The Future of Real Estate Investment: Fractional Ownership

What if investing in real estate were as easy as buying a stock? Imagine tapping into high-yield properties across the globe—instantly, with just a few clicks. That’s the game-changing promise of fractional ownership.

Say goodbye to the red tape, the tenant headaches, and the geographic limitations. Instead, think seamless liquidity in a traditionally locked-up market. Picture owning shares in premium properties from bustling cities to emerging hotspots. The future of real estate is here, and I’m building the inventory to put it at your fingertips.

Fractional ownership is revolutionizing real estate investing, turning it into a fluid, borderless market. Buy and sell your stake in properties with the speed and ease of trading a stock. No hassles. No barriers. Just pure access.

This innovation is unlocking global opportunities, where yield takes priority over location, driving investment into secondary and tertiary markets while compressing cap rates like never before. Finally, you can enjoy direct ownership and exposure to real estate’s growth potential—without the stress of managing it. The world of real estate is now liquid, accessible, and exciting, and you’re just a click away from being part of it.

This has been a vision of mine since I entered the real estate industry, realizing the immense friction in traditional real estate transactions. High entry barriers—capital, financing, legal complexities, and cumbersome title transfers—deterred many. I knew the time would come when technology could eliminate these obstacles, and I was determined to be ready. By curating an inventory of high-yield properties in secondary and tertiary markets, I set out to create a marketplace poised to outperform while others catch up.

The Future of Fractional Ownership in Real Estate

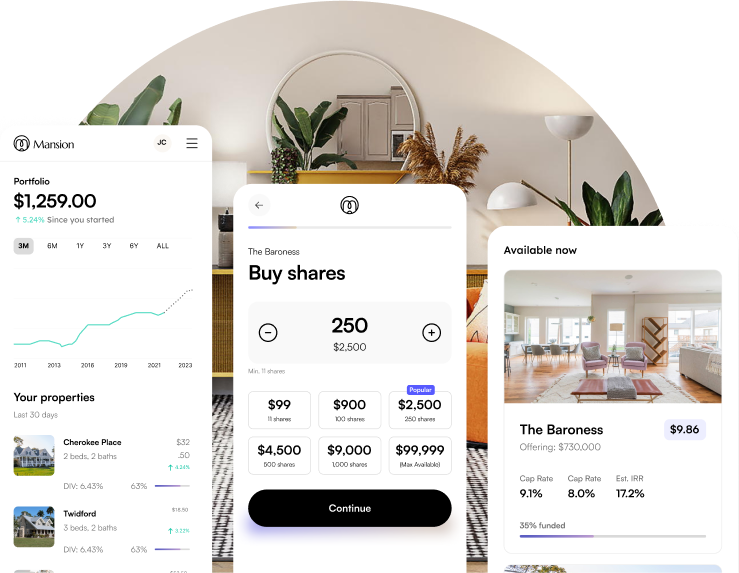

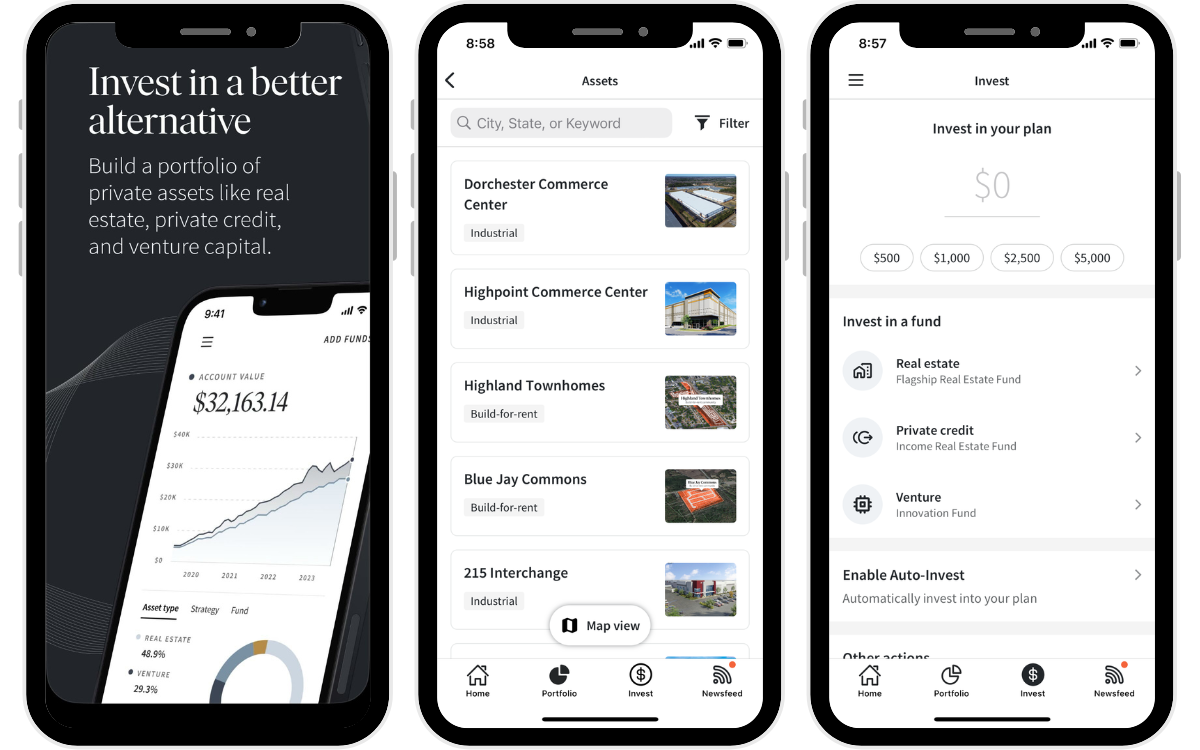

As technology evolves, fractional ownership is poised to transform the real estate market. Emerging platforms are empowering investors to purchase shares in properties, democratizing access to opportunities that were once the domain of high-net-worth individuals and institutions. This innovation is unlocking value in secondary and tertiary markets, creating a wave of appreciation and investment opportunities that were previously overlooked.

When real estate ownership becomes as liquid and seamless as trading stocks, markets with strong cash flows—often in smaller cities—are expected to see significant valuation increases. This could narrow the gap between primary and secondary markets, driving global demand for properties with higher returns. For instance, international investors seeking Canadian real estate exposure might opt for a 10% cap rate deal in New Brunswick over a 5% cap rate deal in Alberta.

Why Fractional Ownership is Reshaping Real Estate Investment

1. Accessibility for Everyday Investors

- Lower Barriers to Entry: With fractional ownership, anyone can invest in real estate with minimal capital. No need for massive down payments or mortgage approvals.

- Democratization of Real Estate: Fractional ownership platforms level the playing field, enabling small investors to access high-quality assets traditionally reserved for institutions.

2. Diversification of Portfolio

- Risk Mitigation: Investors can spread their capital across various properties, asset classes, and locations, reducing the impact of any single underperforming asset.

- Global Reach: Platforms make it easy to invest in properties worldwide, allowing for geographic diversification without the logistical challenges.

3. Enhanced Liquidity

- Easier Exit Strategies: Select fractional ownership platforms often offer secondary markets, enabling investors to sell their shares quickly, unlike traditional real estate’s lengthy sale process.

- Shorter Holding Periods: Unlike full property ownership, fractional ownership doesn’t require decades-long commitments, offering investors flexibility.

4. Passive Investment Model

- No Landlord Responsibilities: Investors enjoy the financial benefits of property ownership without the day-to-day headaches of tenant management or maintenance.

- Professional Management: Properties are typically managed by experienced firms, ensuring operational efficiency and optimal returns.

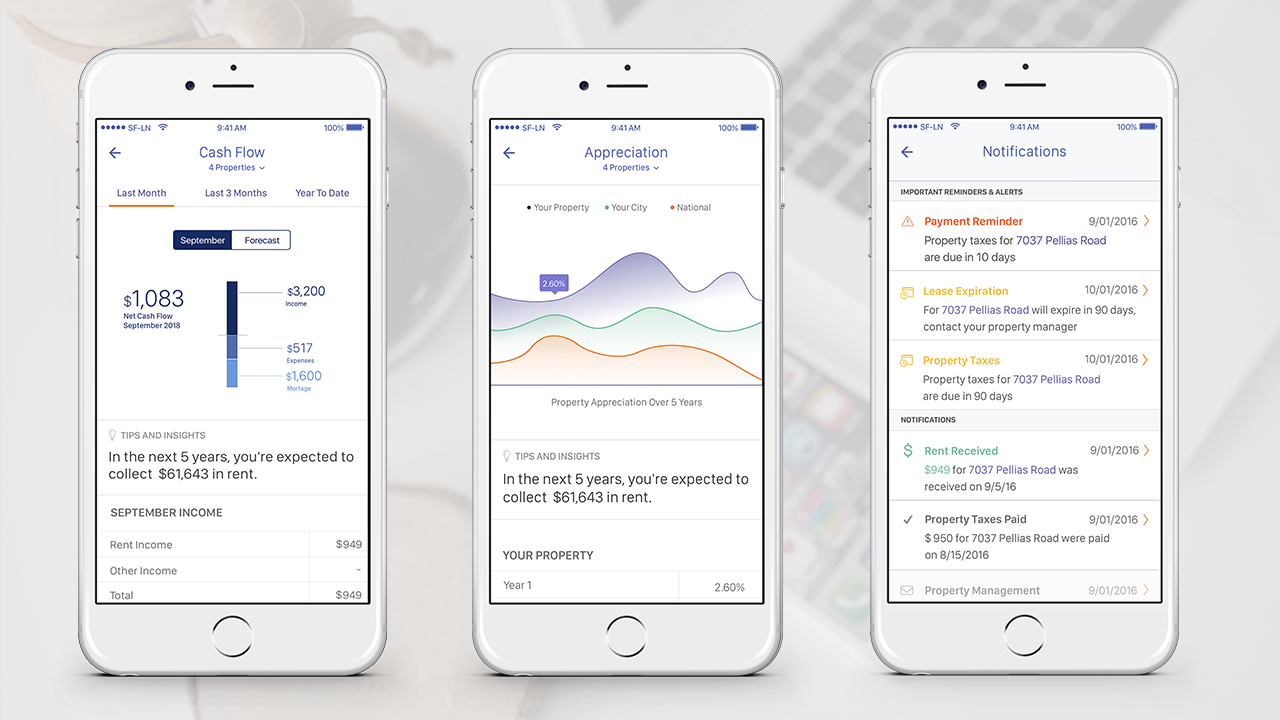

5. Technology Integration

- Utilizing Software for Transparency: Back-end softwares such as Blockchain technology secures transactions, provides tamper-proof records, and ensures transparency in ownership.

- User-Friendly Platforms: Intuitive platforms streamline everything from due diligence to purchasing shares, making real estate investing as simple as online shopping.

6. Fractionalized High-Yield Assets

- Access to Premium Properties: Investors can now hold fractional shares in lucrative assets like office buildings, data centers, shopping centers leased to high-credit rated brands such as Walmart, or luxury residences.

- Participation in Growth Markets: Platforms open doors to high-growth markets like logistics hubs or emerging secondary cities offering strong ROI.

7. Aligns with Evolving Investor Preferences

- Flexibility: Millennials and Gen Z favor tech-enabled, small-ticket investments that fit their dynamic lifestyles. Grow a portfolio of hard assets suchas as real estate while also building a diversified portfolio of stocks.

- Impact Investing: Fractional ownership allows participation in sustainable and community-oriented real estate projects.

8. Rising Popularity of Fractional/Shared Economy Models

- Shifts in Ownership Philosophy: Just as Airbnb and Uber disrupted traditional ownership models, fractional real estate appeals to a mindset where access outweighs exclusivity.

- Cultural Acceptance: As shared economy models grow, trust in fractional real estate will follow.

9. Regulatory Changes Favoring Crowdfunding

- Support for Retail Investors: Governments are increasingly supporting fractional ownership through crowdfunding laws, broadening access to retail investors.

- Increased Oversight: Regulatory frameworks bolster investor confidence by ensuring transparency and accountability.

10. Market Adaptability

- Resilience During Uncertainty: During economic downturns, fractional ownership offers a cost-effective alternative to full property ownership.

- Institutional Participation: Major firms are adopting fractional models, legitimizing this innovative approach to real estate.

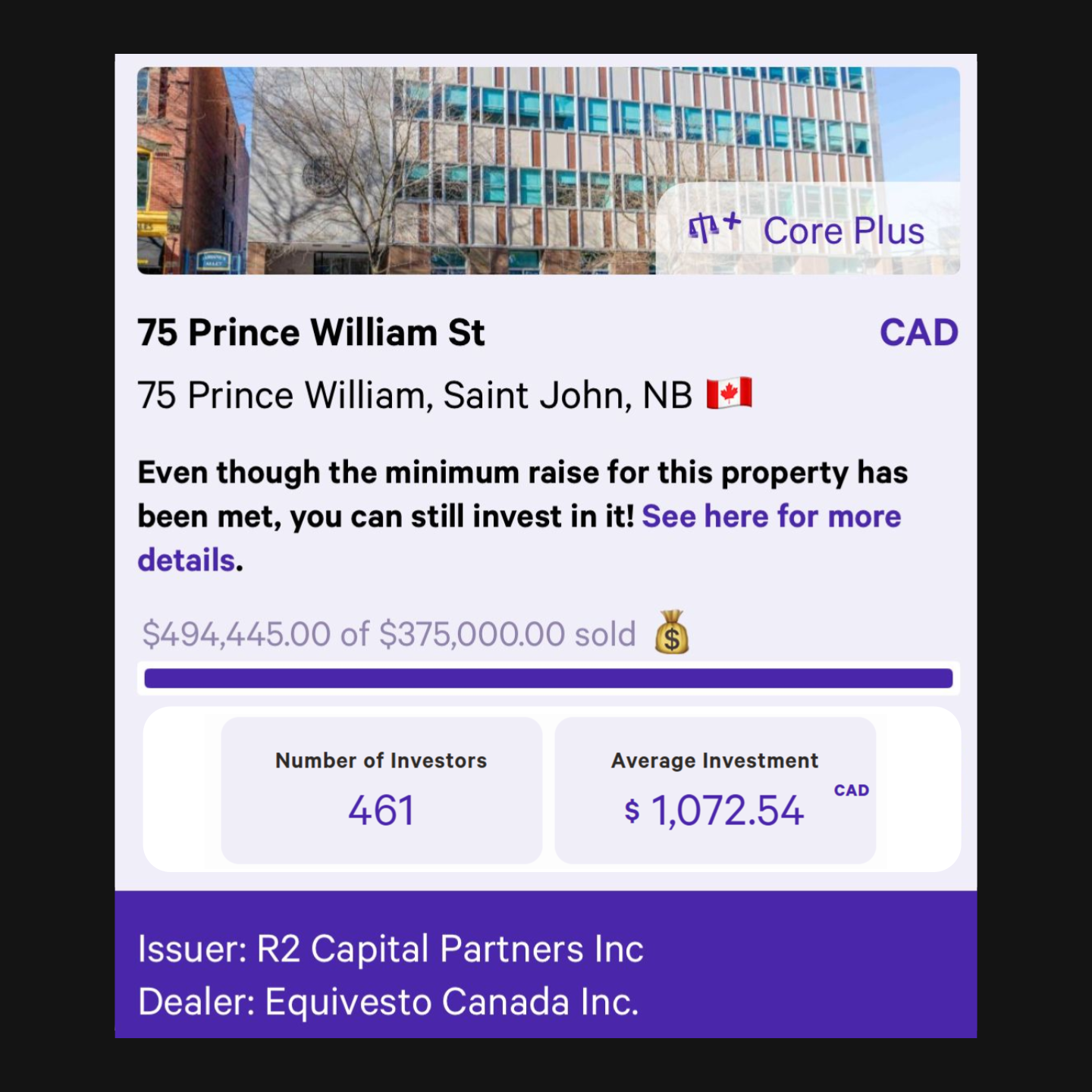

A Case Study: Our First Crowdfunding Success

Our inaugural crowdfunding offering on Addy demonstrated the power and demand for fractional real estate ownership. The investment opportunity featured a fully stabilized, 35,000-square-foot office building in Saint John, New Brunswick. This property, leased to a robust tenant mix—including government agencies, professionals, a public company, and a data center—was the ideal blend of stability and profitability.

The offering aims for a double-digit annualized dividend and an targeted 16% IRR (Internal Rate of Return) to investors. Within just two months, we surpassed our original target raise of $375,000 by 30%, securing $494,445 from 461 investors. On average, each investor contributed $1,072.54, demonstrating both the broad appeal and accessibility of this model. Demand was so strong that we not only exceeded our goal but also faced overwhelming requests for additional opportunities.

This incredible response underscores the untapped potential of fractional ownership. Everyday investors are eager to participate in high-quality real estate opportunities that deliver strong returns without the traditional barriers of large capital requirements or operational complexity. Our first success is a testament to the appetite for accessible, high-yield real estate investments—and it’s just the beginning.

Fractional ownership is breaking down the barriers of traditional real estate, bridging the gap between everyday investors and high-yield assets. By embracing technology and leveraging the power of fractional ownership, we are witnessing a transformation in how properties are bought, sold, and valued. Whether you’re a seasoned investor or just starting, fractional ownership offers liquidity, flexibility, and global access.

This model isn’t just ideal for busy individuals looking to build long-term wealth and get exposure to the real estate asset class. It’s also a game-changer for seasoned investors, developers, general partners (GPs), and new investors with big ideas but limited capital. Soon, listing an investment opportunity online, raising $1,000 each from 1,500 investors, and securing $1.5 million for projects in the matter of weeks will be the new normal. This innovation won’t just revolutionize the real estate industry—it will empower everyday investors to participate in opportunities that were once out of reach.

The future of real estate is liquid, seamless, and at your fingertips.