The Illusion of Democracy

Democracy is often celebrated as the pinnacle of governance, a system designed to empower the people and protect individual freedoms. Yet, when we critically analyze its structure and long-term trends, democracy reveals itself as inherently flawed. It fosters short-term thinking, incentivizes unsustainable policies, and leads to economic stagnation, societal decay, and an inevitable collapse. As taxes rise, public debt balloons, welfare systems expand, and individual liberties erode, democracies appear to be on a collision course with their own contradictions.

In this post, I present a argument for why democracy, as it is currently practiced, is an unsustainable form of governance, leading to a worsening cycle of dependency, inequality, and eventual collapse.

Short-Term Thinking and the Election Cycle

Election Cycles Drive Policy

Democratic leaders are incentivized to legislate with an eye on the next election rather than on future generations. Policies promising immediate voter benefits—such as welfare expansions, subsidies, or stimulus packages—win votes. But they often ignore deeper social and economic problems, leaving them unresolved or kicked down the road.

High Time Preference

This political reality fosters a culture of short-term gratification. Voters and politicians alike prioritize present consumption over long-term planning and investment. As a result, the broader society’s foundation for sustainable economic growth weakens over time.

“The hallmark of maturity is the ability to delay gratification. Take responsibility for your life. It’s not blaming others, it’s not whining, and it’s not victimization. Maturity is the voluntary acceptance of suffering to achieve meaningful goals.” - Jordan Peterson

Examples

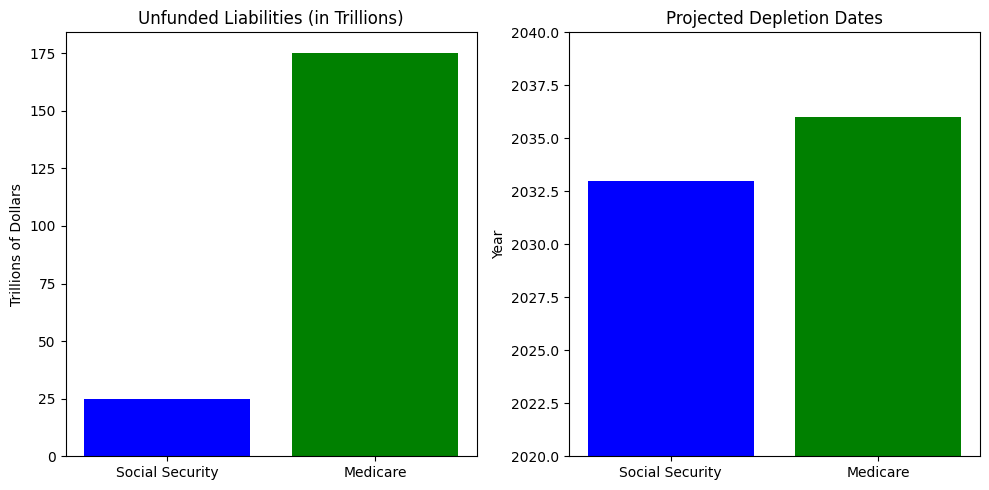

The graphs provided effectively illustrate the financial challenges facing Social Security and Medicare:

- Unfunded Liabilities (in Trillions):

- Social Security: Approximately $24.8 trillion.

- Medicare: Significantly larger at $175.3 trillion.

- Projected Depletion Dates:

- Social Security: Expected to be depleted by 2033.

- Medicare: Expected to be depleted by 2036.

These visuals highlight the significant funding gaps and the urgency for policy reforms to address these looming insolvency issues.

United States

Debt-Fueled Stimulus Packages: The U.S. national debt surpassed $33 trillion in 2023, with pandemic relief packages like the CARES Act alone adding $2.2 trillion—a burden future taxpayers will bear through inflation and higher taxes.

Social Security and Medicare: Social Security and Medicare represent 39% of federal spending and face insolvency by 2035 unless reforms are made, yet no major changes have been proposed due to fear of alienating older voters, who comprise 29% of the electorate.

Infrastructure Neglect: The American Society of Civil Engineers graded U.S. infrastructure at a C- in 2021, with 43% of roads in poor or mediocre condition and 46,154 structurally deficient bridges, requiring an estimated $2.6 trillion investment to address.

Tax Cuts Without Spending Cuts: The 2017 Tax Cuts and Jobs Act added $1.9 trillion to the national debt over 10 years, while federal spending grew by over 7% annually during the same period, further increasing the deficit.

Canada

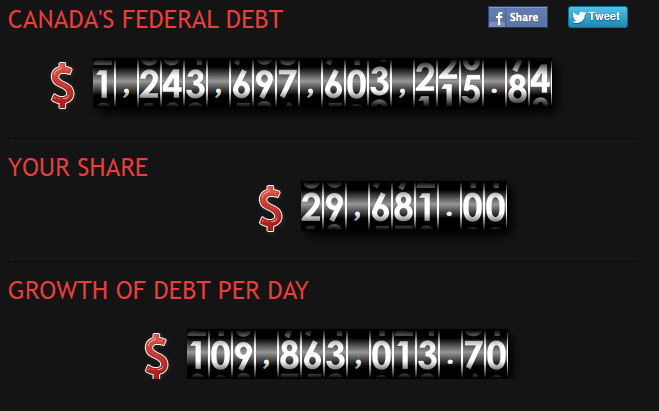

Expanding Welfare Promises: Canada’s national debt reached CAD $1.2 trillion in 2022, with new programs like universal child care and dental care adding an estimated CAD $30 billion annually, raising concerns over long-term affordability.

Housing Affordability Crisis: Canada’s housing market is the least affordable among G7 nations, with average home prices reaching CAD $757,100 in 2023—11 times the average annual household income—while policies like foreign buyer bans and incentives fail to address a housing supply deficit of 3.5 million homes.

Healthcare Wait Times: The average wait time for specialist care in Canada was 27.4 weeks in 2022, up from 19.8 weeks in 2018, with a projected shortage of 117,600 nurses and 44,000 doctors by 2030, further straining the system.

Carbon Pricing and Rebates: Canada’s carbon tax is set to increase to CAD $170 per ton by 2030, but rebates reduce the actual price signal, with 80% of households receiving nearly as much as they pay, undermining its incentive to cut emissions.

Broader Implications

These issues showcase democracy’s inherent focus on short-term electoral gains at the expense of long-term sustainability:

- Debt Addiction: The U.S. and Canada’s combined national debt exceeds $35 trillion, with no comprehensive plans to reverse the trend.

- Band-Aid Policies: Infrastructure neglect, housing crises, and underfunded healthcare systems are deferred to future generations, compounding costs and risks.

- Erosion of Accountability: Politicians prioritize the immediate satisfaction of voters, leaving systemic issues like pensions, climate, and debt unresolved, worsening societal and economic pressures.

The Tragedy of the Commons in Public Resources

Public vs. Private Ownership

Democracy treats government resources as “publicly owned,” effectively creating a commons. Like all commons, these resources suffer from overuse and mismanagement, as no individual politician or official has a genuine, long-term stake in maintaining their value. This dynamic often leads to wasteful spending on popular but unproductive projects meant to secure votes.

Contrast with Private Property

In a private-property system, resources are owned and managed by individuals who face direct consequences for mismanagement. If they misuse their property, they alone suffer the loss, incentivizing them to preserve and enhance it. Democratic systems lack this direct accountability, increasing the likelihood of resource misallocation.

“What belongs in common to the most people is accorded the least care; for people are most careful of their own property.” - Aristotle

Think about it, do you ever wash a rental car before returning it?

The Tyranny of the Majority

Oppression by Popular Demand

Democracy is premised on majority rule. While this sounds equitable, it enables majorities to legislate away the rights and property of minority groups. Policies aimed at “taxing the wealthy” or “redistributing wealth” may be popular, but they can undermine productivity, investment, and innovation, harming everyone in the long run.

Consequences for Economic Policy

Majority-driven populist measures often target politically disfavored groups, creating regulatory uncertainty. Entrepreneurs and businesses become wary of investing if they suspect future legislation may penalize their success. This curbs economic dynamism and can stifle wealth creation across society.

Examples of the Tyranny of the Majority

Ancient Athens (399 BCE): The execution of Socrates demonstrates how majority rule can stifle dissent and target individuals, undermining justice and intellectual freedom.

French Revolution (1793–1794): The Reign of Terror’s populist purges destabilized the economy by targeting property owners and fostering mass insecurity.

Reconstruction-Era U.S. (1865–1877): Southern legislatures used majority-backed laws to disenfranchise African Americans, suppressing political rights and economic growth.

Argentina (1946–1955): Perón’s populist policies undermined property rights, causing capital flight and transforming Argentina from a wealthy nation into an economically stagnant one.

Zimbabwe (1990s–2000s): Mugabe’s land expropriation policies appeased majority demands but caused agricultural collapse, food shortages, and economic ruin.

Venezuela (2000s–Present): Populist policies under Chávez and Maduro devastated private enterprise, creating hyperinflation and a humanitarian crisis.

Weimar Germany (1919–1933): Majority-driven reparations policies led to hyperinflation, eroding savings and democratic trust, ultimately paving the way for authoritarianism.

Soviet Union (1932–1933): Stalin’s collectivization policies led to mass famine, with widespread starvation driving desperate individuals to sell human body parts for survival, exemplifying the devastating consequences of eradicating private property and productive incentives.

The infamous photographs of this era starkly capture the human toll of policies that prioritized ideological conformity over economic and agricultural efficiency.

The striking satellite image of the Korean Peninsula at night vividly illustrates the outcomes of two contrasting systems: the free society of voluntary exchange in South Korea versus the centrally planned, authoritarian system of North Korea.

South Korea, illuminated by vibrant city lights, showcases the prosperity driven by free markets, voluntary trade, and democratic governance, which have fostered innovation, urban development, and widespread access to electricity and modern amenities.

In contrast, the darkness enveloping North Korea reflects the devastating consequences of a centrally controlled economy, where resources are misallocated toward military ambitions and state propaganda rather than basic public needs. Without voluntary exchange or market incentives, North Korea’s rigid, coercive system leaves its population in deprivation, lacking access to electricity, infrastructure, and economic opportunities.

This stark contrast highlights how voluntary cooperation and economic freedom create thriving societies, while authoritarian control leads to stagnation and widespread hardship.

The Expanding Welfare State

Vote-Buying Through Benefits

As democratic societies mature, welfare programs tend to expand. Politicians promise government support—from unemployment benefits to broad social welfare packages—to win votes. Over time, a growing proportion of the population becomes dependent on these programs.

Productive Class vs. Dependent Class

As the number of benefit recipients increases, the burden of taxes and regulations on the shrinking productive class that funds these programs also grows. Heavy taxation and bureaucratic obstacles stifle entrepreneurship and innovation while making it more difficult for individuals to save and invest in their future. This imbalance ultimately hampers economic growth, fostering a cycle of dependency that becomes increasingly difficult to escape.

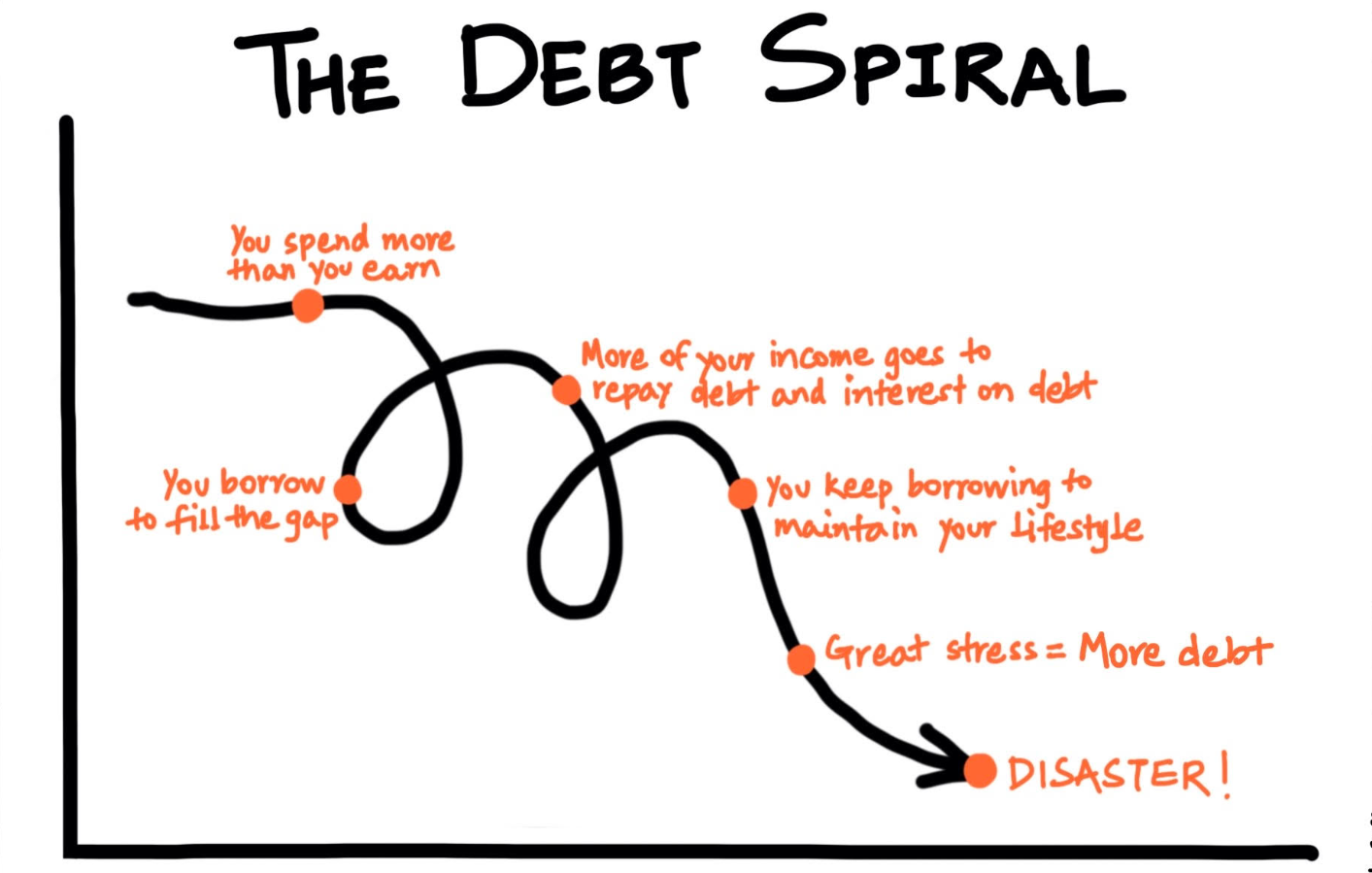

The Debt Spiral

Financing Government Through Borrowing

Democratic governments routinely spend beyond their means, accruing vast public debts to fund welfare, infrastructure, or military endeavors. Servicing this debt necessitates either higher taxes—which depress productivity—or monetary inflation, which quietly erodes purchasing power.

Vicious Cycle of Debt

- Taxes and inflation sap economic growth.

- Weaker growth fuels social discontent and inequality.

- Politicians respond with more welfare or subsidies, piling on more debt.

Eventually, debt reaches unsustainable levels. Future generations inherit an economy burdened by heavy interest payments and an underfunded welfare system, leaving them with fewer opportunities for advancement.

Regulatory Capture and Crony Capitalism

Special Interests Reign Supreme

In democratic systems, politicians rely on campaign contributions and voter support, which special-interest groups and wealthy corporations can heavily influence. Regulations, subsidies, and tax policies thus end up benefiting a select few at the expense of the broader public.

Distorted Markets

Rather than allowing fair competition, democratic governments often pick winners and losers through lobbying and favorable legislation. This not only breeds resentment but also distorts markets, discouraging innovation and effective resource allocation.

Inflation as Hidden Taxation

Monetary Expansion

Inflation offers democratic governments a covert method to finance spending. Rather than raising taxes (which are unpopular with voters), they can print or digitally create money, effectively devaluing the currency.

Inequality and Erosion of Savings

Wealthy asset holders tend to benefit from rising prices, while wage earners and savers see their purchasing power diminished. This undercuts democracy’s claim to foster equality, increasing social stratification and fueling further dissatisfaction.

“Inflation is taxation without legislation.” - Milton Friedman

The Myth of Political Equality

Unequal Influence

While democracy purports to give every individual an equal voice, in practice, well-funded lobbyists and politically connected elites hold disproportionate sway. Ordinary citizens, lacking specialized knowledge or financial resources, struggle to effect meaningful change.

Eroding Public Trust

As inequities persist and special interests capture political institutions, public trust in democratic processes declines. This growing disillusionment feeds calls for more state intervention, ironically aggravating the very problems it aims to solve.

Moral Hazard for Politicians and Voters

No Personal Stakes

Democratic leaders do not face personal liability for the consequences of their decisions. Once they leave office, they’re typically shielded from the fallout of poorly conceived policies.

Short-Term Voter Incentives

Voters, too, face little accountability. Many will support welfare expansions or spending hikes without considering the future tax burdens or inflation that accompany them. This dynamic fosters a culture of risk-free policy-making and exacerbates government overreach.

Centralization and Bureaucratic Inefficiency

Creeping Centralization

Over time, democratic governments trend toward centralizing power, absorbing more responsibilities into federal or national agencies. This uniform approach rarely accounts for local or regional differences, stifling community-based decision-making and individual autonomy.

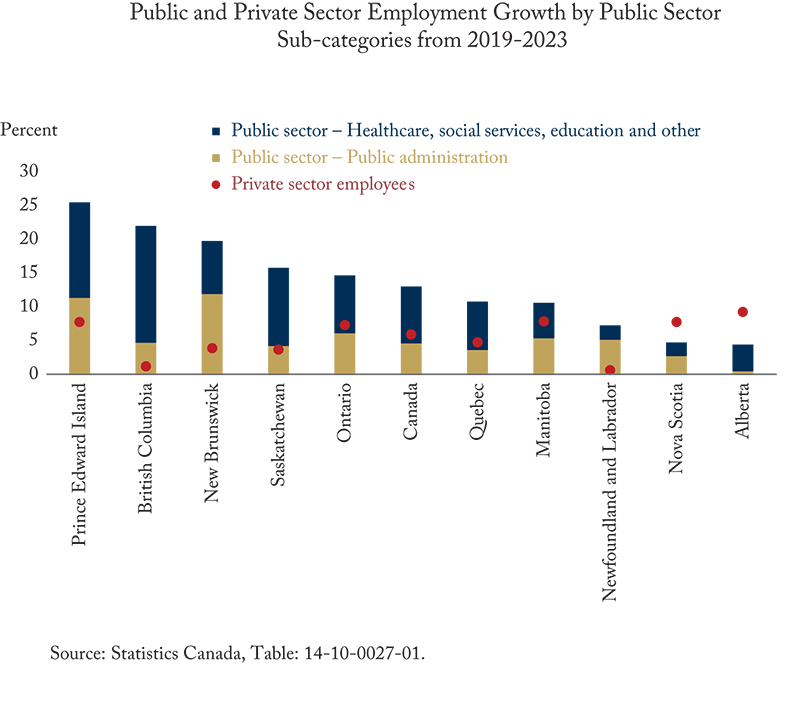

Bloated Bureaucracy

Large bureaucracies lack market competition and direct accountability, leading to inefficiency, waste, and corruption. Public services—from healthcare to education—often operate below par despite significant funding. Efforts to reform these systems stall under political gridlock and vested interests.

The Growth of Government

Estimates range from approximately 115 to over 400 agencies. For instance, the Administrative Conference of the United States lists 115 agencies, while the Federal Register cites 436.

At its inception in 1789, the federal government comprised only a handful of departments, including State, Treasury, and War.

Global Public Sector Employment Statistics: Globally, the public sector accounts for approximately 37% of formal employment. Significant deviations from this average, particularly when public sector employment constitutes more than half of the total workforce, can lead to economic inefficiencies and increased fiscal burdens.

As of September 2024, Canada’s public sector accounts for 21% of the workforce, reflecting 4.4 million employees and a 13% growth since 2019, which outpaced private sector growth by 3.6 times.

The Slow Erosion of Liberty

Taxation, Regulation, Surveillance

To maintain and expand the welfare state—and service mounting debts—democratic governments impose higher taxes and stricter regulations. Over time, these intrusions curtail individual property rights and personal freedoms. As social unrest grows, authorities respond with increased surveillance and censorship to maintain control.

Soft Tyranny

Democracy drifts into a “soft tyranny,” where individuals are nominally free yet live under sweeping government oversight. Innovation, creativity, and personal responsibility suffer, pushing society toward stagnation and stifling the entrepreneurial spirit essential for true progress.

Examples:

Canada

Taxation and Regulation:

-

Carbon Tax Expansion: Canada’s carbon tax, set to rise to $170 per ton by 2030, increases the cost of goods and services, disproportionately impacting lower-income households while reducing individual financial autonomy.

-

Bill C-11 (Online Streaming Act): Passed in 2023, this law gives the government more regulatory control over online content platforms like YouTube, requiring Canadian content prioritization. Critics argue it limits free expression by effectively censoring what users can access and publish online.

Surveillance and Censorship:

-

Emergency Act and Freezing Bank Accounts (2022): During the Freedom Convoy protests, the government invoked the Emergencies Act to freeze the bank accounts of peaceful protest participants without court orders. This unprecedented move raised concerns about financial surveillance and the erosion of civil liberties.

-

Bill C-18 (Online News Act): Requires tech companies like Google and Meta to pay for news content shared on their platforms, which critics argue indirectly controls how information is disseminated, threatening press freedom and open discourse.

Soft Tyranny: Expanding welfare programs and stringent climate regulations create an environment where individuals are more dependent on the state, eroding the culture of self-reliance and personal responsibility.

United States

Taxation and Regulation:

-

IRS Expansion: The Inflation Reduction Act (2022) allocates funding for 87,000 new IRS agents, which critics see as a move to expand government oversight and tax enforcement, potentially targeting middle-class taxpayers and small businesses.

-

Occupational Licensing: Over 30% of jobs now require government-issued licenses, up from 5% in the 1950s, stifling entrepreneurial freedom and access to work opportunities, particularly for lower-income individuals.

Surveillance and Censorship:

-

Patriot Act and Mass Data Collection: Initially passed in 2001, the Patriot Act allows government agencies broad surveillance powers, including monitoring online activity, phone records, and banking transactions. These powers remain largely intact despite ongoing privacy concerns.

-

Big Tech and Censorship: Collaboration between federal agencies and tech companies to regulate misinformation, particularly during the COVID-19 pandemic, led to social media platforms censoring content. Critics argue this reflects a government-driven suppression of free speech.

Soft Tyranny: Increasing government control through expanded welfare programs and surveillance has led to growing dependence on state systems, with critics warning of diminished individual agency and economic stagnation.

The Endgame: Collapse or Transformation

If these trends continue unchecked, democracy often faces one of the following outcomes:

Economic Collapse: Skyrocketing debt, hyperinflation, or an inability to fund welfare programs may trigger financial crises. Public faith in institutions evaporates, leading to widespread social and political turmoil.

Authoritarian Rule: To manage crises, democratic systems may centralize even further, adopting overtly authoritarian measures. Individual freedoms erode rapidly, replaced by top-down control and suppression of dissent.

Decentralization and Secession: Disillusionment with overextended government might spark movements for decentralization or secession. Regions or communities may break away in an attempt to reclaim autonomy, fostering smaller governance models that value local accountability and personal liberty.

Is There an Alternative?

Hans-Hermann Hoppe proposes a decentralized natural order based on private property, voluntary exchange, and localized governance. Under this model:

Private Property and Responsibility: Individuals own their resources outright and thus have strong incentives for prudent, long-term stewardship.

Voluntary Systems of Support: Communities, families, and charitable organizations provide social welfare on a voluntary basis, bypassing coercive taxation.

Local Governance: Competing private systems of arbitration and defense create accountability mechanisms that are more responsive and transparent than any single national government.

Such an arrangement aims to eliminate the systemic triggers for short-termism, debt, and cronyism that plague modern democracies.

Why Democracy Is Unsustainable

Summarizing the core criticisms:

Short-Term Bias: Election-focused policies prioritize immediate voter satisfaction over sustainable, long-range planning.

Unbridled Welfare Expansion: Growing entitlements fuel dependency and stifle productivity.

Endless Debt and Inflation: Borrowing and monetary expansion kick the fiscal can down the road, undermining future prosperity.

Cronyism and Entrenched Inequality: Special interest groups capture the political process, compounding wealth gaps.

Progressive Loss of Liberty: Centralized governance, bureaucratic bloat, and surveillance steadily corrode individual freedoms.

Centralized governance, bureaucratic bloat, and surveillance steadily corrode individual freedoms.

While democracy may function superficially in the short run, these flaws accumulate, pushing societies toward a reckoning. As debt, inequality, and social division escalate, collapse or authoritarian transformation becomes increasingly likely. The real question is how societies will respond when democracy’s contradictions become unmanageable.

Hoppe’s Solution Embracing privatized, decentralized governance grounded in voluntary cooperation and property rights could offer a stable and more equitable framework. By removing the perverse incentives built into democratic systems, humanity might chart a path toward genuine freedom, responsibility, and sustainable prosperity.

Summarizing the argument:

Democracy’s well-intentioned promises clash with economic realities and human incentives. The result is a self-perpetuating cycle of short-term policy-making, rising dependency, swelling debt, and creeping authoritarianism.

A more resilient and principled alternative may lie in vision of decentralized governance—one that places individual liberty and responsibility at the heart of societal organization. Whether or not the broader world adopts this path remains to be seen, but its focus on property rights, accountability, and personal freedom stands in stark contrast to democracy’s inherent pitfalls.