Bought an Office Building in COVID 🏢

Amidst the global health upheaval, with the world seemingly at a standstill, my partner and I took a bold step into the office real estate market in April 2019 while vacancy rates we’re sky rocketing, companies laying off employees, work from home trades emerging and many questioning the future. While many questioned our sanity, we turned what appeared as a perilous investment into a success story. Here’s the tale of that journey:

Front of the building

Front of the building

Strategic Acquisition and Cost Management

We acquired the property from an Califorina investor who had struggled to sell it for years due to inflated pricing. Neglect had taken its toll on the building, leading to rising expenses, increasing vacancies, and a desperate owner willing to offload it at nearly any cost, ultimately settling at just $30 per square foot.

This property is located in Saint John, Canada’s oldest incorporated city, renowned for its historic architecture from the 1800s, which often requires extensive upkeep. However, this building was no ordinary structure. Originally built as the Bank of Canada building, it boasts fortress-like construction reminiscent of meticulous German engineering. The property features marble floors, sandstone brick, steel frames, and copper mechanical piping—reflecting an era when no expense was spared. Adding to its unique character, the former bank vault now serves as a the unit for our data center tenant.

The building’s prime location offers breathtaking harbor views and sits directly across from the highly anticipated $300 million Fundy Quay redevelopment, poised to revitalize Uptown Saint John.

View from the offices

View from the offices

The 35,000-square-foot office building at 75 Prince William Street housed a variety of tenants, including engineering, architecture, and law firms, AVIS rental car, the provincial government, and a data center. When we acquired it, the market was clouded by uncertainty, but our strategy was clear: improve operational efficiency and reduce costs. Here’s how we turned things around:

-

Operational Efficiency: I cut management fees and renegotiated service contracts across the board. From cleaning services to utilities, every dollar saved contributed directly to the bottom line. This focus on strategic cost-cutting yielded significant savings.

-

Energy Audit and Upgrades: Recognizing the importance of efficiency and sustainability, I commissioned a comprehensive energy audit. We implemented energy-efficient upgrades, including heat pumps and building automation systems. These changes not only lowered the building’s carbon footprint but also achieved substantial long-term reductions in energy costs.

-

Rebranding: We knew we had to offer something unique to attract tenants. The building was a premium product, and we needed to position it as such.

By combining strategic cost management with forward-thinking upgrades, we transformed a neglected asset into a valuable and efficient property, well-positioned for the future growth of Uptown Saint John.

Revitalizing Lease Agreements

With 30% of the building vacant, the challenge was to attract high-quality tenants:

- Subdivision Strategy: By dividing larger spaces into smaller, more manageable units, I made the building appealing to a broader range of businesses. This strategy resulted in leasing 1,200 to 1,500 sq ft out of the 4,500 sq ft initially vacant.

- Lease Negotiation: I renegotiated existing leases, pushing back some responsibilities like cleaning onto the tenants where feasible. This not only reduced our operating costs but also aligned tenant interests with building maintenance.

- Win-Win Solutions: We offered more flexible lease terms, assistance with TI’s and rent-free periods, to make the building more attractive to potential tenants.

Back of the building

Back of the building

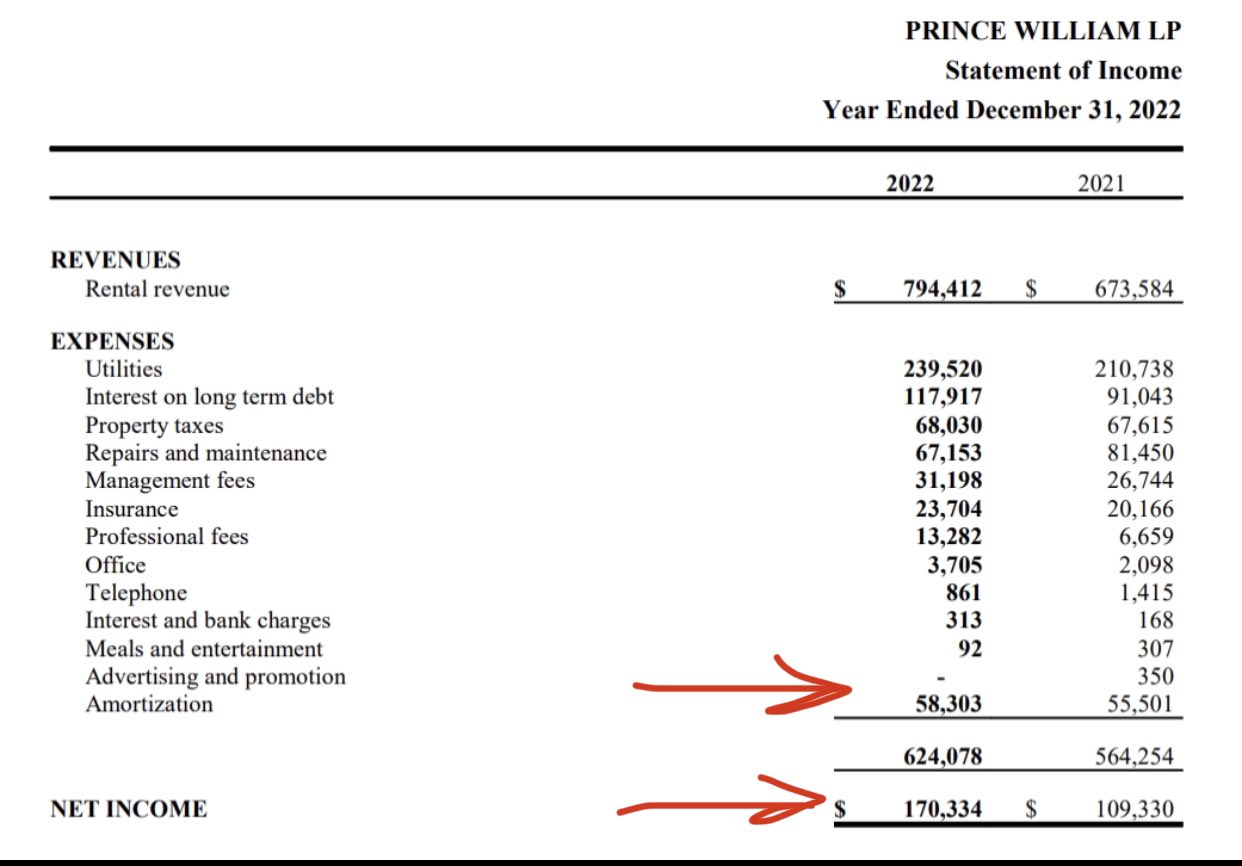

Financial Turnaround

The figures speak for themselves:

- Purchase Price: $1,680,000

- Funds Invested: $591,250

- Current Appraisal: $4,285,000

This represents a forced appreciation of over $2.6 million, a testament to the strategic interventions made.

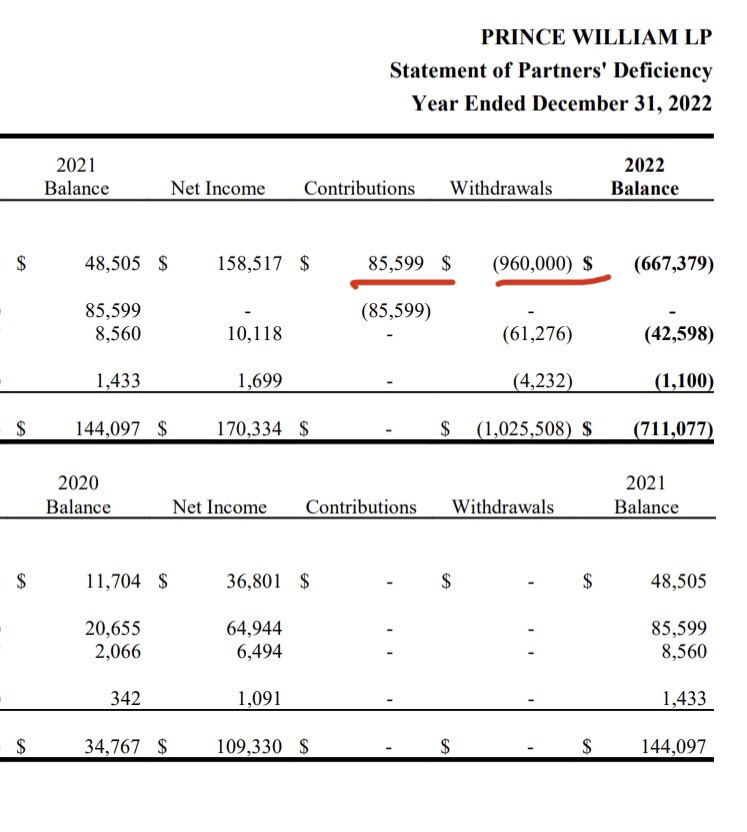

Pulled out $960k on a refi this year

Pulled out $960k on a refi this year

Market Positioning and Future Prospects

Despite a market trend showing a 25% vacancy rate, our building maintained 100% occupancy. This was achieved through:

- Rent Adjustments: A modest increase of 5-10% in rents was implemented, justified by due diligence and market comparables.

- Parking Revenue: Aligning parking lease rates to market standards added another revenue stream.

Example of a unit

Example of a unit

Lessons Learned and Looking Ahead

This journey wasn’t just about real estate; it was a lesson in resilience and strategic foresight. By not succumbing to the prevailing work-from-home trends but instead adapting to them, we created a space that was not just a building but a thriving business center.

As we move forward, the focus will remain on maintaining high occupancy, continuing cost efficiencies, and perhaps, exploring further expansions or similar acquisitions. The real estate market, like any other, rewards those who can see beyond the immediate horizon, and this building stands as a beacon of that vision.