Building Software to Buy a House a Week

Introduction

In the world of real estate investment, speed and precision are everything. Our US single-family home fund set an ambitious goal: acquire one house per week in mid-sized markets across the country.

Rather than relying solely on spreadsheets and intuition, I developed a proprietary software tool in Python to streamline the process—scanning opportunities, analyzing key data points, and enabling rapid, confident acquisitions.

This purpose-built system transformed our strategy, identifying prime real estate in overlooked cities, maximizing returns, and reducing risk. Here’s how it works, why it’s effective, and how it shapes the future of real estate investing.

Identifying the Market Opportunity: Beyond the Obvious

When it comes to real estate investing, the natural inclination is to target trendy vacation hotspots or well-known metropolitan areas. However, these are often saturated, high-priced markets with razor-thin margins. Instead, I discovered that true opportunity lies in what many might consider “unsexy” cities in middle-America—places that remain off the radar for most investors yet offer stable demand, affordability, and room for sustained growth.

Pinpointing Mid-Sized, Underappreciated Cities

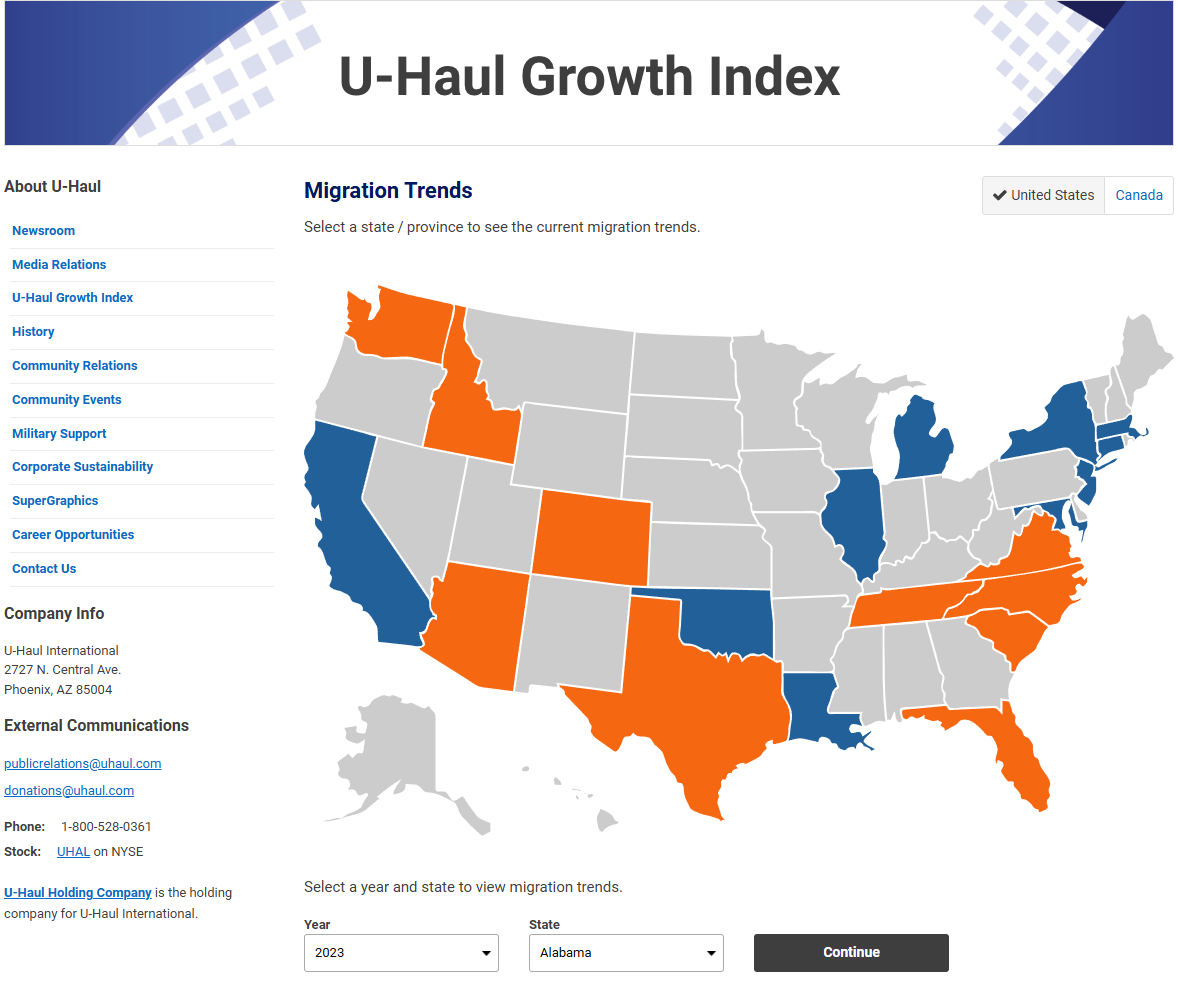

The sweet spot for our strategy is found in cities with populations under 250,000. Rather than chasing after upscale resort towns or urban luxury apartments, we’ve zeroed in on regions that strike a balance between economic vitality and lower competition. Key attributes of these target markets include:

- Stable Economic Foundations: These cities often host large universities, hospitals, and even government-oriented institutions—anchor employers that drive steady year-round travel and a robust rental demand.

- Affordability and Market Access: Unlike coastal trophy cities where property prices soar, mid-sized markets boast more attainable price points, allowing us to purchase properties that deliver better cash-on-cash returns and provide stable, economical fall-back options such as traditional long-term rentals.

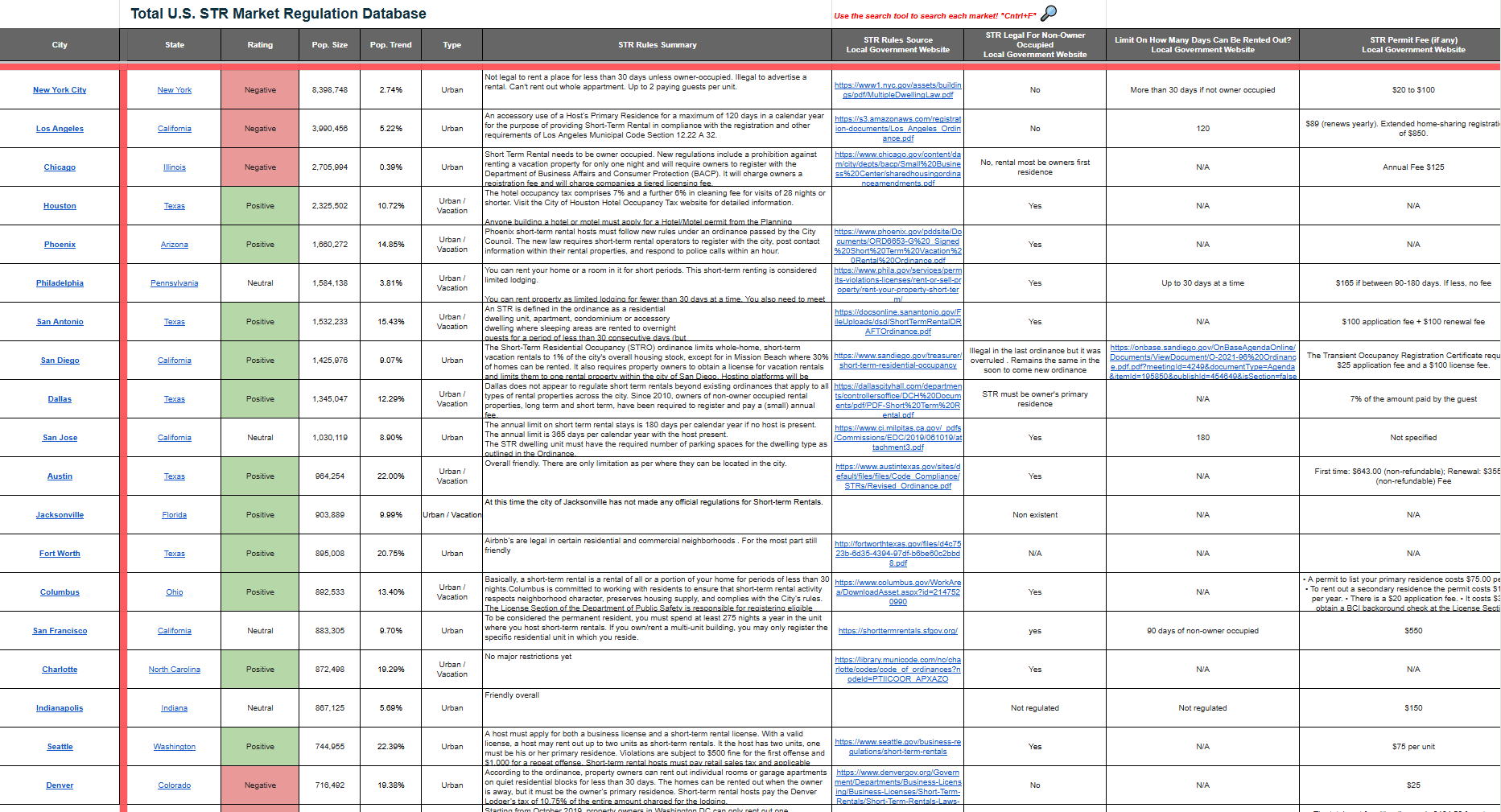

Regulation- and Business-Friendly Environments

Another crucial aspect of these overlooked markets is their governance framework. Many mid-sized cities are more regulation-friendly for short-term rentals, streamlining the path from acquisition to listing. Flexible zoning ordinances, supportive local governments, and clearer short-term rental (STR) guidelines mean fewer hurdles and faster time-to-market.

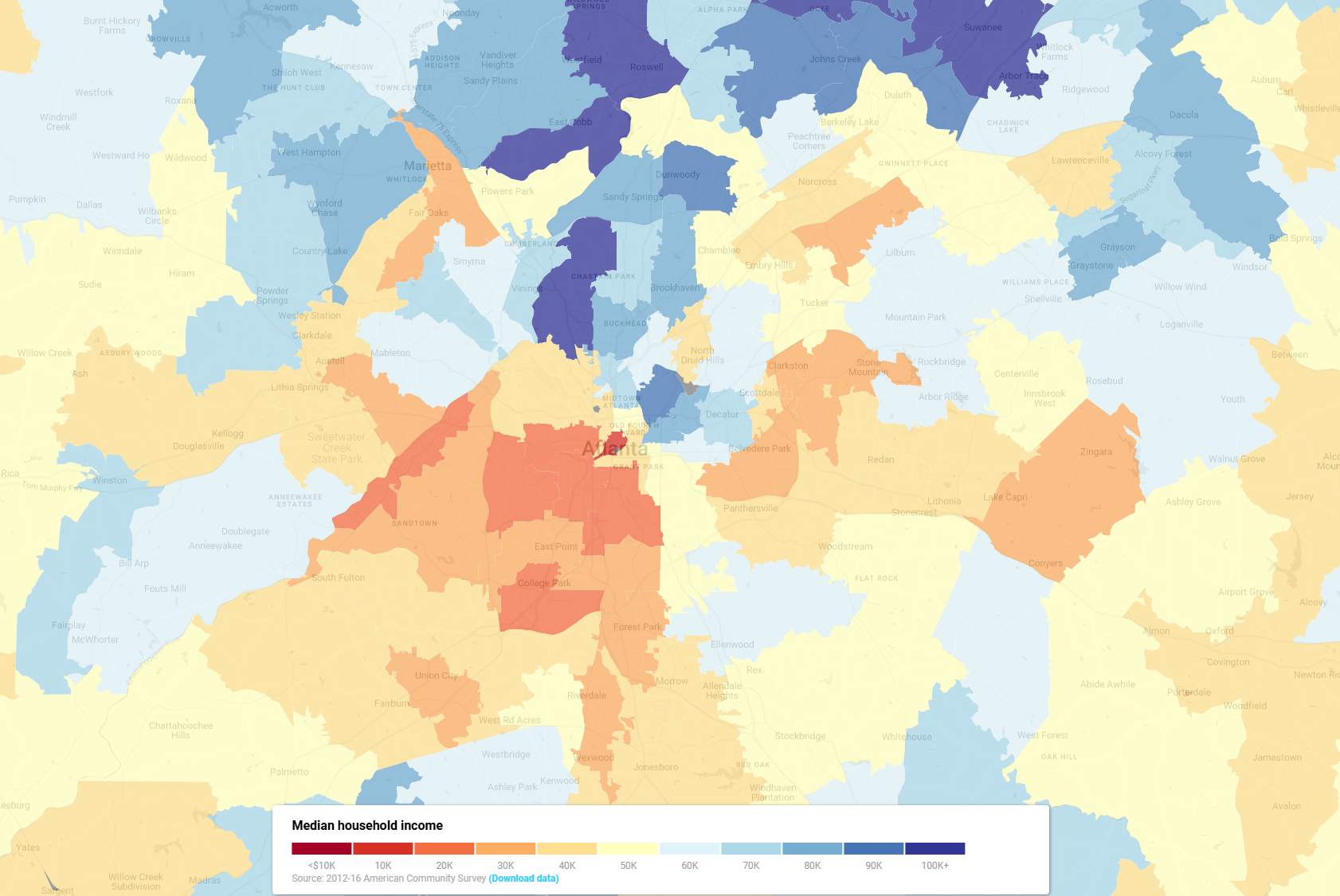

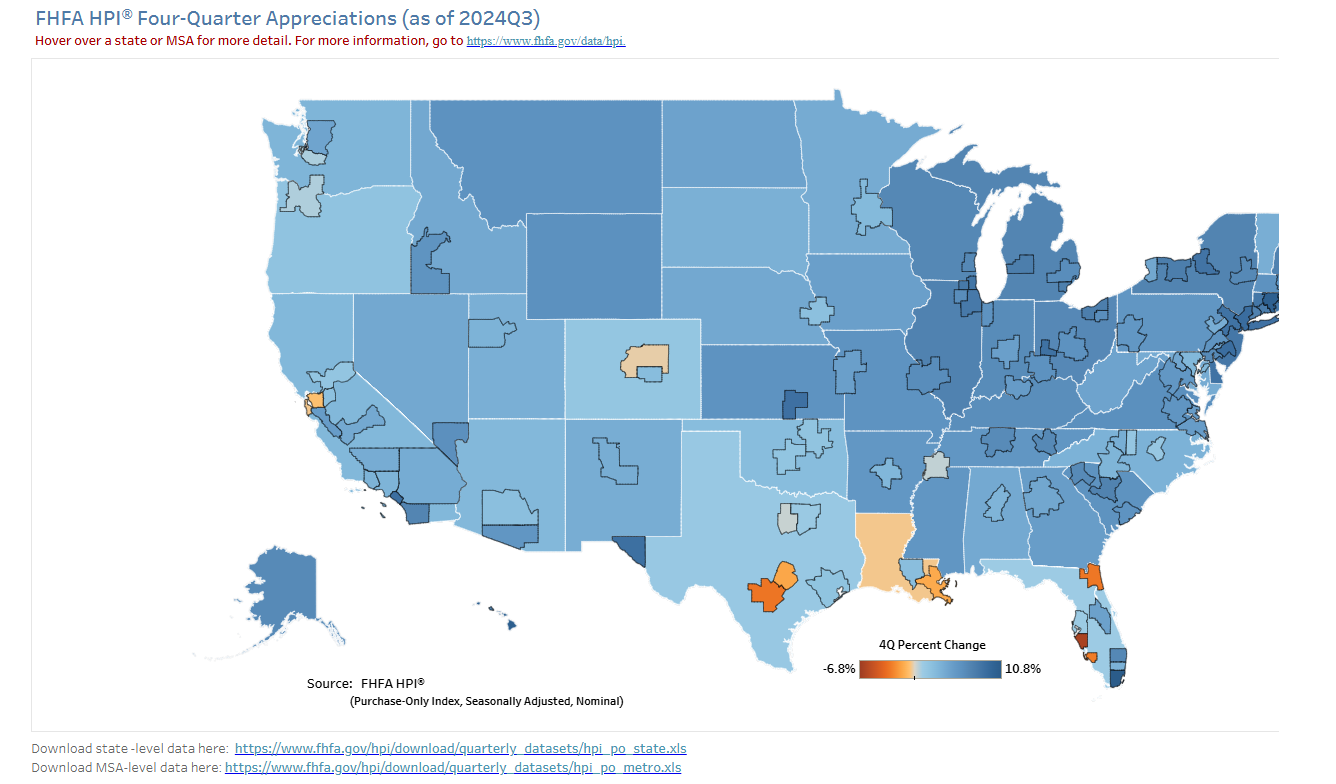

Favorable Demographics and Economic Indicators

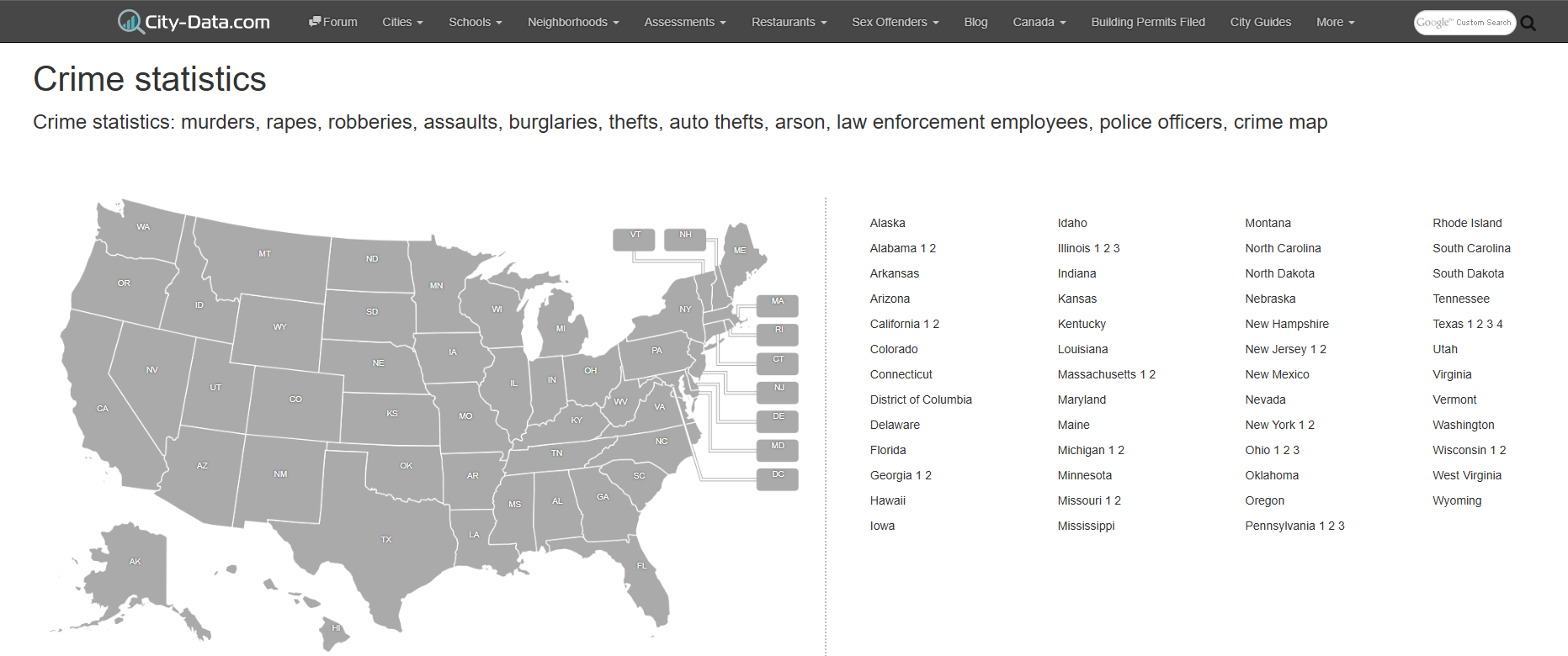

We rely on rich data sources—from census numbers to income and employment metrics—to ensure these markets aren’t just affordable, but also fundamentally sound. Our target markets must meet critical demographic and economic benchmarks, such as:

- Income Threshold: Median household incomes at least three times the mortgage payment, typically above $40,000/year, ensuring a stable economic base.

- Low Poverty Rates: Neighborhoods with poverty rates under 20% signal a healthier local economy and lower investment risk.

- Positive Growth Trajectory: Population growth meeting or exceeding national averages indicates that these cities aren’t stagnant—they are on the rise, with improving neighborhoods and upward-trending property values.

Catering to a Different Kind of Traveler

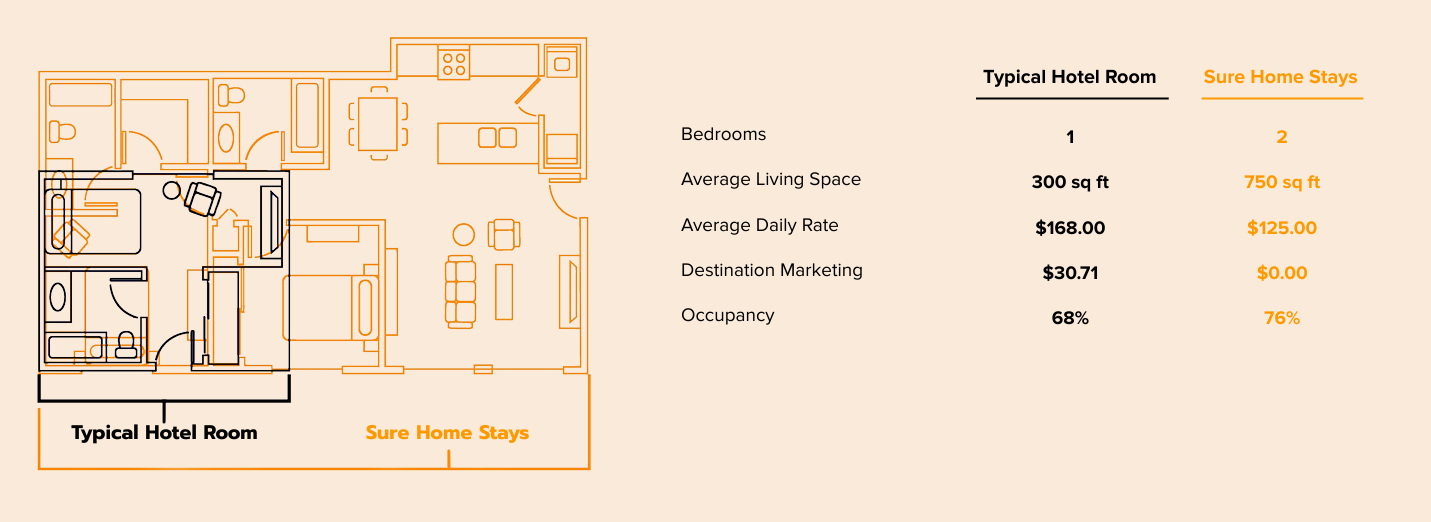

While many property investors chase vacationers in prime tourist destinations, our strategy targets the blue-collar traveler, workgroups, and families needing flexible, value-driven accommodation. These guests often include traveling nurses, technicians, and professionals who prefer larger homes with kitchens, private yards, and the comforts of a residential setting. By focusing on properties with 3–5 bedrooms, spacious layouts, and functional amenities, we serve a niche market that hotels and high-end rental operators tend to overlook.

Overlooked Yet In-Demand

What sets these mid-sized cities apart is that they’re neither glamorous resort towns nor high-density urban cores. Instead, they’re practical, livable communities that quietly, steadily demand short-term rental space. By tailoring our acquisition strategy to these areas, we tap into consistent occupancy rates and robust year-round demand—all while bypassing the intense competition and compressed margins common in more obvious, overhyped locations.

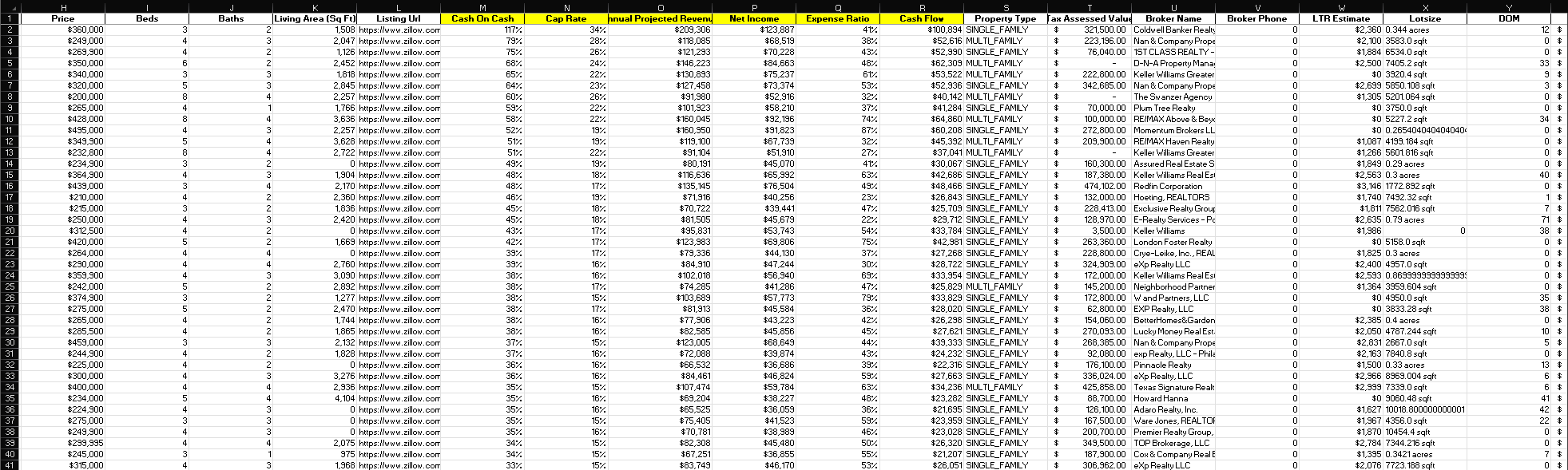

Building the Software Engine: A Data-Driven Approach

Identifying and acquiring the best investment properties each week across the entire U.S. isn’t just an ambitious goal—it’s a complex logistical and analytical challenge. With over 1,800,000 homes for sale at any given moment, success demands both speed and precision. To meet this challenge, I developed a proprietary software system using the Python programming language. This system is the beating heart of our acquisition strategy, allowing us to identify, analyze, and prioritize hundreds of properties in mere minutes. By combining automation, robust APIs, and carefully curated data points, we’ve built an engine that replaces guesswork with quantitative rigor.

From Bulk Data to Actionable Insights

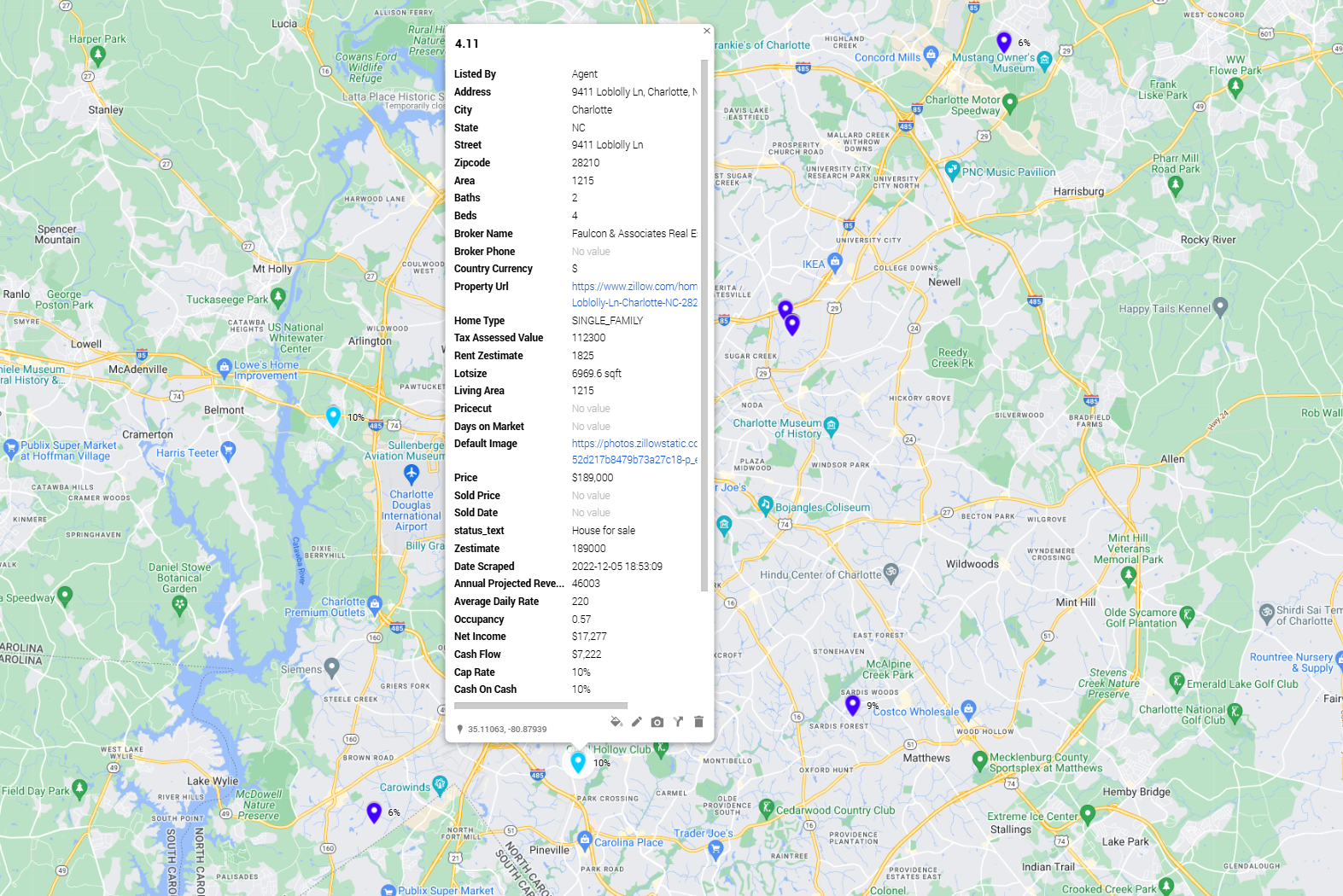

At its core, our software transforms vast streams of raw real estate data into a ranked list of potential opportunities. The system sifts through thousands of MLS listings and integrates over 41 distinct property- and market-level metrics. These metrics include everything from property size and layout to local income statistics and zoning regulations. As a result, we don’t just know which properties meet our numerical criteria—we understand how each property fits into the broader economic and demographic landscape.

Key Components of the Software Engine

Market Identification and Demographics:

The first step is honing in on the right markets—those mid-sized cities with strong fundamentals and overlooked potential. Census and Economic Data: By pulling information from the U.S. Census Bureau and other public data sets, the software confirms target demographics:

- Median household incomes exceeding three times the projected mortgage payment.

- Low poverty rates (under 20%) to ensure economic stability.

- Presence of large, stable employers like universities and hospitals.

This demographic filtering ensures we enter only those markets with a reliable base of tenants and guests, thus reducing risk and improving long-term viability.

MLS Integration for Rapid Property Scans:

With identified markets in hand, the software connects directly to Multiple Listing Service (MLS) databases via API.

- High-Speed Analysis: It scans up to 1,000 addresses per minute, allowing for near real-time identification of new listings that fit our initial parameters.

- Detailed Property Data: Information on square footage, bedroom and bathroom counts, lot size, garage availability, and more is pulled in automatically. This high-speed ingestion creates a massive funnel of potential deals, which the system will quickly narrow down based on our strict criteria.

Short-Term Rental (STR) Performance Metrics:

Not every property in an affordable market is a winner for short-term rentals. To ensure a property’s STR viability, the software reaches beyond MLS data.

- Data Scraping from STR Platforms: By interacting with Airbnb, VRBO, Booking.com, and other platforms, it gathers crucial performance indicators such as Average Daily Rates (ADR) and historical occupancy rates over two-year periods.

- Gross Revenue Calculations: Using these STR metrics, the software calculates a property’s potential Gross Rent Multiple (GRM).

- A GRM of 5 or less ensures the property can produce roughly 20% of its purchase price in annual gross revenue—an important benchmark for ensuring profitable STR operations.

Long-Term Rental (LTR) Fallback Analysis:

Markets evolve, and while STRs are currently thriving, it’s essential to have a backup plan. The software doesn’t just rely on short-term demand; it also projects long-term rental viability.

- Minimum Monthly Rent Thresholds: Each property must be able to command at least 0.85% of its purchase price in monthly rent—ideally closer to the 1% rule—ensuring cash flow even if the STR market shifts or regulations change.

- Market Comparisons: Cross-referencing Zillow, Rentometer, MapLiv, Facebook Marketplace and other rental estimate platforms helps confirm that if the short-term model falters, the property remains a safe, income-producing asset.

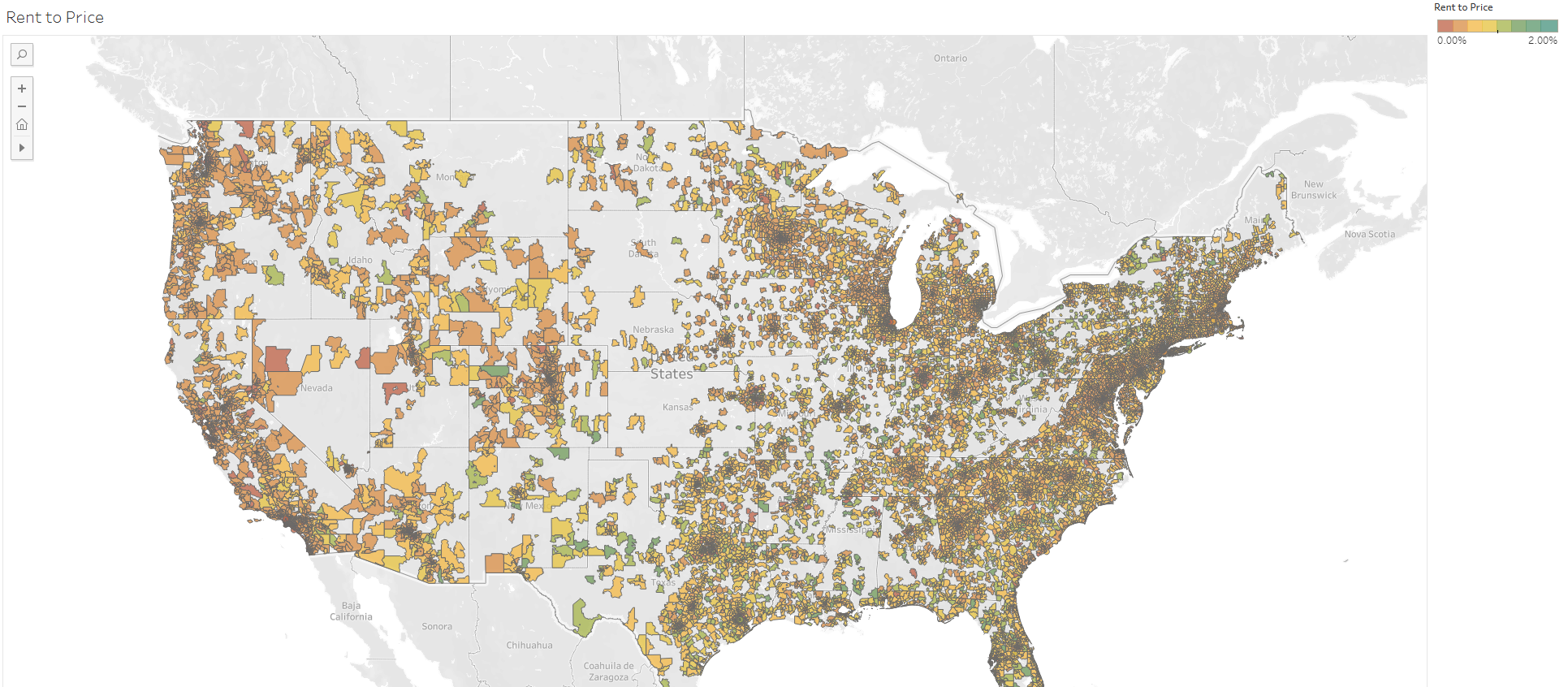

Mapping and Spatial Analysis:

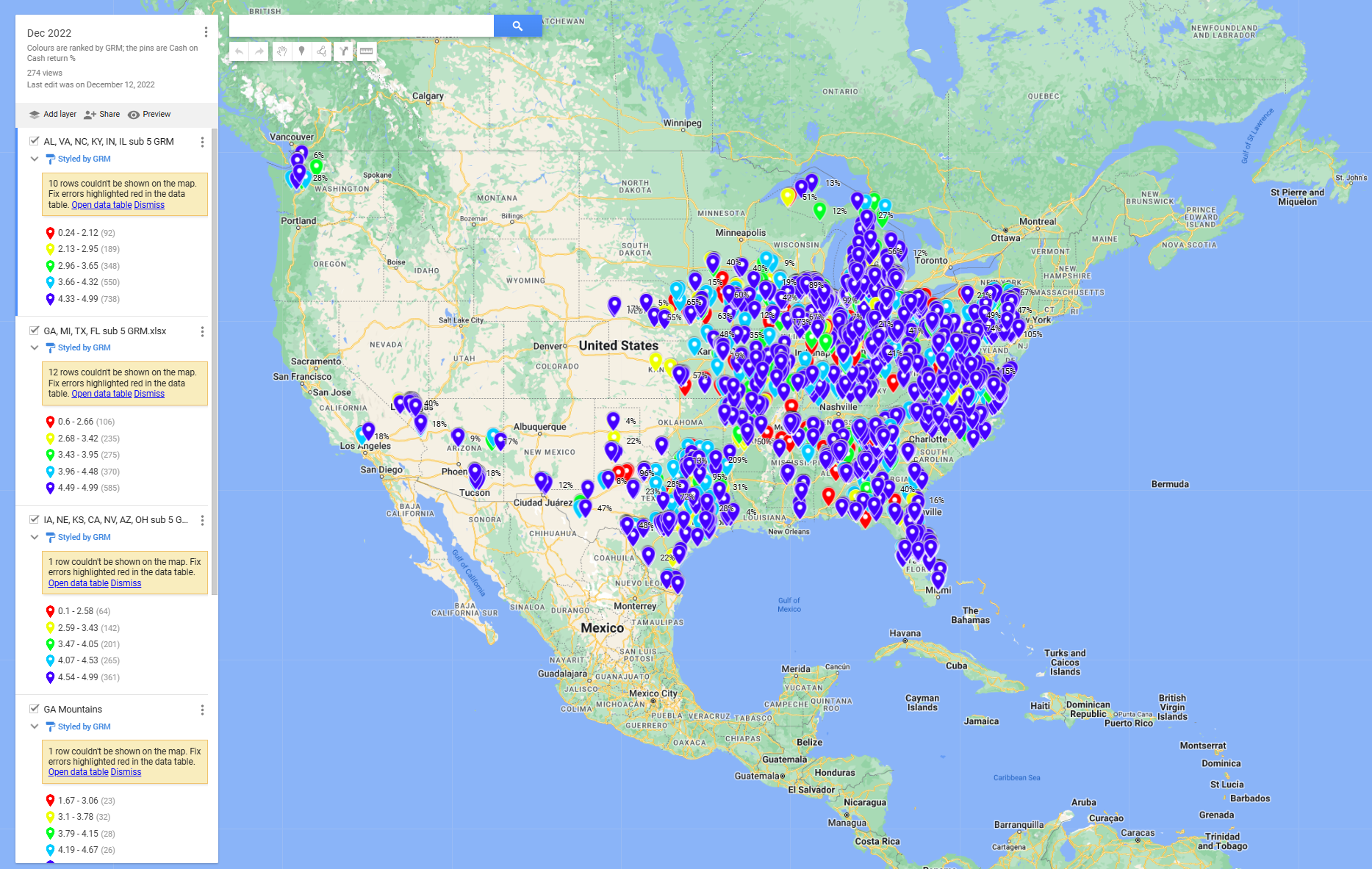

Once a candidate property clears both STR and LTR tests, it’s plotted geographically. Layering Key Indicators: The software overlays economic indicators (crime rates, education levels) and potential growth markers (nearby development projects, major institutions) onto a map of available properties.

- Visual Ranking and Prioritization: The map allows for a spatial understanding of how one property compares to others. Properties are ranked, ensuring we focus on those that not only meet financial criteria but are also positioned in neighborhoods poised for long-term appreciation and stability.

Constant Evolution and Adaptability

The most powerful aspect of this software-driven approach is its adaptability. As markets evolve, regulations shift, or our investment thesis changes, the software’s parameters can be tweaked accordingly.

- Real-Time Market Feedback: Dynamic data inputs and periodic scans ensure the tool always reflects the latest conditions.

- Seamless Scaling: The system’s automated workflows reduce manual labor, allowing us to scale into new states and markets without sacrificing analytical depth or speed.

Human Oversight: The Final Quality Check

While the software automates the heavy lifting, human judgment remains essential. Once the system identifies properties that meet our core metrics, our team steps in for a final review—validating assumptions, confirming aesthetic and logistical considerations, and ensuring no red flags were missed. This hybrid approach—data-driven analysis combined with expert human oversight—provides the precision needed to lock in deals quickly and confidently.

The Perfect Funnel: From Thousands to the Chosen Few

With so many properties hitting the market daily, identifying viable investment options can feel like searching for a needle in a haystack. Our proprietary software and strategic filters create a finely tuned acquisition funnel—one that starts with thousands of potential listings and narrows them down systematically to a select handful worthy of purchase. This funnel not only saves time but ensures that every deal we pursue aligns perfectly with our strict investment thesis.

Casting a Wide Net at the Top

The funnel’s top layer is deliberately broad. It begins with the Multiple Listing Service (MLS), where new properties appear constantly. With the software scanning roughly 1,000 addresses per minute, we capture nearly every relevant listing in our target markets within moments of it going live. This comprehensive approach ensures we never miss a potentially profitable deal.

Rapid Data-Driven Filtering

As each new property enters the funnel, the system applies a series of filters based on my 41 point buying criteria:

- Geographic & Demographic Thresholds:

- Market must have stable median incomes three times the mortgage payment.

- Neighborhood poverty rates under 20%.

- Presence of key economic anchors—universities, hospitals, government institutions.

- Property Essentials:

- Minimum 3–5 bedrooms, ensuring larger group accommodations.

- Square footage above 1,100, ensuring ample living space.

- Turn-key or cosmetic-only renovation needs to hit the ground running post-acquisition.

- Short-Term & Long-Term Viability:

- STR potential: Must achieve a GRM of ≤5, producing at least 20% of its purchase price in gross annual revenue.

- LTR fallback: Must meet at least the 0.85% rule to ensure solid long-term rental returns if the STR environment shifts.

At this stage, the software automatically eliminates any properties failing even one of these core criteria, dramatically reducing the candidate pool from thousands to a more manageable shortlist of a few hundred.

Layering Qualitative Metrics

Once the quantitative filters have run their course, the funnel narrows again as we overlay additional, qualitative factors:

- Neighborhood Quality: Check for improving income, declining crime, and upward-trending property values.

- Location Accessibility: Confirm that the property’s neighborhood is easily accessible from highways, airports, and major institutions. Fewer complicated turns and close proximity to grocery stores or attractions make for higher guest satisfaction.

- Lot Characteristics: Prefer corner lots or properties with more privacy and room to add unique amenities.

This step ensures that not only do we have a financially viable property, but one that resonates with our target guest profile—groups seeking flexibility, comfort, and location convenience.

Visual Mapping & Ranking

The reduced set of properties is then mapped geographically, with each candidate assigned a rank based on the cumulative weight of its metrics—economic indicators, STR revenue potential, neighborhood quality, and more. By visualizing them spatially, we can quickly spot clusters of promising deals or notice outliers that might be worth a second look.

- Economic Overlays: Crime rates, income levels, and education indexes appear as layers on the map, making it easy to see how each property’s micro-location measures up against our benchmarks.

- Comparative Positioning: Properties are compared side-by-side to assess which ones truly shine in terms of return potential and long-term resilience.

Human Oversight: The Final Cut

Although the funnel is primarily automated, it’s not purely algorithmic. The last layer—human oversight—ensures we never rely solely on data. Our team steps in to review the remaining top candidates with a critical eye:

- Property Photos & Videos: Does the house’s layout lend itself to communal gathering spaces? Are there any cosmetic red flags (outdated appliances, poor lighting, too much carpet) that might turn guests off?

- Local Regulations & Zoning: Even if a city is friendly toward short-term rentals, certain neighborhoods or zoning designations might present hidden hurdles.

- Market Context & Timing: Are there upcoming local events, seasonal factors, or recently announced infrastructure projects that could influence demand or property values?

This human element polishes the funnel’s output, ensuring that the properties at the bottom aren’t just theoretically good investments—they’re ones we’re confident about putting real capital into.

A System That Delivers Consistent Results

The beauty of this funnel is its repeatability. We can rinse and repeat the process every day in multiple markets, confident that the system’s layered filters will consistently surface only the best deals. This efficiency is what makes achieving “a house a week” not just a goal but a sustainable reality.

By employing a data-driven, step-by-step funnel—with each stage weeding out properties that don’t match our criteria—we focus our energy only on the strongest contenders. This approach saves time, reduces risk, and ensures every property added to our portfolio contributes to our long-term vision of scalable, profitable real estate investments.

Why This Strategy Works

Many real estate investors flock to popular vacation hotspots and major metropolitan areas, chasing high-profile properties and relying on name-brand appeal. But this conventional approach faces stiff competition, narrow margins, and growing saturation. Our strategy—anchored in overlooked mid-sized cities, data-driven decision-making, and strict investment criteria—carves out a profitable niche that most overlook.

Targeting Underserved Mid-Sized Markets

Less Competition, More Opportunity: While crowded coastal towns or big cities may have name recognition, they’re also saturated with large institutional players, luxury operators, and experienced mom-and-pop hosts. By focusing on mid-sized markets under 250,000 in population, we operate where others don’t. There’s lower investor density, allowing us to buy quality properties at better prices and negotiate more favorable terms.

Economic Stability & Steady Demand:

These hand-picked markets aren’t random—each has underlying fundamentals like strong employment drivers (universities, hospitals, government institutions) and a stable or growing population. This foundation supports year-round demand from workgroups, traveling professionals, and families. Instead of relying on seasonal tourism or unpredictable travel fads, we benefit from a consistent rental base.

Serving an Overlooked Guest Segment

Practical Accommodations Over Luxury:

Our properties cater to the blue-collar traveler, family groups, and budget-conscious guests who value space, privacy, kitchens, and affordability over luxury amenities and trendy locations. While others compete for vacationers seeking beachfront villas or upscale condos, we meet the everyday needs of guests who simply want a comfortable, well-located home base.

High Utility, High Loyalty:

A home with 3–5 bedrooms, a fully equipped kitchen, and a private yard often outperforms standard hotel rooms or cramped rentals. Guests can cook their own meals, hold family gatherings, and enjoy privacy—all factors that drive repeat bookings and strong word-of-mouth.

Data-Driven Filtering for Quality Acquisitions

Consistent Criteria, Reduced Risk:

Our software imposes strict numerical filters—like median income thresholds, poverty rates, and GRM targets—ensuring every property not only performs today but remains resilient long-term. By combining short-term rental (STR) and long-term rental (LTR) analyses, we always have a fallback plan in case the STR landscape shifts.

Speed and Precision in Decision-Making:

The automated acquisition funnel saves countless hours while maintaining rigorous quality standards. Quickly identifying the best properties means we’re first to submit offers, secure deals, and list properties, consistently beating slower, less data-savvy competitors to the punch.

Balancing Short-Term Gains with Long-Term Security

Immediate Cash Flow and Safety Nets:

Properties that hit our GRM target (generating at least 20% of their value in gross annual revenue) deliver strong short-term returns. Meanwhile, meeting the 0.85% LTR rule ensures the asset can pivot to a conventional rental if needed. This dual approach mitigates market volatility and ensures that our investment remains profitable under multiple scenarios.

Building Wealth Through Land Ownership:

Focusing on freehold properties in stable neighborhoods—rather than condos or units bound by HOAs—lets us own both the structure and the land. While houses can depreciate, land generally appreciates, building wealth over time. By carefully selecting lots that allow potential value-adds, we enhance long-term upside and protect our capital against downturns.

Efficiency That Scales

Repeatable, Scalable Systems:

Our method isn’t guesswork—it’s a documented, data-driven system. This repeatability means we can quickly enter new states, adopt the same criteria, and achieve similar success. Over time, refinements to our software and buying criteria only increase accuracy and returns.

Fast Time-to-Market:

By targeting properties needing only cosmetic updates, we reduce renovation timelines significantly. Getting listings live sooner means earlier revenue generation, quicker portfolio growth, and compounding profits over time.

Deep Dive: How the Software Operates at Scale

Acquiring one home per week across multiple states demands a system that’s fast, adaptive, and data-driven. Our proprietary Python-based software delivers exactly that—scanning thousands of listings, integrating multiple datasets, and producing real-time insights that keep us ahead of competitors.

1,000 Addresses a Minute:

By connecting directly to the MLS, the software reviews around 1,000 properties per minute, ensuring we never miss a promising deal. It runs on a continuous loop, sending instant alerts whenever a listing meets our criteria, allowing us to move quickly.

Multiple Data Sources, One Profile:

Beyond basic MLS info (bedrooms, lot size), we pull in census data, income levels, and employment indicators to confirm market strength. STR metrics (Airbnb, VRBO) reveal ADRs and occupancy trends, while LTR tools (Zillow, Rentometer) gauge fallback rental potential. This comprehensive view ensures each property hits our strict revenue and risk benchmarks.

Automated Filters & Ranking:

Over 41 filters—income thresholds, minimum bedroom counts, cosmetic-only reno requirements—pare down thousands of options to a top-tier shortlist. Layering crime rates, education levels, and economic factors on a map lets us visually spot standout neighborhoods and prime opportunities.

Human Oversight & Flexibility:

Even with advanced automation, humans make the final call. Our team reviews photos, zoning, and inspection details to catch anything algorithms might miss. As markets shift or new data sources arise, we adjust parameters, ensuring the system remains agile and accurate.

Scaling Nationwide:

A consistent, data-driven framework applies to any region, enabling quick entry into new markets. By validating properties upfront, we shorten acquisition timelines and maintain our “house a week” momentum.

Real-Time Insights, Constant Refinement:

With instant alerts, evolving criteria, and feedback loops, the software continually improves. It tracks performance, flags emerging hot spots, and guides better decisions, keeping us data-informed, nimble, and always ready to capitalize on the next opportunity.

Residential Investment Philosophy: Land Ownership & Value Creation

Our strategy emphasizes owning freehold properties—where we own the land—rather than condos, townhouses, or units controlled by HOAs. Land is finite and typically appreciates over time, while buildings depreciate. By focusing on land, we gain full autonomy to add value through amenities, expansions, or improvements without external restrictions.

Investing in stable, upward-trending neighborhoods ensures that as local incomes rise, crime falls, and infrastructure improves, both rental demand and property values increase. This approach provides two key benefits: immediate cash flow from rentals and long-term wealth from appreciating land.

Instead of betting on flashy markets or risky structures, we choose enduring, flexible assets. Land-centric investments enable us to adapt to changing market trends, protect against regulatory shifts, and secure a foundation for long-term stability and growth.

Streamlining Renovations and Onboarding

Speed drives profitability. To get new properties generating income quickly, we choose homes needing only cosmetic fixes—paint, flooring, fixtures—no structural work or permits. This shortens turnaround times from months to weeks.

Cosmetic-Only Updates:

Simple improvements minimize delays, lower costs, and reduce unexpected issues. Faster completion means we can list properties sooner, driving early revenue.

Bulk Purchasing & Logistics:

We standardize furniture, décor, and appliances, ordering in bulk for discounts and consistency. Local storage units receive and hold packages until assembly teams arrive, ensuring a smooth, one-step setup.

Efficient On-Site Teams:

Local crews handle light repairs, assemble furnishings, and finalize décor. With pre-planned layouts and clear guidelines, they work quickly and confidently, cutting downtime.

Smart Tech Integration:

Installing Schlage smart locks, Ecobee thermostats,Blink cameras, noise monitors and our in-house management streamlines every new properties onboarding process. Once furnished, professional photos are taken and listings go live across 11 different OTAs (online travel agencies) within 24 hours.

Faster Income & Growth:

By reducing renovation complexity and centralizing logistics, properties are guest-ready in days instead of months. This rapid onboarding fuels ongoing portfolio expansion and consistent returns.

Achieving a House a Week: The Operations Behind the Scenes

Automated Discovery & Rapid Offers:

The software flags suitable listings instantly. We submit multiple offers at once, often directly to sellers or through agents via DocuSign. With a steady stream of pre-vetted leads, we never slow down.

Tight Due Diligence Timelines:

We complete inspections, 3D mappings, and layout planning within a three-week cash-close window. This swift verification ensures we’re confident in each acquisition without delaying our pace.

Cosmetic-Only Renos & Pre-Planned Décor:

By targeting properties that need minimal work, we shorten rehab times. Standardizing furnishings and décor reduces guesswork, while bulk ordering and local storage streamline delivery.

Local Teams & Rapid Setup:

On-the-ground crews handle assembly, light repairs, and final touches. Pre-determined floor plans and a clear checklist ensure efficient turnaround, often just days after closing.

Tech-Enabled Management :

Every listing is entered into our cloud-based property management software, granting access to everyone in our organization. This system includes dozens of data points for each property, such as passwords, utility bills, account numbers, backup lockbox codes, cleaner access details, emergency information, and more.

Our team ensures that properties are listed across various OTAs (Online Travel Agencies), with a unified inbox consolidating all guest communication. This inbox is managed by our call center, located in the Philippines, ensuring efficient and centralized support.

Scaling with Systems:

This repeatable, data-driven model lets us enter new states seamlessly. By refining processes as we go, we maintain our acquisition pace, continually placing capital and generating revenue sooner.

Ongoing Management & Upsells

Long-term success depends on efficient property operations, smart pricing, and strategic revenue enhancements. We rely on automation, local support teams, and guest-focused services to maintain high occupancy and maximize returns.

Local Cleaners & Contractors:

Trusted cleaners and handy contractors receive automated notifications for each reservation, ensuring prompt turnovers and quick fixes. This consistent, professional service keeps guest satisfaction high.

Dynamic Pricing for Optimal Revenue:

Tools like PriceLabs adjust nightly rates based on demand, events, and seasonality. Just as airlines or hotels do, we constantly fine-tune rates for peak profitability and strong occupancy.

Simple Upsells & Add-Ons:

We offer early check-ins, late check-outs, and event-themed packages. These small upsells add value for guests and boost our bottom line, increasing per-stay revenue without significant extra effort.

Continuous Improvement:

Guest reviews and market data guide ongoing refinements. By learning from feedback, we enhance amenities, streamline processes, and maintain a competitive edge in every market we serve.

Financing & Scaling

Efficient financing strategies and smart use of capital fuel ongoing growth. By accelerating closing timelines, leveraging better loan terms, and recycling equity, we ensure our portfolio expands without slowing down.

Faster Closing with Cash:

Cash deals streamline acquisition and secure properties quickly. Especially when buying property out of state, out of country and all the signings and paperwork required with financing. This speed locks in deals before competitors and allows immediate renovations and listings. You also get better purchase prices and terms with cash.

Refinancing & Portfolio Loans:

After improvements, we refinance based on the property’s new appraised value—not just the purchase price—unlocking built-in equity. Cross-collateralizing multiple homes into a single portfolio loan can yield better terms, simplify management, and free up capital for new acquisitions.

Recycling Capital for Continuous Growth:

With each refinance, we pull out funds to reinvest in the next property, keeping our pipeline moving. This rinse-and-repeat model turns one successful deal into a steady flow of opportunities.

Scaling Nationwide:

Because our systems are data-driven and repeatable, we can apply the same approach across multiple states. With adaptable criteria and flexible financing, we quickly enter new markets, maintaining our steady pace of acquisitions.

Results and Future Growth

Proof of Concept: Achieved the goal of one house per week, spread across multiple states.

Long-Term Vision: As the portfolio grows, technology, process refinement, and strategic positioning ensure continued success.

Conclusion

By blending automation, data-driven decision-making, and thoughtful human oversight, I’ve built a proprietary investment system capable of acquiring properties at remarkable speed and efficiency. This model—focused on mid-sized markets, strict criteria, and quick operationalization—positions us to capitalize on untapped opportunities, generating both immediate cash flow and long-term appreciation.

As the industry evolves, this approach will remain a guiding force, demonstrating how technology-driven strategies can reshape real estate investment for the better.