

As long as demand far outstrips supply, prices will remain elevated. The current housing shortage, coupled with rising construction costs and government land restrictions, ensures scarcity will persist.

Affordability and Interest Rates

Even with rising prices, many Canadians can still qualify for homes outside of major metropolitan areas. For example:

A dual-income household earning $160,000/year could afford a home worth up to $736,000 with a 20% down payment and a 2.34% mortgage rate.

While affordability in cities like Toronto or Vancouver remains challenging, many outer suburbs or other provinces (e.g., New Brunswick, Saskatchewan) offer more affordable alternatives.

Average 2021 Home Price per Province

- British Columbia = $887,000

- Alberta = $418,403

- Saskatchewan = $290,789

- Manitoba = $318,074

- Ontario = $864,159

- Quebec = $418,230

- New Brunswick = $224,785

- Nova Scotia = $340,096

- Newfoundland = $282,500

Government Intervention

Some fear rising interest rates could trigger a crash. While higher rates may cool demand, a significant spike would destabilize the economy—not something policymakers are likely to risk. The most realistic outcome is gradual rate increases, which may temper price growth but won’t solve the underlying issue of limited housing supply.

Closing Thoughts

Yes, housing prices are at an all-time high, and yes, affordability is a growing concern. But this does not mean a crash is imminent. The fundamentals—persistent supply shortages, population growth, and low interest rates—continue to support long-term price growth.

The real question isn’t whether the market will crash but rather how we can address the root causes of the housing crisis:

- Loosening restrictions on land development

- Incentivizing new housing construction

- Managing immigration levels in line with housing supply

Until these issues are addressed, I believe we are still in the early stages of a prolonged housing market surge.

What do you think? Am I right, or did I miss something? Let me know your thoughts in the comments below!