Two Inflation Rates: The One You Hear About and the One That Really Matters

Inflation is one of those economic concepts that most people recognize but rarely question. The standard measure—the Consumer Price Index (CPI)—gets all the attention, dominating headlines and shaping public perception of rising prices. And if your financial world revolves around Domino’s Pizza, streaming subscriptions, and the occasional night out, CPI might seem like a reasonable reflection of reality.

But if were here to talk about about building wealth, we need to dig deeper. In my view, there are actually two distinct inflation rates: consumer price inflation (CPI) and asset inflation. The former affects everyday expenses like food, gas, and rent. The latter determines who builds wealth and who gets left behind. While most people focus on CPI, asset inflation—rising prices in stocks, real estate, and other investments—is what truly shapes long-term financial security.

Every month, CPI numbers are reported as if they define the economic landscape. But if you ignore asset inflation, you could be missing the bigger picture. In this post, I’ll break down why these two inflation rates exist, how they impact different aspects of financial life, and why understanding this distinction is crucial for creating wealth. Let’s dive in.

Consumer Inflation vs. Asset Inflation

Consumer price inflation measures the cost of living, tracking how much more expensive essentials like housing, transportation, and food become over time. Governments use CPI to justify monetary policies, and it is often calculated in a way that understates the real inflation experienced by consumers. Asset inflation, on the other hand, affects the value of wealth-building assets such as real estate, stocks, businesses, and other investments. Unlike consumer inflation, which fluctuates due to short-term supply chain issues or policy changes, asset inflation compounds over decades, widening the wealth gap between those who own appreciating assets and those who don’t.

A look at the past two decades makes this distinction clear. Below are the compounded annual growth rates (CAGR) of various asset types:

Real Estate

Coastal Residential Real Estate: (Vancouver, New York, Miami, Los Angeles): Home values have doubled or tripled, far outpacing official housing inflation metrics. The average annual growth rate of Canadian home prices from 2004 to 2024 was approximately 5.6%, with Vancouver reaching 6.2%.

Commercial Real Estate: The National Council of Real Estate Investment Fiduciaries Property Index (NPI) reported a total annualized return of 8.3% from 2004 to 2023.

Business Valuations

As capital has flooded into private and public markets, business earnings and valuations have soared:

- Private Business & Consumer Services: 5.58% CAGR (NYU Stern data)

- Building Materials: 17.08% CAGR

- Public Sector Tech/Software: 20.3% CAGR

- Engineering/Construction: 22.7% CAGR

- Communications: 7.5% CAGR

Stock Market Performance

S&P 500: Widely recognized as a benchmark for financial assets, the S&P 500 has delivered average annual returns of 10%+, far exceeding CPI inflation.

Bitcoin:

From 2010 to 2024, Bitcoin’s average annual return was an astounding 211%.

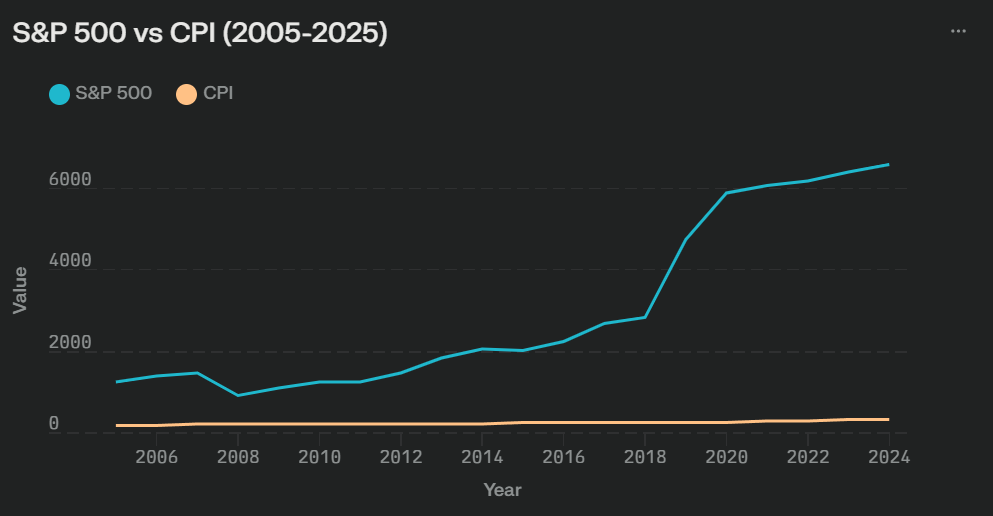

The Real Gap: CPI vs. Asset Inflation

This growing disparity between consumer and asset inflation explains why so many people feel like they’re falling behind. If your income grows at CPI rates (2-4% per year) while real estate, stocks, and businesses appreciate at 10%+, you will never catch up.

Simply saving money in a bank account or relying on wage growth is no longer enough. The purchasing power of cash erodes over time—not just due to CPI inflation but also due to the much faster rise in asset prices.

Recall the phrase, “the rich get richer”—this is why. They grasp this fundamental concept, in addition to applying leverage suchas specialized knowledge, and fostering strong networks that enable them to continuously expand their wealth.

The S&P 500 as a Proxy for Asset Inflation

In my opinion, the S&P 500 serves as a measure of asset inflation for several reasons:

Accessibility and Liquidity:

- Unlike real estate or private businesses, the S&P 500 is accessible to all investors, regardless of size, offering a low barrier to entry.

A Global Benchmark for Capital:

- While it is a U.S. stock index, the S&P 500 reflects global financial trends and capital flows.

A Reflection of Monetary Policy:

- Every time central banks print money, liquidity flows into financial markets, driving asset prices higher. The S&P 500 captures this trend better than CPI ever could.

A Hedge Against Cash Erosion:

- If your investments aren’t compounding at 7-10% annually, you’re effectively losing purchasing power.

Why This Matters

The Middle Class Is Being Squeezed:

- If wages only grow at CPI rates while anything desirable such as housing, investments, and other wealth-building assets rises much faster, wealth inequality will continue to widen.

Traditional Savings Strategies Are Obsolete:

- Keeping money in a bank account earning 1-3% interest does little to combat the real erosion of purchasing power.

Investing Is No Longer Optional:

- In a world driven by asset inflation, those who don’t invest will inevitably fall behind. The only way to keep up is to own appreciating assets.

The Takeaway: Own Scarce, Appreciating Assets

Governments emphasize consumer price inflation (CPI), but asset inflation is the true determinant of financial success. Over time, those who fail to acquire productive, appreciating assets will find themselves priced out of wealth-building opportunities.

To stay ahead, focus on owning scarce desirable assets (cannot be easily created or printed)—such as real estate, businesses, Bitcoin, and high-quality financial investments. The financial system rewards those who understand this dynamic and punishes those who don’t.

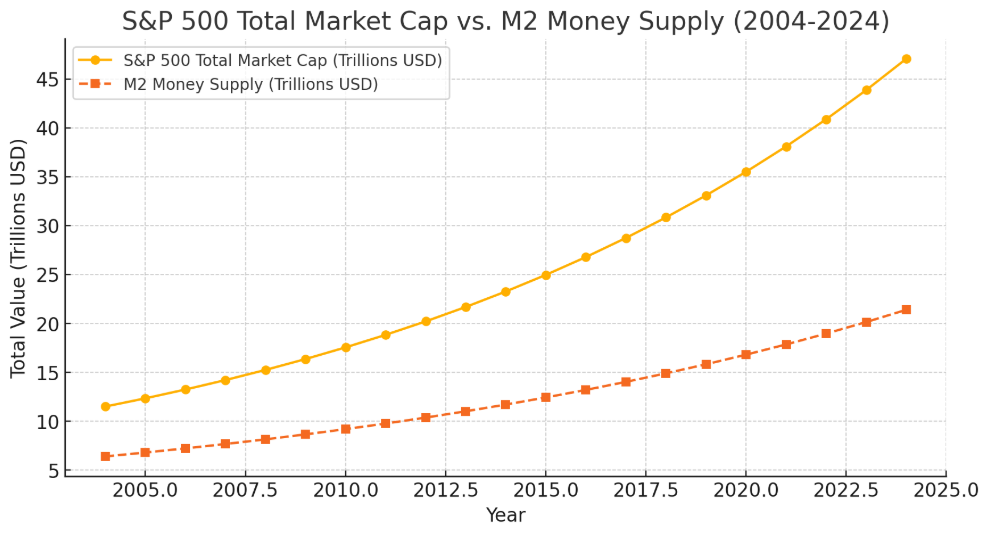

S&P 500 vs. Money Supply Growth

Over the past 20 years, the U.S. M2 money supply has more than tripled, growing from $6.4 trillion in 2004 to $21.4 trillion in 2024. During the same period, the S&P 500 grew from 1,100 to approximately 4,500 points.

Annualized Growth Over 20 Years

- M2 Money Supply CAGR: 6.22%

- S&P 500 CAGR: 7.30%

Here’s a 20-year chart of S&P 500 market cap vs. M2 money supply (2004–2024), showing their growth and the link between monetary expansion and stock valuations.

Key Observations

- Both the money supply and the S&P 500 have seen significant growth over two decades.

- The S&P 500’s annualized return slightly outpaced M2 growth, indicating that asset inflation, particularly in equities, has kept up with or exceeded monetary expansion.

The Cost of Holding Cash vs. Buying Assets

If you had invested $100,000 in the S&P 500 20 years ago, assuming an average annual return of 9.5%, your investment would have grown to approximately $614,161 today.

If you had kept that $100,000 in a savings account with zero interest, inflation and real wage growth (averaging 2.5% per year) would have eroded its purchasing power, leaving you with an equivalent value of just $61,027 today.

Key Takeaway

The S&P 500 serves as the fairest and most accurate measure of asset inflation due to its accessibility and consistent, long-term annualized growth rate of 7-10%. While consumer price inflation (CPI) focuses on short-term cost-of-living increases, asset inflation—reflected in the rising prices of stocks, real estate, and businesses—determines real wealth accumulation.

If your income and wealth aren’t growing at least at the rate of the S&P 500, you are effectively falling behind. Cash savings and wage increases that only keep pace with CPI (2-4%) fail to preserve purchasing power against the much faster rise in asset values. The S&P 500, in my opinion, is the true gauge of asset inflation, and keeping up with it is essential for financial security and long-term wealth building.

- S&P 500 Investment: $614,161 (a 514% increase in value)

- Cash in Savings: $100,000, but only worth $61,027 in today’s purchasing power (a 38.9% loss in value)

Not participating in the asset inflation game over long periods is a guaranteed way to lose purchasing power. Investing in appreciating assets allows you to outpace the inflation rate that matters and build real wealth.