The Debt Dilemma: Are Canadian Developers on Shaky Ground?

Introduction

The Canadian residential real estate market has been heavily propped up by government-backed financing programs, most notably the MLI Select program offered through the Canada Mortgage and Housing Corporation (CMHC). While this initiative has fueled a construction boom and enabled developers to achieve numbers that would otherwise be infeasible under traditional underwriting standards, the foundation of this model is fragile. This post critiques the unsustainable reliance on government-backed debt, analyzes rising vacancy trends, explores the potential impact of policy changes, and contrasts residential real estate with alternative distressed asset classes that may present superior opportunities.

1. Real Estate Valuation is Tied to Capital Availability

At its core, income-producing real estate is a function of supply and demand, and heavily influenced by capital availability. The easier and cheaper it is to finance a property, often, the greater values increase. In the Canadian market, residential real estate has been the primary beneficiary of artificial financing through the MLI Select program, which offers:

- High loan-to-value (LTV) ratios (up to 95% financing)

- Favorable debt coverage ratios

- Lower mortgage insurance premiums

- Extended amortization periods (40 years)

These financing conditions allow developers to stretch their return on equity (ROE) to artificially high levels, making projects appear lucrative on paper. However, this model assumes:

- The MLI Select program will continue indefinitely.

- Valuations will remain high due to sustained demand.

- Occupancy and rental rates will not decline.

The reality is that these assumptions are already being challenged.

2. The Risks of Overreliance on Government Lending Programs

History has demonstrated that government-backed lending programs are not permanent. During the COVID-19 pandemic, CMHC abruptly restricted equity takeouts, preventing property owners from accessing their own capital. If MLI Select were to be curtailed due to:

- A change in political leadership

- Government budget constraints

- Public backlash against corporate real estate ownership could trigger a collapse of the entire financing structure that supports residential development.

If that happens, developers would be forced to sell at valuations based on traditional financing terms, which are significantly lower than the artificially enhanced values used in MLI Select underwriting. This would dramatically reduce the sale value of their buildings, resulting in:

- Negative equity positions (where the loan exceeds the property’s value).

- Inability to refinance at favorable terms.

- Higher default risks for developers who over-leveraged based on artificial valuations.

A mere 5% decline in property values under high-LTV financing structures could wipe out a developer’s entire equity position.

3. Rising Vacancy Rates and Overbuilding Lag

One of the critical failures of real estate development is the significant time lag between project initiation and delivery. By the time new units come online, the economic conditions that justified their construction may no longer exist.

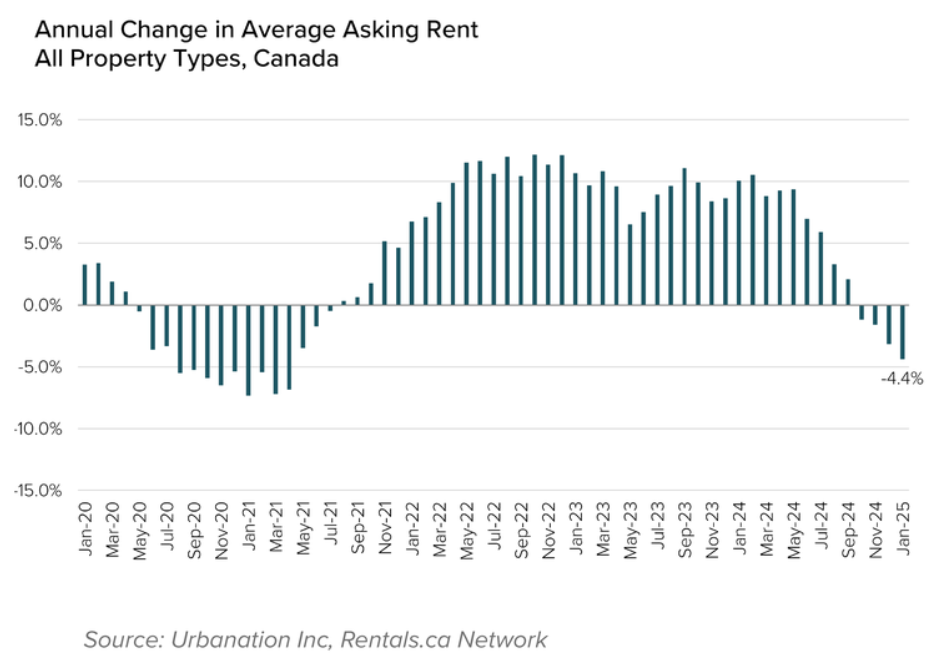

Current data already shows increasing vacancy rates in major Canadian cities.

- Rental price growth is beginning to stall and even decline in some regions.

- Thousands of units financed under MLI Select are still under construction, meaning the true supply glut has not yet been realized.

- When these units hit the market, increased supply will exacerbate the rental rate decline, further eroding the financial viability of these projects.

The assumption that “there is an endless housing shortage” ignores the real-time supply and demand dynamics:

- Immigration levels are being reduced due to political and economic concerns.

- The student visa program is being scaled back, reducing demand from a key tenant base.

- Birth rates in Canada are at record lows, meaning long-term domestic demand is structurally weakening.

If population growth slows while new supply floods the market, developers will struggle with lower-than-expected rents, higher vacancy rates, and compressed net operating income (NOI).

4. Lessons from Historical Real Estate Cycles

The Canadian residential market is following a textbook pattern of speculative overdevelopment fueled by cheap debt. Similar crises have unfolded before:

Savings & Loan Crisis (1980s)

- Office buildings were massively overbuilt due to excessive capital availability.

- When financing dried up, values collapsed, leading to widespread foreclosures.

2008 U.S. Housing Crash

- Government-backed lending (subprime mortgages) fueled artificial demand.

- When underwriting standards were tightened, the entire market collapsed.

- Oversupply exacerbated the crash.

These examples underscore the key principle that when financing conditions change, asset prices reset.

5. Alternative Investment Strategies: Distressed Commercial Real Estate

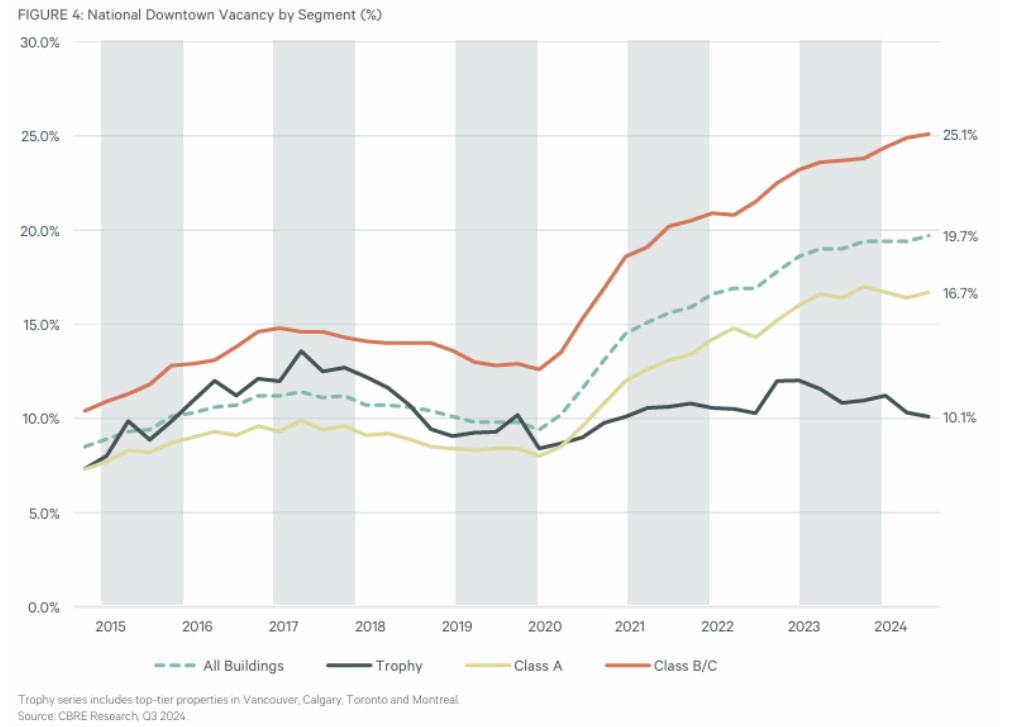

While residential development is reaching its peak, certain distressed asset classes are at or near their cycle lows.

Office buildings and enclosed shopping centers currently offer:

- Massively depressed valuations due to restrictive financing.

- Entry prices far below replacement cost.

- Stable in-place cash flow.

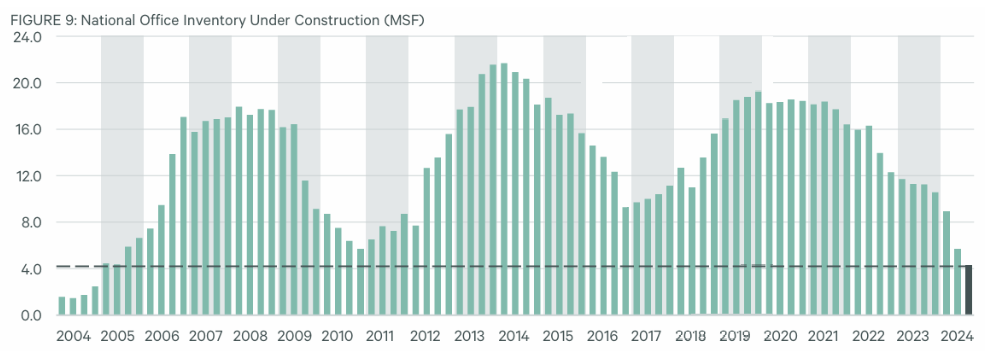

- Zero new supply risk (since rents are too low to justify new construction).

In contrast to residential, these asset classes do not require artificial government lending to be viable. By investing at these low points in the cycle, an investor can benefit from capital appreciation as conditions normalize.

I invest where the returns are, focusing on in-place cash flow while creating value through active management. I don’t rely on external market forces to speculate on appreciation.

I look for trends that signal a compelling asset class with strong long-term upside—like 25%+ vacancy rates and the lowest supply growth in two decades. If the last chart overlayed real replacement cost, it would reveal an even more fascinating picture.

Buying when the market sits at 1% vacancy carries too much risk, as there’s only one major direction it can go. I prefer to be on the other side of that trade.

Office sector:

Contrarian Investing: Finding Opportunity in What Banks Fear

One of the most powerful ways to build a winning real estate investment strategy is to consistently go against the prevailing sentiment of the banks. When financial institutions deem an asset class “unfinanceable,” it often signals an opportunity for those with liquidity and strategic foresight.

This concept has played out repeatedly across history: retail properties were left for dead during COVID-19, multifamily was shunned after the 2008 crisis, and today, offices are facing a similar fate. Yet, in each case, those who acquired assets at the point of peak distress saw the greatest returns when capital inevitably returned to the sector.

The Capital Availability Cycle: The Real Driver of Property Values

Real estate is not simply a matter of supply and demand—it is also a function of capital availability. When lenders are eager to finance a property type, values become inflated due to easy access to debt. Conversely, when banks retreat, liquidity dries up, and income producing real estate values decline—not necessarily because the properties are intrinsically bad, but because the ability to finance them has been restricted.

The Formula for Distressed Opportunities:

1. Identify what banks are avoiding.

- Right now, it’s office space. A few years ago, it was retail. Before that, it was multifamily with high vacancy risk.

2. Analyze in-place cash flow.

- Look for assets with sustainable rental income that can support debt service, even if traditional lenders have backed away.

3. Acquire at a fraction of replacement cost.

- When financing dries up, you can often buy properties for far below what it would cost to build new, reducing downside risk.

4. Wait for capital to return.

- Once banks decide a sector is “safe” again, new capital floods in, pushing values back up. This creates built-in appreciation.

Applying This Strategy Today: The Office Sector Play

Right now, banks are avoiding office buildings like the plague. Office landlords are struggling to refinance, leading to deeply distressed pricing—often below 50% of replacement cost. This echoes what happened with retail during COVID-19. At that time, major institutions dumped shopping centers at fire-sale prices, only for investors who stepped in to see values rebound as capital markets normalized and the underlying fundamentals prevailed.

Today’s office environment presents the same asymmetric opportunity. Properties in strong locations with solid tenants and long-term leases can generate double-digit cash-on-cash returns based on in-place income for investors willing to take the contrarian bet and ride out the cycle. As financing conditions improve—whether through inflationary adjustments to lease rates, a shift in work trends, or simple market normalization—these deeply discounted assets will see massive value appreciation.

Avoiding the “Hot” Investment Sectors

The biggest mistake investors make is chasing whatever is currently in favor with lenders. Right now, that means multifamily. With CMHC’s MLI Select program distorting the market, developers are overbuilding based on unrealistic underwriting assumptions. When interest rates rise or government subsidies shift, these assets could face sharp corrections.

Instead of following the crowd into overvalued sectors, I focus on:

- Buying based on today’s cash flow, not speculation.

- Targeting assets that are out of favor by banks and the general market.

- Acquiring properties at prices well below replacement cost.

- Positioning for capital inflows that will eventually return to the sector.

Cranes in the air, beware.

The Bottom Line: Make the Banks Your Contrarian Indicator

If a sector is easy to finance, it’s likely already overvalued. If banks refuse to touch it, that’s where the deepest discounts and greatest upside exist. Whether it’s office, retail, or another “out of favor” asset class, the key is recognizing that capital availability dictates property values more than any other factor.

Smart investors don’t chase what’s hot. They buy what others fear—when the numbers make sense.

Conclusion

Canadian residential developers face significant downside risks due to their reliance on government-subsidized financing, rising vacancies, and declining rental demand. The MLI Select program, which has artificially inflated valuations, could be scaled back or eliminated, triggering a sharp repricing of residential assets.

By contrast, investors willing to shift their focus to distressed commercial properties can capitalize on low acquisition costs, no supply risk, and in-place cash flow. The prudent real estate investor should recognize where the cycle is headed and position capital accordingly, rather than chasing inflated residential assets built on a fragile foundation of government-backed debt.

As of February 2025, Canada’s rental market is experiencing notable shifts influenced by various factors, including rental rates, vacancy rates, population growth, immigration policies, and fertility rates. Here’s an overview to help you assess the current landscape for developing a new multifamily building:

Rental Rates and Vacancy Rates:

-

Vacancy Rates: In 2024, the average vacancy rate for purpose-built rental apartments increased to 2.2% from 1.5% in 2023, still below the 10-year historical average of 2.7%.

-

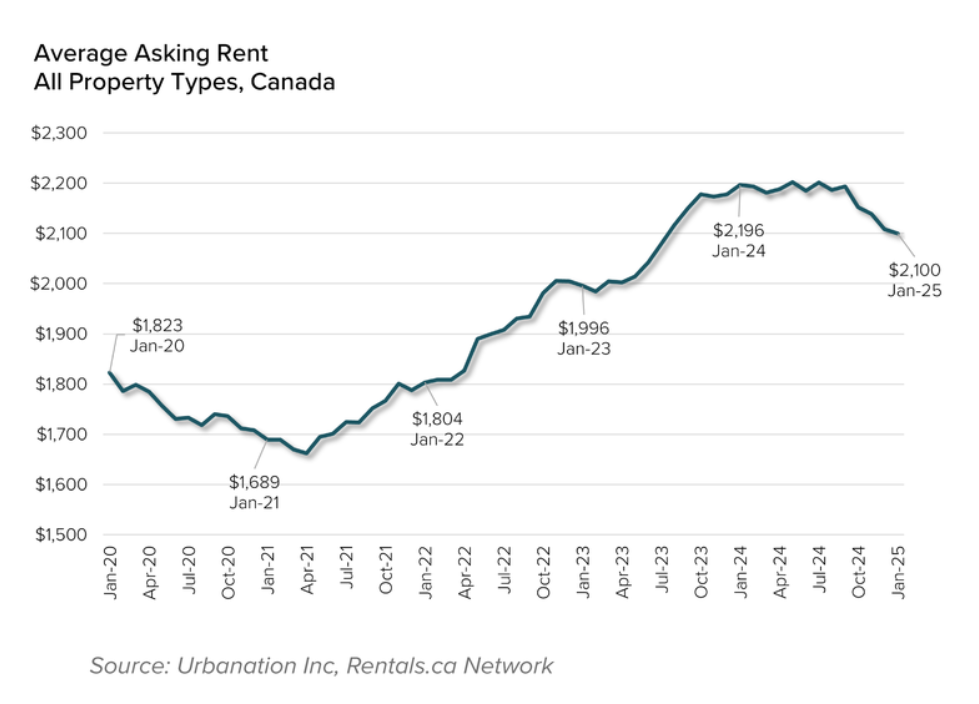

Rental Rates: Average rent growth for two-bedroom units slowed to 5.4% in 2024, down from a record 8.0% in 2023.

-

Rental Rates: The average asking rent for all residential properties in Canada was $2,100 in January, declining 4.4% compared to a year ago to reach an 18-month low.

https://rentals.ca/national-rent-report

Population Growth and Immigration:

-

Population Growth: Canada’s population grew by 242,673 people in the first quarter of 2024, a 0.6% increase, with international migration accounting for 99.3% of this growth.

-

Immigration Policies: The federal government plans to reduce immigration targets, aiming for 395,000 new permanent residents in 2025, down from 485,000 in 2024.

Fertility Rates:

- Canada’s fertility rate has been declining, reaching 1.26 children per woman in 2023, below the replacement level of 2.1.

Implications for Multifamily Development:

- Demand: Despite a slight easing, rental markets in major urban centers remain tight, indicating sustained demand for rental housing.

- Supply: Record levels of rental completions have contributed to higher vacancy rates, suggesting increased competition among property developers.

- Policy Environment: The reduction in immigration targets may lead to a slower rate of population growth, potentially impacting future housing demand.

Given these dynamics, it’s crucial to conduct a thorough market analysis specific to your target location, considering local supply and demand factors, demographic trends, and policy changes. Engaging with local housing authorities and staying informed about municipal regulations will also be essential in making informed decisions for your multifamily development project.