The Contrarian View: Going Long Office Real Estate

400 Main Street, Saint John, NB

400 Main Street, Saint John, NB

In a market clouded by uncertainty, we’re stepping up with a bold and contrarian investment in the office real estate sector. Our acquisition of 400 Main Street, a 160,000-square-foot office building in Saint John, NB with 60% vacancy, showcases our strategy to identify undervalued assets, capitalize on mismanagement, and unlock extraordinary value.

This property, purchased at $17.50 per square foot, exemplifies a once-in-a-generation buying opportunity fueled by structural shifts in the market and our ability to execute on untapped potential. Here’s why I’m excited about this acquisition and what it means for the broader office real estate sector.

The Opportunity: Mismanagement, Neglect, and Untapped Potential

The property at 400 Main Street is a diamond in the rough. It has suffered years of mismanagement from the previous REITs ownership and its property manager, resulting in excessive vacancy, poor financial performance, and unnecessary operating expenses. This mismanagement has created a value gap that my team and I aim to capitalize on.

Key Issues with Current Management:

- Inefficient Management: a Texas-based property management firm has been charging exorbitant management fees of up to 40% of gross revenues while delivering little value. The property remains largely vacant, and potential tenants have been turned away due to speculation that the property will be converted to residential use.

- Vacancy and Missed Opportunities: Formerly leased to large call center tenants, the building has been largely vacant for 3+ years, further intensified by the effects of COVID-19. The REIT’s inability to retain tenants or market the property effectively has resulted in it being priced at land value, far below its intrinsic worth.

- Poor Marketing: Initially listed at $6.2 million, the property was advertised with an annual net operating income of -$226,000, scaring off potential buyers and forcing the vendor to slash the listing price in half. This lack of foresight underscores the untapped potential in the asset.

- Not Financeable: With negative net operating income, the property is not financeable, effectively eliminating all potential buyers who require financing. This significantly narrowed the buyer pool, further driving down the price.

- Excessive and Unnecessary Expenses: The current owner has incurred unjustifiable costs, such as leasing unnecessary parking spaces in contracts that exceed $100k annually and maintaining bloated contracts for security, cleaning, and other services that are being completed subpar. These expenses, combined with poor oversight, have driven large operating losses.

Back of the building and parking

Back of the building and parking

The Plan: Unlocking Value Through Smart Repositioning

We see enormous potential to reposition 400 Main Street into a high-performing office asset. With better management, strategic marketing, and targeted cost reductions, we can transform this underperforming property into a thriving hub for businesses in Saint John.

Investment Overview and Strategy

Attractive Purchase Price:

- Acquisition at $2.8 Million: Purchased at $17.50 per square foot, well below the replacement cost of $400+ per square foot, providing a significant margin for upside.

Repositioning and Lease-Up Plan:

- Competitive Rents: By setting gross rents at $12 per square foot, the property is positioned below market rates, creating a competitive advantage.

- Conservative Occupancy Goals: Achieving 56% occupancy would allow us to repay all invested capital and stabilize the property within 2–3 years.

- Turnkey Spaces: Many spaces are move-in ready, allowing for expedited lease-up with minimal upfront capital requirements.

We anticipate investing up to an additional $3 million in lease-up costs to reposition and stabilize the property, with a phased approach to leasing and strategic cost management.

Unfinished units

Unfinished units

Lease-Up Strategy:

- Gross Rent Escalation: Starting with a gross rent of $12 per square foot (54% below market rates), we aim to increase this to $20 per square foot by the final leasing phase.

- Phased Leasing Approach: Leasing 30,000 square feet every 6 months, with conservative lease-up costs estimated at $22 per square foot.

- Landlord Work Budget: Allocated at $14.75 per square foot, covering tenant improvements and common area updates.

- Tenant Allowances and Leasing Commissions: Allowances are budgeted at $5 per square foot, and commissions are projected at 4% of gross rent over the first five years of each lease.

- Cost Reduction Through As-Is Leasing: We anticipate leasing some spaces in their existing condition with minimal tenant improvement (TI) costs, significantly reducing the assumed lease-up expenses.

Remodeled unit

Remodeled unit

Cost Efficiency:

- Operational Savings: Renegotiating contracts for parking, cleaning, and security will reduce overhead costs, boosting net operating income (NOI).

- Focused Management: Improved operational efficiencies will replace the previous management’s inefficiencies, unlocking immediate savings.

- Energy Management: Conduct an energy audit, install BAS (building automation systems), replace all lighting with LED, and upgrade mechanical to materially lower energy costs.

- Appeal Property Taxes: Appeal the property tax assessment to reflect the last transaction value.

Effective Marketing:

- Targeted Campaign: A strategic marketing initiative will emphasize the property’s:

- Prime Location

- Competitive Rents

- On-Site Parking

- Turnkey Readiness

- The campaign is designed to attract local businesses and regional tenants seeking value and convenience.

- Contact every business in the community, find those looking to expand or those seeking more affordable space.

- Incentivize everyone in our network and in the local real estate community by offering top-market referral fees to any tenant someone brings to us.

- Prime Location

Tenanted space

Tenanted space

Why I’m Betting Big on the Office Sector

The broader office real estate market is at an inflection point, and I see opportunities others are overlooking. While I find retail similarly appealing, the scale of opportunity isn’t as significant as it is in office. Retail offers many of the same benefits as office, with the added advantage of being able to acquire properties at double-digit in-place cap rates, often backed by high-quality tenants. With moderate leverage, this can result in year one cash-on-cash returns exceeding 20%.

The key difference with office properties lies in the higher vacancy rates. Banks perceive this as higher risk and are often unwilling to lend, necessitating cash purchases. However, this very dynamic creates opportunities—vacancies provide the potential to lease up and drive significant value. In my view, retail is a solid, safe investment option with reliable cash flow, while office represents a chance for both excellent cash flow and substantial forced appreciation upside.

Market Fundamentals That Favor This Strategy:

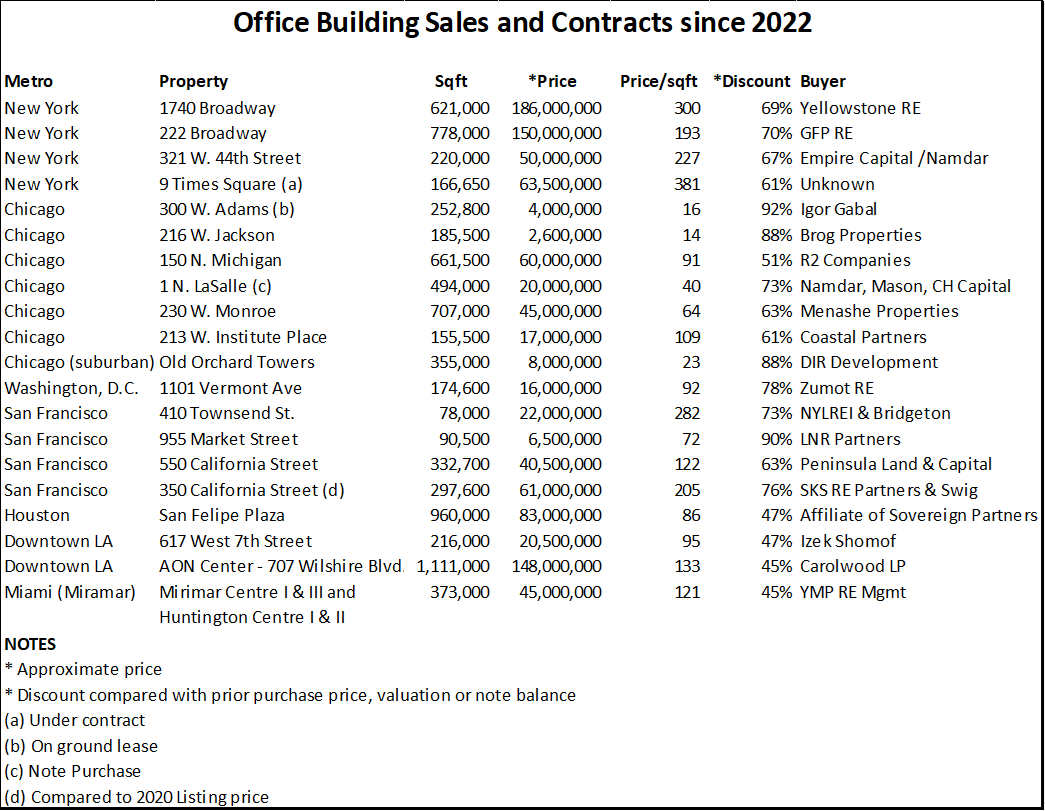

Unprecedented Discounts:

Quality office properties are trading far below replacement cost, a valuation anomaly unlikely to persist as market fundamentals stabilize.

Institutional Sell-Offs:

Financially stressed institutional investors are selling high-quality office properties at steep discounts, as much as 80% of their previous values, creating opportunities for well-capitalized buyers with long-term views.

Limited New Supply:

Rising construction costs and stricter regulations have essentially halted new office developments. With fewer projects entering the pipeline, existing properties are set to benefit from the shrinking supply of leasable office space.

Shrinking Gross Leasable Area (GLA):

Many older office buildings are being repurposed into residential units or demolished entirely. This trend favors existing spaces by putting upward pressure on rents of well-located, adaptable office spaces like Place 400.

Demand for Premium Spaces:

While overall office vacancies remain elevated, premium office buildings in prime locations are bucking the trend. Our success with 75 Prince William Street—a 35,000-square-foot office building just down the street, where we achieved 100% occupancy at an average rate of $22 per square foot—demonstrates the strength of this dynamic.

Return-to-Office Momentum:

While the work-from-home era brought a wave of skepticism to the office market, the long-term fundamentals remain strong. Major corporations like Amazon, Google, Disney, Zoom, RBC, Microsoft, JPMorgan and countless more are mandating a return to office policies, signaling a reversal of the remote work trend.

Collaboration & Culture:

The office remains a vital space for fostering collaboration, company culture, and innovation—factors that are difficult to replicate in a remote setup.

Flexibility for Repurposing:

Office buildings are increasingly being adapted for mixed-use purposes, such as coworking spaces, residential conversions, and community hubs, enhancing their strategic value.

Supply & Demand Dynamics:

Many of these factors strengthen the long-term fundamentals of the office market. By reducing supply, upward pressure is applied to demand, which in turn drives rents—and consequently, property values—higher. However, the current disconnect between existing rents and the cost of new construction remains significant. It will take time before new construction becomes economically viable again. This dynamic benefits existing operators who are purchasing properties near the market’s bottom, effectively resetting property values from their previous highs.

Common areas

Common areas

Why Place 400 is a Perfect Fit

- Location, Location, Location:

400 Main Street is situated in a prime location:

- Proximity to Uptown Saint John: Just a one-minute drive from Uptown, the property offers easy access to the city’s vibrant commercial and residential hub.

- Convenient Amenities: Adjacent to a Holiday Inn Express, McDonald’s, and a retail strip with Tim Hortons, Shoppers Drug Mart, and Dollarama, the property is perfectly positioned for convenience and visibility.

- Access to Major Throughways: With direct highway access and proximity to residential developments, this property is a natural choice for tenants looking for accessibility and modern infrastructure.

- Exceptional Structure: The building’s robust steel and concrete construction ensures low long-term maintenance costs and makes it an attractive option for tenants seeking secure, high-quality spaces.

- Strategic Location: Saint John, NB, offers a growing market with limited office supply and strong demand for well-located, adaptable office spaces.

Projected Returns: Turning Potential Into Performance

Our plan projects a transformation for 400 Main Street:

- Stabilized Value: Once repositioned, the property is expected to achieve a valuation of $14.95 million based on a conservative 9% capitalization rate.

- Fully Leased Potential: At full occupancy, the property’s value could exceed $22.5 million, representing a 700% increase from the acquisition price.

Summary

This project is not for the faint of heart. With so much at stake, even modest success is necessary to avoid a significant downside. However, we are confident in our vision and, more importantly, in our perspective on the fundamentals and indicators driving this sector. I do not believe we’re wrong—just early. Recognizing this, I’m preparing myself for the long haul. This is not a quick-win project; it will take three-four-five or more years to realize its full potential. The outcome could make this either the greatest deal I’ve ever done—or the most challenging; only time will tell!

Stay tuned as we bring this property back to life and redefine what’s possible in the office real estate market!

Interested to learn more about investing in office space? Check out my post on the first office building I purchased and leased up, a 35,000 sq. ft. office building in Uptown Saint John.