Bitcoin: The Unparalleled Asset in the Digital Age

The apex monetary asset

Forward

Over the last five months, I have dedicated well over 100 hours to studying and researching Bitcoin. My purpose in doing so was to gain a comprehensive understanding of this asset class before making any investment, much like I do with all my previous investments. For me, the most beneficial way to determine whether an investment is viable is to spend several hundred hours researching it thoroughly. By examining an investment from every angle and then regurgitating my findings into a paper, I find that it helps me better understand and organize my thinking, allowing me to see clearly before making any investment decisions. Therefore, the purpose of this paper is to present my findings and highlight my opinion on Bitcoin as an asset class.

Throughout my research, I have delved into books, watched securities commissions discuss Bitcoin in detail, and read government bills and papers regarding its introduction. I have accumulated a playlist of some of the most thought-provoking videos and explainers on Bitcoin as an asset class, which I will continue to add to for those who wish to follow in the same steps.

One of the largest advocates in the Bitcoin space is Michael Saylor, whose insights have resonated throughout the community. He famously says, “Everyone gets Bitcoin at the price they deserve.” Had I looked into Bitcoin earlier and appreciated it instead of dismissing it as hype, I would have been better off financially. Another of his notable quotes is, “Those who study Bitcoin own it; those who do not, dismiss it.” This rings true for me because once you investigate and research Bitcoin, understand its protocols, and grasp its goals and purposes, it becomes difficult to dispute its potential as a prevailing asset and a revolutionary technology poised to change the world.

In this paper, I aim to share my findings on Bitcoin, detailing its advantages, and offering my perspective on its future as an asset class.

Most people will spend 80,000 hours working to earn money, but won’t spend 100 hours learning how to keep it.

Resources

-

My YouTube Playlist on Bitcoin

-

Bitcoin White Paper - Satoshi Nakamoto

-

The Bitcoin Standard: The Decentralized Alternative to Central Banking - Saifedean Ammous

-

MIT Course: Introduction to Blockchain and Money - Prof. Gary Gensler

-

Bitcoin for Beginners: Bitcoin Explained in Simple Terms - Andreas M. Antonopoulos

-

Crypto-Currency Act Of 2020 - U.S. Congress

-

The Investment Case For Bitcoin - VanEek

-

The Case For Bitcoin - Fidelity

-

The Case For Cryptocurrency - Morgan Stanley

-

The Sovereign Individual: Mastering the Transition to the Information Age - James Dale Davidson

-

Bitcoin.org Community, Resources, Tools and History

-

What is Money Podcast Series - Michael Saylor Series

-

Satoshi’s Forum Posts Want to dive into Bitcoin’s origins?

Introduction

In the rapidly evolving landscape of global finance, Bitcoin emerges as a revolutionary asset class, distinctively poised to redefine the essence of monetary systems for the digital age. This paper delves into the multitude of reasons why Bitcoin is arguably the superior asset, devoid of a close second, leveraging its technological prowess, economic principles, and unprecedented market performance. Grounded in extensive research, we will explore how Bitcoin is not merely an alternative but the epitome of digital financial sovereignty.

“There is no second best” - Michael Saylor

1. Security and Decentralization: The Impenetrable Network

Bitcoin’s foremost advantage lies in its robust security and decentralized architecture. As the world’s most secure decentralized digital monetary network, Bitcoin is fortified against hacking, fraud, and seizure by any entity, including governments. Its proof-of-work consensus mechanism and vast network of miners provide a security model that is resilient against attacks, safeguarding users’ assets with unparalleled reliability.

Hacking the Bitcoin Network

Executing a successful 51% attack is theoretically possible but extremely challenging due to the network’s security and decentralization. Here are the main factors to consider:

Financial Costs

Hardware Costs:

To perform a 51% attack, you need more than half of the total mining power of the Bitcoin network. As of now, the total network hashrate is in the hundreds of exahashes per second (EH/s). Acquiring enough ASIC (Application-Specific Integrated Circuit) miners to exceed this hashrate would cost billions of dollars. Each high-performance ASIC miner (like the Antminer S19 Pro) costs several thousand dollars, and you would need millions of these units.

Electricity Costs

Bitcoin mining consumes a vast amount of electricity. Running enough miners to control 51% of the network would require an enormous power supply, likely costing millions of dollars per day in electricity alone.

Computational Power

Hashrate:

The current total Bitcoin network hashrate is around 400 EH/s (as of 2024). To control 51%, you need at least 200 EH/s. Each Antminer S19 Pro has a hashrate of about 110 TH/s. Therefore, you would need approximately 1.8 million such miners.

Data Centers:

Housing and maintaining millions of ASIC miners require significant infrastructure, including data centers with appropriate cooling, power supply, and maintenance facilities.

Practical Challenges

Coordination and Secrecy:

Organizing such an attack would require significant coordination and secrecy to prevent detection by the network and countermeasures by the Bitcoin community.

Economic Incentives:

Even if someone could gather the required resources, the economic incentives usually discourage such attacks. The value of Bitcoin would likely plummet if a successful attack were attempted, reducing the potential financial gain.

Detection and Response:

The Bitcoin network has many stakeholders who constantly monitor for unusual activity. Any attempt to gain a majority of the network’s hashrate would likely be detected quickly, leading to potential countermeasures such as changes to the protocol or forks.

Estimated Costs to Hack the Network

-

Initial Hardware Investment: $10 billion or more.

-

Electricity Costs: $10 million per day or more.

-

Operational Costs: Several million dollars per month for maintenance, staffing, and data center operations.

In summary, while a theoretical 51% attack on the Bitcoin network is possible, the financial, computational, and practical challenges make it highly unlikely. The network’s design and the economic incentives aligned against such attacks help secure it from these threats.

Confiscation

Bitcoin’s resistance to confiscation stems from its decentralized and cryptographic nature. Here’s an in-depth explanation of why Bitcoin can’t be easily confiscated:

Decentralization

Bitcoin operates on a decentralized network of nodes, meaning no single entity controls it. Unlike bank accounts, which can be frozen or seized by governments or financial institutions, Bitcoin exists across a distributed ledger called the blockchain, maintained by a global network of computers.

Private Key Ownership

Bitcoin ownership is determined by possession of private keys. A private key is a cryptographic code that grants access to the Bitcoin stored at a particular address. Without the private key, it is virtually impossible to access or transfer the Bitcoin. If a user keeps their private key secure (e.g., in a hardware wallet or written down in a safe place), it becomes exceedingly difficult for anyone else to confiscate their Bitcoin.

Anonymity and Pseudonymity

While Bitcoin transactions are publicly recorded on the blockchain, the identities of the parties involved are pseudonymous. Addresses are not directly linked to real-world identities, making it challenging for authorities to associate Bitcoin holdings with specific individuals without additional information.

Self-Custody Options

Bitcoin can be stored in various ways that enhance security against confiscation:

-

Hardware Wallets: Physical devices that securely store private keys offline.

-

Paper Wallets: Physical documents containing the private key, stored securely.

-

Brain Wallets: Memorizing the private key or a seed phrase to reconstruct the private key when needed.

Geographic Dispersion

Because Bitcoin exists on the blockchain, it is not confined to any physical location. This global distribution makes it difficult for any single government or entity to seize Bitcoin en masse.

Cryptographic Security

Bitcoin transactions and the network’s security are based on advanced cryptographic principles. This makes it virtually impossible to hack or alter the blockchain without possessing the private keys. Any attempt to seize Bitcoin without the private keys would require breaking this cryptographic security, which is currently infeasible with existing technology.

Limitations and Considerations

While Bitcoin has these attributes that make it resistant to confiscation, it’s important to acknowledge some limitations and considerations:

-

Physical Coercion: If someone knows you own Bitcoin, they could use physical force or coercion to compel you to reveal your private key.

-

Legal Measures: Governments can still take legal actions against individuals, such as compelling them to surrender their private keys through legal orders.

-

Technical Security: If a private key is stored improperly (e.g., on an insecure computer), it could be stolen by hackers, making proper security practices essential.

In other words, the only way any entity can access your bitcoin is by knowing your 12 or 24-word seed phrase, which you can memorize. Without you revealing each word in the correct order, no one can access your assets. This marks the first time in history that property cannot be forcibly taken from an individual. Throughout history, wealthy kings and pharaohs were buried with their physical wealth—gold, jewels, and more. Bitcoin is the first asset that can truly go to the grave with you.

2. Economic Sovereignty: Beyond Censorship and Inflation

The core design of Bitcoin ensures it remains immune to the pitfalls of traditional fiat currencies—namely, censorship and inflation. Bitcoin’s predetermined supply cap at 21 million coins embodies a deflationary ethos, starkly contrasting with fiat currencies that suffer from endless inflation due to governmental monetary expansion. This scarcity not only preserves value but also makes Bitcoin a hedge against inflation, standing as a beacon of stability in turbulent economic times. All currencies will lose 99.9% of their value, even the USD, one of the strongest currencies in the world, is losing 7%-12% of its value per year.

Bitcoin is the first truly scarce and highly desirable asset. While CEOs can issue more company shares, central banks can print more money, miners can extract more gold and silver, farmers can produce more commodities, and drillers can extract more oil, and even real estate can be expanded—as seen in the development of cities like Boston, Dubai, and Miami Beach—Bitcoin’s supply is strictly limited. This finite supply makes Bitcoin uniquely valuable.

Equities vs. Bitcoin

Supply Limitation

Bitcoin’s supply is strictly limited to 21 million coins, ensuring scarcity and protecting against debasement, unlike companies that can issue more shares, diluting existing stockholders.

Decentralization

Bitcoin operates as a decentralized network with no centralized leadership or board that can make poor decisions impacting its value. It functions according to a transparent protocol without a single point of failure or control.

Counterparty Risk

Stocks represent fractional ownership of a company, making them susceptible to mismanagement, fraud, or bankruptcy. Bitcoin, on the other hand, has no counterparty risk and cannot be mismanaged or go bankrupt.

Value Proposition

The value of stocks depends on a company’s profitability and future cash flows, which can be affected by competition, regulation, and economic cycles. Bitcoin’s value proposition lies in its pristine monetary properties as hard money.

Inherent Risk

Stocks can become worthless if a company fails, while Bitcoin’s value is derived from its security, scarcity, and status as the leading cryptocurrency network. Its value persists regardless of any single entity.

Transparency

Bitcoin operates transparently based on open-source code without centralized control, unlike companies whose decisions are often opaque. Its monetary policy is immutable.

In essence, Bitcoin is seen as superior because it is a truly decentralized network with a capped supply and no central control points. Unlike companies that can dilute shares, be mismanaged, or fail entirely, Bitcoin’s value comes from its pristine monetary properties, making it immune to factors that can undermine stocks.

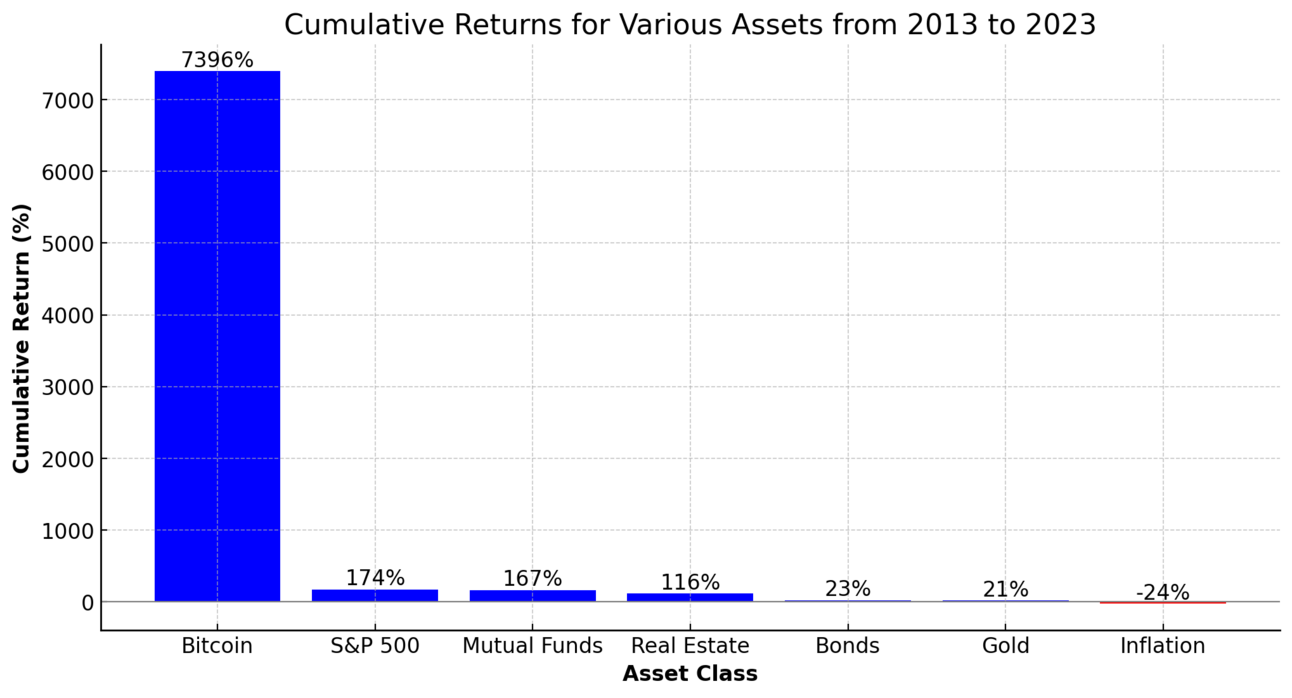

3. Superior Store of Value: Digital Gold

Bitcoin has been aptly termed “digital gold” due to its ability to store and appreciate value over time. Historically, Bitcoin has outperformed major asset classes, including gold, stocks, and real estate, with an astonishing cumulative return since inception. This performance is anchored in its limited, known supply which mimics the scarcity and appreciation potential of well-located real estate, yet with greater transferability and divisibility.

Gold vs. Bitcoin

Divisibility

Gold: Gold is a physical asset that can only be divided into smaller units to a limited extent. This makes smaller transactions cumbersome and impractical.

Bitcoin: Bitcoin is divisible up to eight decimal places, with the smallest unit called a Satoshi. This high level of divisibility makes it ideal for both large and microtransactions, enhancing its utility as a medium of exchange.

Transparency

Gold: Transactions involving gold are often opaque, with details such as the buyer, seller, and transaction price not publicly available.

Bitcoin: Every Bitcoin transaction is recorded on a public ledger known as the blockchain. This transparency makes it difficult to manipulate and impossible to counterfeit, thereby increasing trust in the Bitcoin network.

Portability

Gold: Transporting large amounts of gold is challenging due to its weight and the security risks involved.

Bitcoin: Bitcoin can be transferred globally with the click of a button, regardless of the amount. It requires no physical transportation and can be moved quickly and securely, making it far more portable than gold.

Security and Storage

Gold: Storing gold requires physical security measures, such as vaults and insurance, which can be costly.

Bitcoin: Bitcoin is stored digitally, protected by cryptographic security. Proper security measures (like hardware wallets and multi-signature accounts) can effectively mitigate risks.

Supply and Scarcity

Gold: The supply of gold is relatively fixed but can increase with new mining discoveries.

Bitcoin: Bitcoin has a fixed supply of 21 million coins, which is hard-coded into its protocol. This cap ensures that Bitcoin remains scarce, providing a hedge against inflation and ensuring its long-term value proposition.

Accessibility

Gold: Investing in gold often requires dealing with brokers, storage fees, and other intermediaries, complicating the process for the average investor.

Bitcoin: Bitcoin can be easily bought, sold, and stored by anyone with an internet connection. This accessibility democratizes investment opportunities and allows more people to participate in the market.

Inflation Hedge

Gold: Gold has traditionally been seen as a hedge against inflation due to its long-standing value and limited supply.

Bitcoin: Bitcoin is increasingly recognized as digital gold due to its finite supply and deflationary nature. Its performance during times of economic uncertainty has demonstrated its potential as an inflation hedge.

In summary, while gold has been a trusted store of value for centuries, Bitcoin offers several advantages in terms of divisibility, transparency, portability, security, fixed supply, and accessibility. These features position Bitcoin as a strong competitor to gold, especially in a digital age where efficiency and technological integration are paramount. As more retail and institutional investors recognize these benefits, Bitcoin is likely to see increased adoption and acceptance as a superior asset for preserving wealth and conducting transactions.

4. Technological Supremacy: The First True Digital Property

As the first asset that can be transmitted seamlessly across the globe without intermediaries, Bitcoin introduces a new paradigm of property rights in cyberspace. It is teleportable, divisible, and operates on a trustless system where transactions are irreversible and recorded on an immutable public ledger, fostering transparency and trust.

Physical Property (Real Estate) vs. Digital Property (Bitcoin)

Accessibility and Portability

For the first time in history, we have access to an asset that we can hold in the palm of our hand and send $1 billion across the world in 10 minutes for the cost of a nickel. This unprecedented accessibility and portability set Bitcoin apart from traditional assets like real estate. While real estate requires physical presence and significant logistical efforts to transact, Bitcoin can be moved effortlessly across borders, offering unparalleled convenience and security.

Wealth Preservation with Reduced Risk

Wealthy families traditionally buy real estate to preserve and protect their wealth. However, real estate comes with counterparty risk. For instance, owning a building worth $1 billion is subject to the whims of local government policies; mayors can increase or impose new property taxes, and there are large maintenance and management costs. In contrast, Bitcoin is not subject to these risks. Its value is not dependent on local government decisions, physical upkeep, or management, making it a more reliable store of value.

Liquidity and Transaction Speed

Real estate transactions can take months or even years to execute. If you wanted to move a $1 billion property to protect your wealth, you would face significant delays and potential losses due to market fluctuations and transaction complexities. Bitcoin, on the other hand, allows for near-instantaneous transactions, enabling you to respond to market changes and protect your assets swiftly. Additionally, Bitcoin can be fractionalized and sold off in parts, providing greater liquidity and flexibility. Furthermore, you can also borrow against your bitcoin to reap one of the main benefits of investing in real estate.

Discreet Wealth Management

One of the significant disadvantages of real estate is that it cannot be hidden. High-value properties often draw attention, potentially making the owner a target for legal actions, theft, or other risks. Bitcoin offers a level of discretion and privacy that real estate cannot. With Bitcoin, you can manage and move your wealth discreetly, reducing the likelihood of becoming a target.

5. Unstoppable Adoption: The Network Effects

Bitcoin benefits from profound network effects as each additional user enhances the value and security of the network. It is the most widely recognized and utilized cryptocurrency, with increasing adoption by individuals, corporations, institutional investors, and even some governments as a strategic asset and reserve currency.

The recently approved Bitcoin ETFs are purchasing $125 million USD worth of Bitcoin daily, and over $175 billion in Bitcoin is now held by ETFs, public companies, and nations. Bitcoin became the fastest asset class to reach a market capitalization of $1 trillion.

Retail Investors

Significant growth from 15 million people in 2018 to 106 million in 2024.

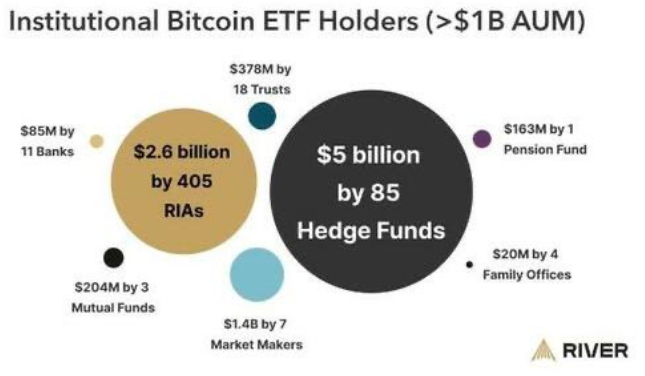

Institutional Investors

Rapid increase, starting from $0.5 million in 2018 to $120 billion in 2024, 10% of the total Bitcoin supply. Some of these institutional investors include BlackRock, Fidelity, and Deutsche Bank.

Pension Funds

State of Wisconsin Investment Board (SWIB): One of the largest pension funds in the United States, SWIB, disclosed a $162 million allocation to Bitcoin ETFs in 2023.

Houston Firefighters Relief and Retirement Fund (HFRRF): In October 2021, the HFRRF announced a $25 million investment in Bitcoin and Ether.

Governments

Growing interest, with the number of governments involved increasing from 1 in 2018 to 4 in 2023.

Public Companies

Steady rise in public companies holding Bitcoin, from 5 in 2018 to 50 in 2023.

Market Cap

Substantial growth in market capitalization, reaching $1.2 trillion in 2023. Considering gold’s market cap of $15.6 trillion, it is reasonable to expect that Bitcoin could eventually match or exceed gold’s market value.

Daily Trading Volume

Increased trading activity, with daily volumes growing from $3 billion in 2018 to $20 billion in 2024.

6. The Promise of Digital Money: A Global Currency

Bitcoin is not just an investment; it is the foundation of a potential global monetary system that offers free, instant, and borderless transactions. This capability makes Bitcoin an invaluable tool for global remittances and financial inclusion, particularly in regions with unstable currencies or restrictive financial systems.

Protection Against Hyperinflation

Countries experiencing hyperinflation, such as Venezuela, Zimbabwe, Sudan, Lebanon, Argentina, Turkey, Ethiopia, Sri Lanka, Cuba, and Suriname, face rapidly devaluing local currencies. This erosion of savings and purchasing power severely impacts their economies. Bitcoin offers a stable alternative, enabling individuals to preserve their wealth without relying on failing local currencies. By leveraging Bitcoin, people in these regions can protect their assets from the detrimental effects of hyperinflation.

Secure Property Ownership

Unfavorable property laws and the risk of expropriation by governments or criminal actions make real estate a precarious investment in many parts of the world. For example, in some countries, property can be seized with little or no compensation. Bitcoin, however, is a digital asset that can be securely purchased on a $30 smartphone, making it accessible and secure even in the most volatile environments.

Avoidance of Confiscation

Local banks in unstable regions can freeze or confiscate funds without warning, leaving individuals without access to their money. Bitcoin’s decentralized nature ensures that only the owner with the private key has control over their funds, making it immune to such confiscation.

Practicality of Transport

Transporting traditional assets like gold or oil across national borders is fraught with risks and regulations. For instance, carrying $20,000 worth of gold or oil is likely to attract attention and could be seized at border crossings. Bitcoin, being digital, can be transported easily and discreetly across borders without physical limitations or legal hurdles.

Financial Inclusion and Accessibility

Bitcoin’s digital nature means that anyone with a smartphone and internet access can participate in the global economy. This is particularly important for people in middle or underdeveloped countries where traditional financial services are lacking or prohibitively expensive. Bitcoin offers a way to save, transfer, and receive money without the need for a bank account or government intervention.

In a world where traditional financial systems can be unstable, restrictive, or outright hostile, Bitcoin presents a compelling alternative. It offers security against hyperinflation, protection from confiscation, ease of transport, and unprecedented accessibility. As a potential global currency, Bitcoin holds the promise of a more inclusive and resilient financial future.

7. Institutional and Corporate Adoption: Legitimizing Bitcoin

The growing interest and investment in Bitcoin by institutional players and major corporations are further legitimizing its role as a store of value. Companies like MicroStrategy and nations are increasingly integrating Bitcoin into their financial strategies, which not only enhances its market stability but also encourages wider acceptance.

8. Bitcoin’s Performance

Bitcoin has distinguished itself as a remarkable asset class, consistently outperforming traditional assets such as stocks, bonds, real estate, and commodities over the past decade. Its price appreciation has been exponential, driven by increasing institutional adoption, recognition as a digital store of value, and its finite supply of 21 million coins. Unlike traditional asset classes, Bitcoin offers unique benefits like high liquidity, 24/7 trading availability, and global accessibility, enabling investors from all walks of life to participate. Additionally, Bitcoin’s decentralized nature and transparency provided by blockchain technology enhance its appeal as a secure and trustworthy investment. Despite its volatility, Bitcoin’s long-term performance has demonstrated resilience and growth, making it an attractive option for portfolio diversification and a hedge against inflation in an increasingly uncertain economic environment.

As more institutional investors, corporations, and even nation-states embrace Bitcoin, its adoption and mainstream acceptance will continue to grow. Major companies like Amazon and Tesla have already begun accepting Bitcoin for transactions, catalyzing further institutional and nation-state adoption. This growing adoption, coupled with Bitcoin’s limited supply, is expected to drive its value higher, solidifying its position as a superior asset class.

Predictions from Cathie Wood & Chamath Palihapitiya

9. The Case for Bitcoin: A Modern Store of Wealth (Intrinsic Value)

In October 2011, The Economist labeled Bitcoin as a bubble when it was valued at $30. Fast forward 12 years, and Bitcoin’s value has surged to $80,000 CAD. For those who continue to dismiss Bitcoin as a bubble or a fad, it’s time to reconsider and ask why these predictions have consistently been proven wrong.

Bitcoin addresses a fundamental global problem: the need for a secure, long-term store of wealth free from debasement and seizure. It represents a technological breakthrough, engineered to be the ultimate store of value, much like how Teslas are designed to be the best cars and iPhones the best mobile devices.

Investing in technology stocks is widely accepted, so why is investing in Bitcoin, a technology designed to solve one of humanity’s biggest problems, considered foolish by some? Traditional assets like sovereign debt, equities, real estate, gold, and fine art have served as stores of wealth but are imperfect, vulnerable to inflation, debasement, and government seizure. Bitcoin changes this narrative with its unique characteristics.

Intrinsic Value of Bitcoin

-

Finite Supply:

Bitcoin has a hard cap of 21 million coins, ensuring that no central authority can dilute its value through excessive issuance. -

Divisibility:

Bitcoin is highly divisible, allowing transactions as small as $0.10 or as large as $10 billion, making it versatile for all types of transactions. -

Seizure Resistance:

Bitcoin cannot be physically confiscated. Secure storage methods ensure that only you have access to your wealth. -

Inelastic Supply:

Bitcoin’s supply remains constant regardless of price increases, preventing the kind of supply-induced price drops seen in other commodities. -

Portability:

Bitcoin is easily transferable across borders without the need for physical movement or regulatory approval, making it exceptionally portable. -

Counterparty Risk Elimination:

Bitcoin is free from counterparty risk; even if the entire financial system collapses, you still retain your Bitcoin. -

Global Accessibility:

Bitcoin is universally accessible and not confined to any single jurisdiction, ensuring fairness and availability to everyone.

Bitcoin’s unique combination of these features makes it an unprecedented asset. Since March 2020, Bitcoin has outperformed the S&P 500’s gains since the bottom of 2009. Major financial institutions like BlackRock, Fidelity, Deutsche Bank, Crédit Agricole, and Citadel are now offering Bitcoin to their clients. This institutional endorsement is a testament to Bitcoin’s growing legitimacy and potential.

Billionaires and seasoned investors like Paul Tudor Jones, Michael Saylor, Elon Musk, Jack Dorsey, Tyler and Cameron Winklevoss, Tim Draper, Stanley Druckenmiller, Chamath Palihapitiya, and others are increasingly advocating for Bitcoin. They recognize its potential as an unparalleled investment opportunity. The window to understand and invest in Bitcoin is closing as institutional adoption accelerates.

As Bitcoin continues to gain traction and institutional support, the opportunity to invest in this groundbreaking asset at its current value is diminishing. The question is not whether Bitcoin will be a successful store of wealth, but whether you will recognize its potential before it’s too late. Investing in Bitcoin today could position you to benefit from what is arguably the most obvious investment opportunity of our generation.

Conclusion: Bitcoin as the Apex Monetary Asset

Bitcoin represents more than just an asset; it embodies a shift towards a more decentralized and equitable financial system. Its intrinsic properties—security, scarcity, decentralization, and network effects—converge to position Bitcoin as the superior choice in the digital age. As it continues to integrate into the global financial ecosystem, Bitcoin promises not only to be a store of value but also a cornerstone of future monetary systems. Its trajectory suggests a continuous appreciation in value and influence, making it an unparalleled asset with no close second.

This paper consolidates the compelling arguments for Bitcoin’s superior role, backed by extensive data, expert insights, and a profound understanding of its technological and economic impact. As the digital era unfolds, Bitcoin stands as the definitive asset of the future, continually proving that there indeed is no second best.

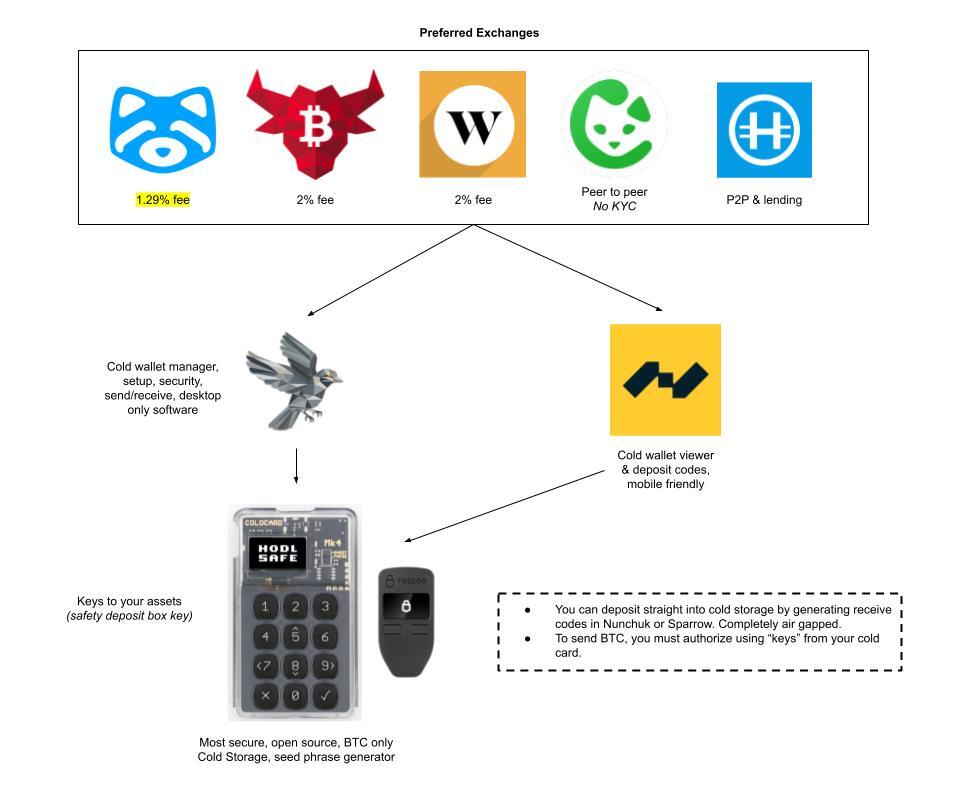

How to Buy and Store Bitcoin

In the world of Bitcoin, a famous phrase resonates: “Not your keys, not your coins.” This means if you don’t control the private keys to your Bitcoin, you don’t truly own it. To secure your Bitcoin, you must store it in a cold storage device, such as a Coldcard, which you keep in a safe place or with a trusted custodian. As long as no one else has access to your keys, your assets are protected.

Bitcoin and the broader cryptocurrency industry have had a checkered history, tainted by malicious actors who ran unregulated offshore exchanges. These platforms allowed users to buy and sell Bitcoin, but without proper oversight, they could manipulate user deposits. Many such exchanges operated like Ponzi schemes, using customer funds for speculation or personal expenses while falsely showing intact balances.

As the industry matures, regulated and local exchanges such as Coinbase, PayPal, Square, CashApp, Interactive Brokers, Wealthsimple, and more now offer safer options for buying Bitcoin. While these services are convenient for purchasing Bitcoin, it’s prudent to withdraw your holdings to a cold storage wallet once they exceed a certain amount, such as $500.

My Bitcoin Setup

Cold Storage Wallet

I use Coldcards Mk4, an open-source hardware wallet renowned for its reliability, security, and transparency. Although they are on the pricier side, they offer top-notch protection. For those seeking a more budget-friendly option, the Trezor wallet is a great alternative.

Hot Wallet vs. Cold Wallet

A hot wallet is connected to the internet, making it more vulnerable to attacks. In contrast, a cold wallet is offline, powered without a direct connection to a computer, often using an external power source like a battery or power pack.

Following the instructions provided by Coldcard, I set up my device using the desktop Sparrow software. This allows me to view my cold storage balances, generate addresses for deposits, and permit withdrawals or transfers from my wallet.

Nunchuk App

I frequently use the Nunchuk mobile app due to its user-friendly interface, which lets me view my Bitcoin balances and generate deposit addresses. This enables quick deposits into my cold storage wallet without needing to be physically near it or have it powered on. Importantly, I do not authorize Nunchuk to initiate withdrawals, ensuring that if someone gains access to my phone or Nunchuk account, they can only view my balances and create deposit addresses.

Buying Bitcoin with ShakePay

I use ShakePay to purchase Bitcoin due to its low fees, user-friendly app, and rewards program. I set up automatic e-transfers from my bank accounts into my ShakePay account, where a portion is allocated to dollar-cost averaging (DCA) into Bitcoin. The ShakePay Visa, linked to my Apple Pay, rounds up purchases to the nearest dollar, giving cashback in BTC and offering frequent rewards for daily use.

ShakePay is a KYC (Know Your Customer) platform, so your Bitcoin purchases are not anonymous. Their fees for processing Bitcoin buy orders are 1.29%, which is among the lowest in the industry. In comparison, platforms like Wealthsimple and BullBitcoin typically charge 2% or more.

For the first month, you’ll receive 2% cashback in Bitcoin. Use this referral code when you sign up and buy $100 worth of Bitcoin to receive $20 back:

ShakePay Referral Code

Earn $20 by using the above referral code and buying $100 worth of bitcoin!

Non-KYC Bitcoin Purchases

If you prefer anonymous Bitcoin purchases, consider peer-to-peer (P2P) exchanges like Bisq or Hodl Hodl. These platforms facilitate direct Bitcoin purchases from other holders without requiring identification. However, rates on these platforms are generally above market prices.

My Bitcoin Investment Strategy

I allocate a modest percent of my business’s net income into Bitcoin, consistently DCA-ing monthly (Dollar Cost Averaging). I have never sold any of my Bitcoin holdings. A satoshi (sat) is the smallest unit of Bitcoin, with one Bitcoin divisible into 100 million satoshis, facilitating small transactions.

Disclaimer

This article is for informational purposes only and not financial advice. Bitcoin investments carry risk, and there is no guarantee that the price will increase. Always do your own research and consider your risk tolerance before investing.

By following these practices, you can buy and store Bitcoin securely, safeguarding your investment in this innovative digital asset.

Why Run Your Own Bitcoin Node?

Running your own Bitcoin node provides enhanced security, privacy, and control over your Bitcoin transactions. By independently verifying all transactions and blocks, you ensure the integrity and validity of your Bitcoin activity without relying on third parties. This autonomy enhances your privacy, as it keeps your financial activities hidden from external services. Running a node also contributes to the decentralization and robustness of the Bitcoin network, making it more resilient against attacks. While running a node is not required for transacting with Bitcoin—since transactions can be conducted through wallets that connect to external nodes—it is highly beneficial for those who prioritize security, privacy, and full control over their Bitcoin experience.

Bitcoin Node Download Link

Reasons to consider running your own Bitcoin node:

1. Enhanced Security

When you run your own Bitcoin node, you independently verify all transactions and blocks on the Bitcoin network. This ensures that you are not relying on a third party, which could potentially provide false information or compromise your security. By validating transactions yourself, you protect against fraudulent activities and double-spending.

2. Increased Privacy

Using a third-party service to interact with the Bitcoin network often means sharing your transaction details with them. Running your own node allows you to transact privately, as your IP address and transaction history remain hidden from external services. This significantly reduces the risk of your financial activities being tracked or monitored.

3. Full Control

With your own Bitcoin node, you have full control over your Bitcoin experience. You are not dependent on third-party services for transaction validation, which means you can avoid fees, censorship, or restrictions imposed by these services. This autonomy allows you to participate in the Bitcoin network on your own terms.

4. Improved Network Decentralization

By running your own node, you contribute to the decentralization of the Bitcoin network. A more decentralized network is stronger and more resistant to attacks. Each additional node helps distribute the network load and increases the resilience of the overall system.

5. Verification of Incoming Transactions

Running a node allows you to independently verify incoming transactions, ensuring they are legitimate and confirmed. This is particularly useful for merchants and businesses that accept Bitcoin, as it provides assurance that they are receiving valid payments.

6. Support for the Bitcoin Network

By running a node, you support the Bitcoin network by relaying transactions and blocks to other nodes. This helps maintain the robustness and efficiency of the network, contributing to its overall health and sustainability.

7. Learning and Understanding

Operating your own node provides a deeper understanding of how Bitcoin works. It can be an educational experience that enhances your knowledge of blockchain technology and the underlying principles of Bitcoin.

8. Participation in Consensus

Running a node allows you to participate in the Bitcoin consensus mechanism. You can enforce the rules of the Bitcoin protocol, rejecting any invalid transactions or blocks. This ensures that you are part of maintaining the integrity of the Bitcoin network.

Conclusion

Running your own Bitcoin node is an empowering step towards maximizing your security, privacy, and control over your Bitcoin transactions. It allows you to actively contribute to the decentralization and robustness of the network, while also gaining a deeper understanding of the technology. While it requires some technical knowledge and resources, the benefits of running a node are substantial for any serious Bitcoin user.

Interesting Fact! What is the Bitcoin Satellite?

The Bitcoin Satellite is a project initiated by Blockstream, a blockchain technology company, to broadcast the Bitcoin blockchain from space. This system leverages a network of geostationary satellites to transmit Bitcoin blockchain data to almost every part of the world. The primary components of this system include:

-

Satellites: Geostationary satellites that cover nearly the entire planet, ensuring global reach.

-

Ground Stations (Teleports): Facilities that upload Bitcoin blockchain data to the satellites.

-

Receiver Kits: Equipment on the ground that users need to receive the satellite broadcasts, including a satellite dish and a receiver.

Why Does the Bitcoin Satellite Exist?

1. Global Accessibility

The Bitcoin Satellite ensures that the Bitcoin blockchain is accessible even in remote or underserved regions where internet connectivity is unreliable or non-existent. This broadens the potential user base of Bitcoin, promoting financial inclusion for those without stable internet access.

2. Network Resilience

By providing an alternative method of accessing the Bitcoin blockchain, the satellite system enhances the resilience of the network. It serves as a backup for the traditional internet-based access, ensuring that Bitcoin users can continue to receive blockchain data even during internet outages or disruptions caused by natural disasters, censorship, or other incidents.

3. Censorship Resistance

In some regions, governments or other entities may attempt to censor or restrict access to the Bitcoin network. The satellite system circumvents such censorship efforts by providing a direct, uncensorable link to the Bitcoin blockchain, allowing users to receive and verify transactions without reliance on local internet infrastructure.

4. Cost Reduction

For users in regions with high internet costs, the Bitcoin Satellite offers a cost-effective alternative. Once the initial receiver kit is set up, users can receive Bitcoin blockchain data without incurring ongoing data charges, making it economically viable for sustained Bitcoin operation.

5. Decentralization

The satellite system contributes to the decentralization of the Bitcoin network by providing an independent channel for blockchain data dissemination. This reduces reliance on centralized internet service providers and enhances the overall robustness of the Bitcoin network.