Why I’m Betting Big On Retail Real Estate

Why I’m Investing in Commercial Retail Real Estate in Secondary and Tertiary Markets

Six years ago, I took my first step into real estate by purchasing a rental property in Winnipeg’s North End. Today, my partner and I are closing on our second grocery-anchored shopping center, acquired well below replacement cost at just $60 per square foot.

This necessity-based center spans 195,000 square feet of leasable space and hosts twenty-five tenants, the majority of whom are national brands and publicly traded companies. Our journey began with an initial offer of $14.4 million. Through strategic negotiations—leveraging the current economic conditions—we secured the property at a 33.5% reduction below the prior owner’s (a REIT) book value.

Our plan is to stabilize the property and increase the Net Operating Income (NOI) over the next two years. This will enable us to refinance and pay out our investors, allowing us to hold this property for the long term with effectively zero dollars down.

Project Summary

Site: 14 acres

Gross Leasable Area (GLA): 195,000 sq ft

Purchase Price: $11.82 million

Net Operating Income (NOI): $1.65 million

Going-in Cap Rate: 14%

Cash Flow: $964,000

Year 1 Cash-on-Cash Return: 19.66%

Photo of the malls main entrance

Photo of the malls main entrance

I’m putting my money where my mouth is, as I recently shared on social media:

Retail Resilience: Unlocking Value in Shopping Centres

Key Takeaways

1. Attractive Cap Rates: Retail is the only real estate asset class where you can buy stabilized, double-digit in-place cap rates underpinned by reputable, publicly traded companies on 10–40-year Triple Net (NNN) leases.

2. Population Growth vs. Supply: Canada has built only two enclosed shopping centers in the past fifty years, yet the population is growing at 2.5% per year—a 25% increase over the last twenty years alone.

3. Shrinking Retail Supply: The retail sector has less Gross Leasable Area (GLA) today than 25 years ago due to conversions and closures.

4. Rising Replacement Costs: The costs to replace these structures relative to market rents are no longer economically viable given soaring material, labor, and land costs. Tenants are thus competing over existing buildings.

5. Record-High Rental Rates: Retail rental rates have reached record highs, with average asking rents at $22.90 per square foot—a 3.9% annual growth rate and a 17.3% increase from 2019.

6. Record-Low Vacancy Rates: Vacancy rates have plummeted to a record low of 5.3%.

7. Robust Retail Sales: Retail sales are recording double-digit growth rates.

8. Variable Rent Clauses: Many retail leases include clauses for variable rent based on gross sales, allowing landlords to share in a percentage of tenants’ gross sales. As retail businesses thrive, rents increase, elevating property values.

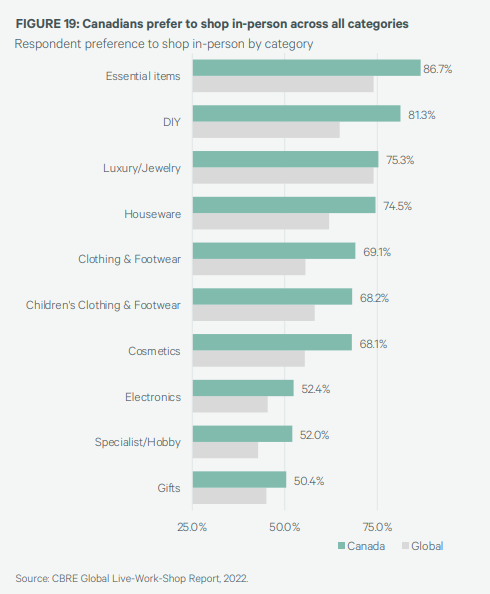

The Canadian Retail Real Estate Landscape

In Canada’s real estate market, a promising opportunity is emerging—particularly in the retail asset class. Despite a 25% population increase over the last two decades and an annual growth rate of 2.5% (five times that of the United States), only two enclosed shopping centers have been built in the past fifty years. This population boom is driving increased demand for housing, employment, shopping, and entertainment. As incomes rise, business sales increase, enhancing the value of the properties these businesses occupy.

Jon Love, Founder and CEO of KingSett Capital—a Canadian real estate firm that has raised over $16 billion in capital to date—highlights the significant supply and demand imbalance in Canada’s retail real estate sector.

Resilience Amid Challenges

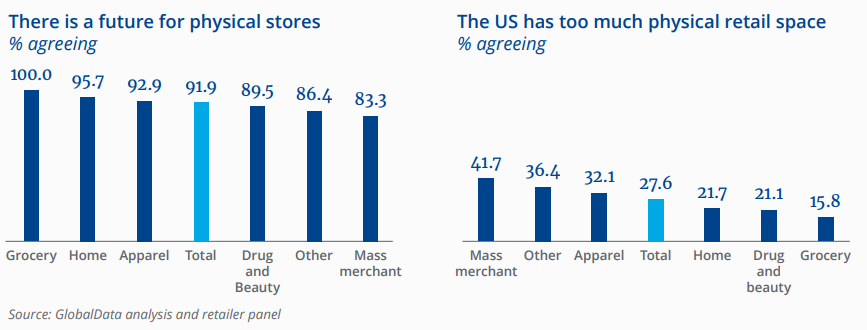

Well-positioned retail real estate has shown remarkable resilience in the face of numerous challenges over the past few years, including the rise of e-commerce and the impacts of a global pandemic. While some might argue that e-commerce giants like Amazon pose a significant threat to traditional retail, there are numerous segments that online platforms cannot replicate:

- Essential Services: Fresh produce markets, pharmacies, healthcare services, walk-in clinics.

- Personal Services: Salons, barbershops, automotive repair services.

- Experiential Retail: Fast-food and fine dining restaurants, bars, coffee houses, movie theaters.

- Specialty Retail: Liquor, tobacco, cannabis sales, home improvement centers.

- Community Services: Social services, community event spaces, fitness centers, funeral homes.

- Convenience Retail: Dollar stores, thrift stores, self-storage, gas stations, car washes.

Retail real estate often holds the most strategically positioned properties within communities, acting as hubs around which neighborhoods develop. These properties typically cover extensive land areas and feature existing structures adaptable for various real estate uses, including office, industrial, residential, and multi-family—a versatility rarely found in other real estate sectors.

Distressed Mall Rethinks Its Anchor Space and Returns to Its Role as Community Hub

Strategic Locations and Future-Proofing

Strategically located last-mile retail real estate is akin to the “Boardwalk” and “Park Place” of Monopoly within communities. These prime locations offer accessibility and convenience that e-commerce cannot match, which is why even e-commerce companies are beginning to lease these spaces themselves.

Even if online shopping were to completely overshadow traditional retail in the future, these prime locations could easily transition into last-mile e-commerce delivery hubs and personal pick-up points. With minor modifications—such as adding partition walls and exterior roll-up doors—these spaces could serve as efficient pick-up, return, and warehouse sites. This scenario benefits landlords, as tenants in these spaces generally require fewer Tenant Improvements (TIs) than traditional retail outlets.

The Importance of Replacement Cost

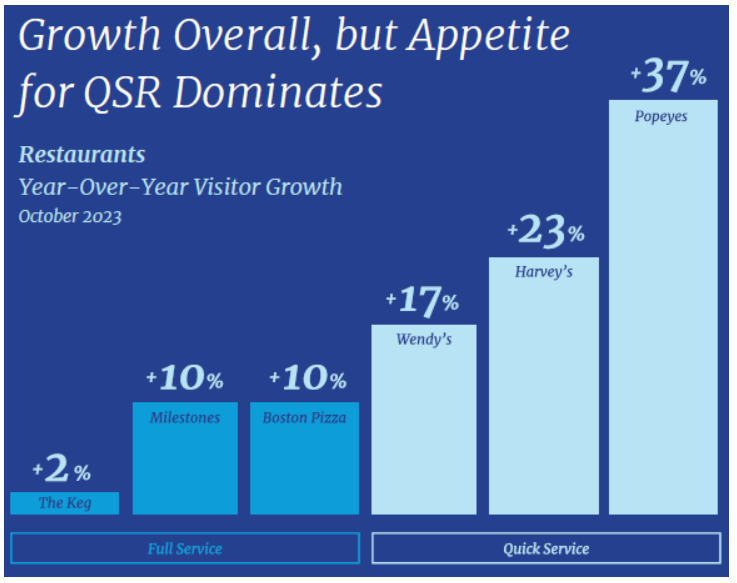

The escalating costs of constructing new retail structures—driven by soaring prices of materials, labor, and land—have made new development economically unfeasible relative to current rental rates. For example, I received a quote to build a 3,500-square-foot structure for two Quick Service Restaurants (QSR) with drive-throughs at an exorbitant $2.3 million, or $657 per square foot for structural and civil work. This financial impracticality has led to a scarcity of new retail spaces, forcing tenants to compete over existing structures.

When investing in Retail Commercial Real Estate (CRE), roofing costs are one of the most substantial capital expenditures. For our property, the quote to replace the roof was $50 per square foot, totaling $9.6 million for the entire roof—a stark contrast to our purchase price of $60 per square foot, which includes 14 acres of land.

Drone shot of the property

Drone shot of the property

To replace this building would cost an estimated $450 or more per square foot. Securing properties significantly below their replacement cost provides a substantial margin of safety. It allows us to offer competitive rental rates or provide free rent in exchange for Common Area Maintenance (CAM) fees, disrupting the local retail market, pushing out competitors, and deterring new supply.

As legendary real estate investor Sam Zell, forefather of the modern Real Estate Investment Trust (REIT) and with a net worth of $5.3 billion, aptly stated:

“Replacement cost is the most reliable indicator of property value.”

The Lack of New Supply

From the REIT level down, there has been a complete lack of new retail construction. It’s simply too expensive to build today. The good news? This lack of supply means stronger tenant retention and rental growth for existing centers.

RioCan’s President & CEO, Jonathan Gitlin, summarizes the situation:

“Quality retail with the kind of demographics and locations that we have is in really limited supply because no one’s built any new retail in the last decade, and no one can really build any new retail now because replacement costs are vastly in excess of the existing market value for retail.”

“In order to justify building new retail, you’ve got to get rents that are so much higher than what the market rents are. And because of that supply constraint, it allows for upward pressure on retail rents. That’s what we’re seeing now in this market.” - Gitlin told RENX.

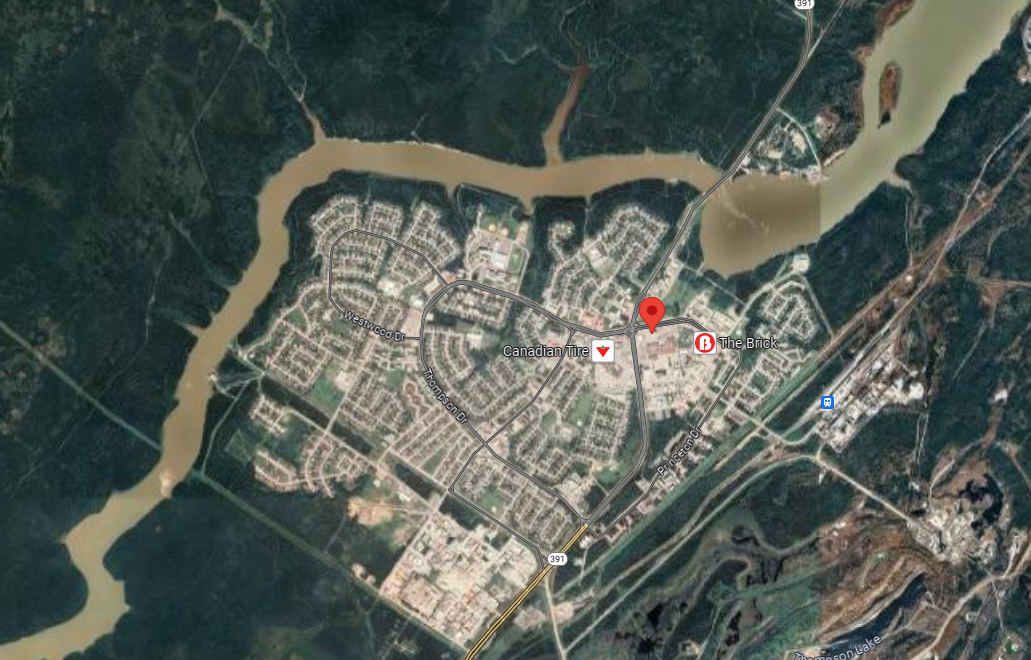

Why Secondary and Tertiary Markets?

Investing in retail centers within secondary and tertiary markets presents significant advantages:

-

Less Competition: These markets are often overlooked by larger institutional investors due to perceived lower asset values and the challenges of remote property management. This oversight creates a less competitive buyer landscape, providing opportunities to capitalize on mispriced assets.

-

High Yields: Retail properties in these areas often offer solid double-digit cap rates underpinned by reputable, publicly traded companies, along with prospects for adding value.

-

Barriers to Entry: The significant disparity between the cost of existing real estate and the expense to build anew acts as a strong deterrent to new competitors. This often positions us as a primary—or sole—retail provider in these locales.

-

Untapped Opportunities: Those willing to invest the effort can uncover tremendous opportunities in these less saturated, smaller markets for high-yielding real estate that are virtually unmatched elsewhere in the nation.

I am optimistic that as the search for higher yields continues and technological advancements streamline investment and management processes, the current valuation discrepancies in these markets will diminish. This will offer more stability and open the door to broader investor participation.

Ariel view of the city

Ariel view of the city

Retail Sector Overview

-

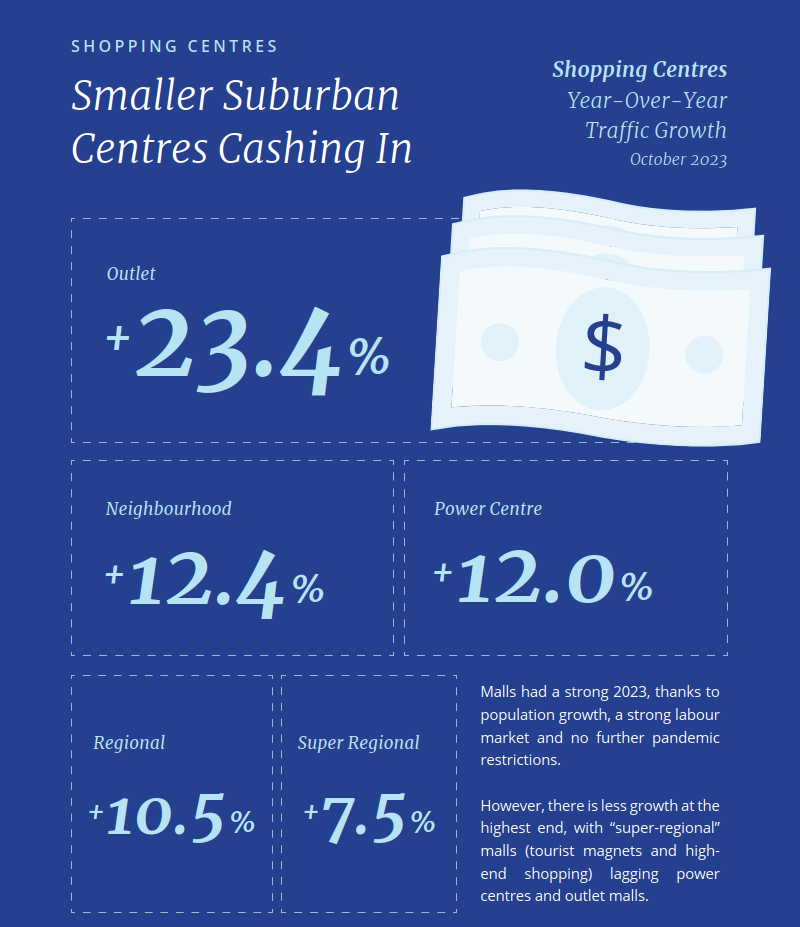

Surging Mall Visits: Annual mall visits have surged by 18% year-over-year compared to pre-pandemic levels, highlighting a consumer preference for quick and convenient shopping experiences.

-

Declining Vacancies and Rising Rents: The continuous decline in retail vacancies puts upward pressure on asking rents, which rose to $22.90 per square foot—a 3.9% annual growth rate. Positive retail asking rent growth is occurring in 99% of 390 metro areas, according to the National Association of Realtors (NAR).

-

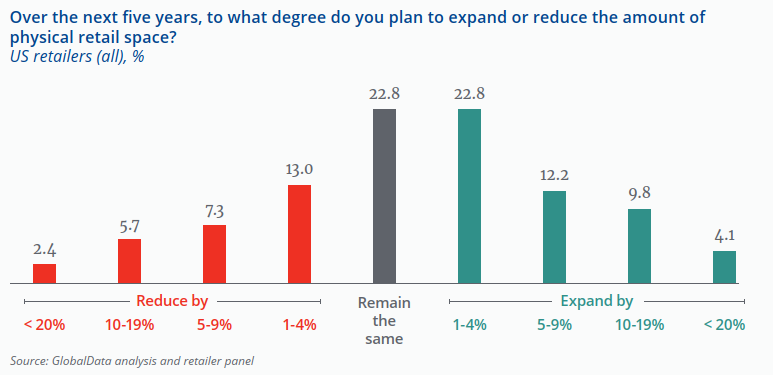

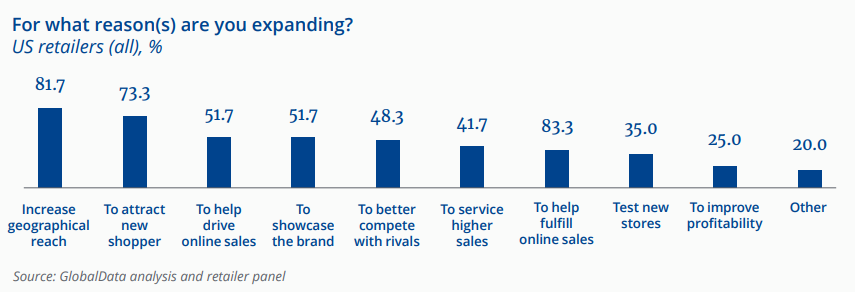

Physical Retail Rebounds: Physical retail has bounced back, with 2022 seeing more store openings than closures for the first time since 2016. Retail sales at malls grew more than 11% in 2022 to nearly $819 billion.

In Conclusion

As investor Charlie Munger aptly said:

“Real estate doesn’t disappear, but their owners do.” - link

Our recent acquisition at 36% below the previous owner’s book value demonstrates the cyclical nature of real estate markets.

Successful real estate investing requires precise timing, cautious underwriting, and the courage to act when others are reluctant. Well-situated real estate will always be in demand and hold intrinsic value. The key to success is acquiring properties significantly below their intrinsic worth—a rare and invaluable opportunity that presents itself only a few times in each generation.

By focusing on strategic investments in undervalued markets and understanding the evolving dynamics of retail real estate, we can unlock significant value and secure long-term growth.

Inside the mall

Inside the mall

Updated News & Market Data as of February 22, 2024

-

Affordable Retail is Thriving:

With high inflation and increased borrowing costs, discount retailers have greatly benefited from a more cost-conscious consumer environment. Key indicators include significant percentage increases in visitor traffic for some of the sector’s largest discount merchants. -

QSR Dominating Restaurant Growth:

While restaurants overall saw positive year-over-year traffic growth despite inflationary concerns, Quick Service Restaurants (QSRs) captured the largest share of that growth. This is partially due to rapid expansion of popular QSR brands across Canada. Data shows a significant disparity in visitor growth between sit-down restaurants and QSRs. -

Smaller Suburban Centres Cashing In:

2023 saw positive visitor growth for malls, thanks to population growth, a strong labor market, and no pandemic restrictions. However, traffic counts at higher-end malls, such as Regional (10.5%) and Super Regional (7.5%), have lagged behind Power Centres (12.0%), Neighbourhood Centres (12.4%), and Outlet Malls (23.4%). This trend demonstrates higher consumer demand for discount offerings at Outlet Malls versus high-fashion merchants at Regional Malls. Smaller suburban centers continue to perform well due to daily-needs tenants drawing regular consumer traffic.

Post Sources:

https://www.collierscanada.com/en-ca/research/research-insights-foot-traffic?

coresight.com/research/the-state-of-the-american-mall-competitive-attractive-and-here-to-stay/

retail-insider.com/retail-insider/2023/01/retail-leasing-in-canada-rebounds-with-positive-fundamentals-morguard-report/

www.statista.com/statistics/245054/us-vacancy-rate-forecast-for-commercial-property-by-type/

nar.realtor/blogs/economists-outlook/commercial-weekly-retail-vacancy-declines-pushing-up-asking-rents

https://www.wsj.com/real-estate/commercial/retail-landlords-rent-discounts-ending-b07723ec?

https://www.cnbc.com/2024/01/31/walmart-plans-to-add-150-more-stores-across-us.html?